Market Segment

September 14, 2023

HRC Futures Mixed Ahead of UAW Deadline

Written by Logan Davis

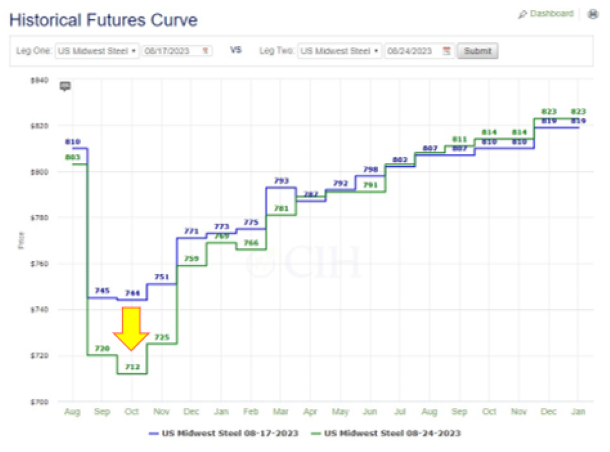

Hot-rolled coil (HRC) futures prices fell after our last column published Aug. 17, putting in recent lows around $25-30 per ton lower than the week prior.

In the SMU Column from Aug. 24, written by Daniel Doderer and John Medich of Flack Global Metals, the authors pointed to healthy volume and open interest prevalent in the marketplace while we established spot lows. Speculative traders closing longs and adding to short positions contributed to this price decline. Conversely, physical participants were expected to begin locking in lower futures prices as contracting season begins, which may have contributed to the support in the back of the curve, as you can see above.

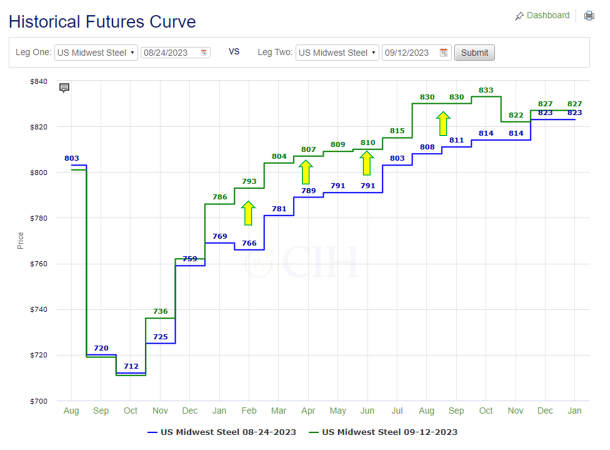

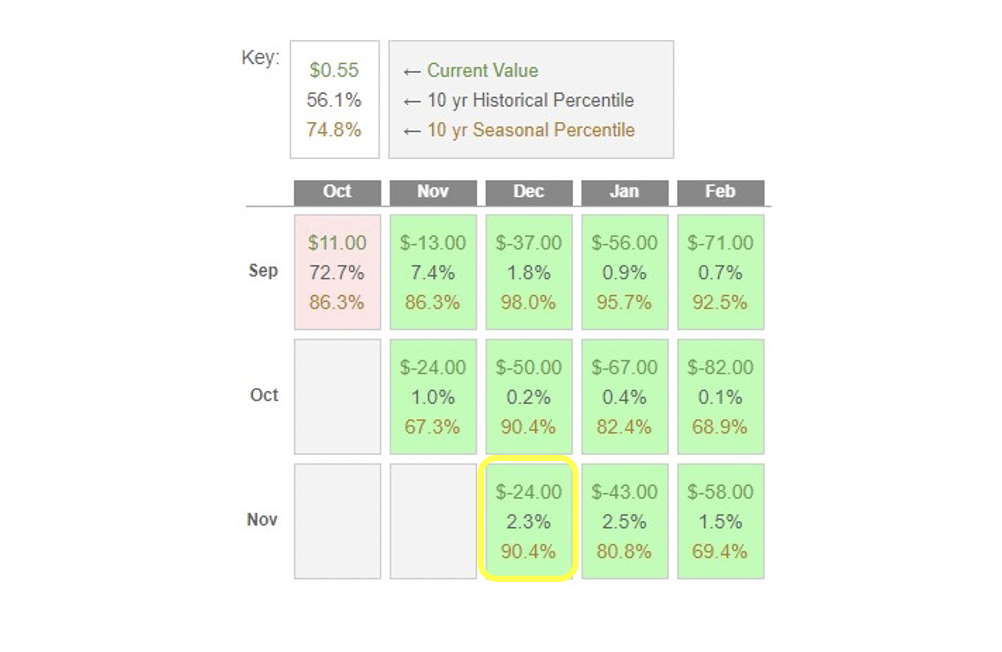

As Jack Marshall of Crunch Risk wrote about in his Sept. 7 column, the HR forward curve had rebounded after the Labor Day weekend, with the index remaining above $750/ton, and surprising some by not reflecting rumored lower prices for larger volume deals. Historically, the December HRC Futures contract remains high relative to spot prices. Today could be an opportune time to place protection on either the buy-side or sell-side.

Interest rates are likely to remain elevated after a higher-than-expected CPI print on Sept. 13, leaving the carrying cost of inventory high. Another factor that has not changed since our last column is the threat of the United Auto Workers (UAW) strike ahead of the 11:59 pm deadline on Thursday.

With deferred prices showing cautious optimism but several risks remaining, low-cost insurance may be desired. Leveraging a slight bump in implied volatility (above), one might consider a 3-way option strategy that will cost less than $5/ton for either buyers or sellers. This strategy would provide both a range of protection as well as opportunity for prices to move in one’s favor, as described below.

For Buyers:

A 3-way would allow buyers to capture the benefit of recent falling price at a very low cost, while leaving some room for further downside while the labor negotiations and other fundamental factors continue to be resolved. Steel buyers may choose to buy a $750 call option for ~$43/ton. To reduce that cost, they could sell a $680 put option and an $880 call option, collecting a total of ~$38.50 ($27.50 and $10.50, respectively). Net, the strategy would cost about $4.50/ton and provide protection from $750 to the high prices we saw in June. The put sold below the market would limit the trader’s participation at $680, a price we haven’t seen since the end of 2022. The theoretical net cost comes in a an attractive 3.5% of the range of protection.

For Sellers:

Given the commentary summarized above, sellers may have concerns about further downside in the event on an extended strike. That said, prices have already fallen precipitously. The 3-way strategy described below is a low-cost way to avoid further potential losses, while leaving room for improvement should the market begin to pick back up. Purchasing a $725 put for ~$43.50/ton, and simultaneously selling both the $650 put and $820 call would result in a net cost of ~$4.00/ton ($19.75 and $19.75 respectively). For reference, the 2019 General Motors strike resulted in futures falling ~$50/ton (~10%) from mid-September to the end of October when the dispute was resolved. This strategy would provide protection for a similar drop for under $5.00/ton cost.

There is risk in futures and options trading.

- Both strategies would carry potential margin risk (capital call).

- Both strategies involve limitations to protection and participation.

- Offsetting either strategy before expiration will change the cost and P/L

When trading options, positions should be managed as the market changes and time passes.

Options pricing above based on theoretical values. There is a risk of loss in futures trading. Past performance is not indicative of future results. © 2023 Commodity & Ingredient Hedging, LLC. All rights reserved.