Market Data

September 14, 2023

Steel Mill Lead Times Hold Steady

Written by Laura Miller

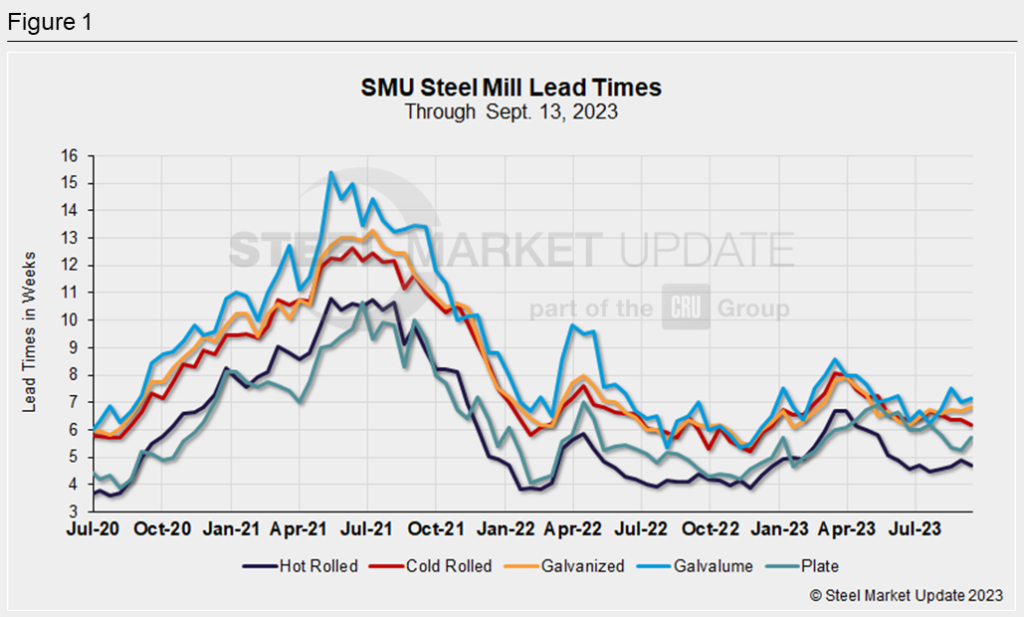

Steel mill lead times this week were basically flat from our previous market check, with production times shrinking marginally for hot rolled and cold rolled, and extending slightly for galvanized, Galvalume, and plate.

The looming strike by the United Auto Workers (UAW) union appears to have had little impact on lead times. Sheet production times have held steady since June, while plate’s is now down by about a week from June’s level.

Notably, sheet prices have been coming down while lead times have been more stable. Fall maintenance outages at mills could be factoring into it. While the outages are not necessarily huge ones, they could be supporting these stable lead times. Sources estimate that planned outages from September to November could impact 1 million net tons of steel products.

Lead Times Reported This Week

Surveyed buyers reported lead times for hot rolled ranging from 3 to 7 weeks. SMU’s average hot rolled lead time declined by 0.19 weeks from two weeks ago to 4.71 weeks this week. That’s the same lead time reported in our early July market check. HR lead times have been below 5 weeks since the beginning of June. So far, the longest HR lead time this year was 6.7 weeks in March.

Cold rolled lead times were reported between 5 and 8 weeks, with an average of 6.18 weeks this week. That’s down by 0.2 weeks from two weeks prior, and the lowest production time for cold rolled so far this year.

Galvanized lead times inched up by 0.14 weeks to an average of 6.81 weeks this week. The range reported was between 5 and 9 weeks. This is the longest lead time reported for galvanized since the end of April.

Lead times for Galvalume were also said to be between 5 and 9 weeks, with an average of 7.14 weeks. That’s a slight extension from 7.0 weeks two weeks ago. Note that figures for Galvalume can be volatile due to the limited size of that market and our smaller sample size.

Plate lead times were reported between 4 and 8 weeks. The average of 5.73 weeks was 0.48 weeks longer than two weeks ago. Lead times for plate have been below 6 weeks since early August. Before that, they had been between 6 and 7 weeks since mid-March.

This Week’s Survey Says

The number of steel buyers predicting contracting lead times two months from now shrunk this week to the lowest level since January: 12%. That’s down from 15% in the survey two weeks prior. Those expecting extending lead times rose to 26% from 19%. The remaining 52% anticipate flat lead times.

“Market is bottoming out. Will rebound then,” said one trader predicting extending lead times.

Most steel buyers say current lead times are normal or shorter than normal. This week, 65% of surveyed OEMs categorized them as ‘normal,’ while 29% said they are ‘shorter than normal.’ 50% of service centers said they are ‘shorter than normal’ while 44% said they are ‘normal.’

Many buyers said the direction of lead times is dependent upon a UAW strike.

One service center buyer noted that “some mills have outages and have moved out lead times.”

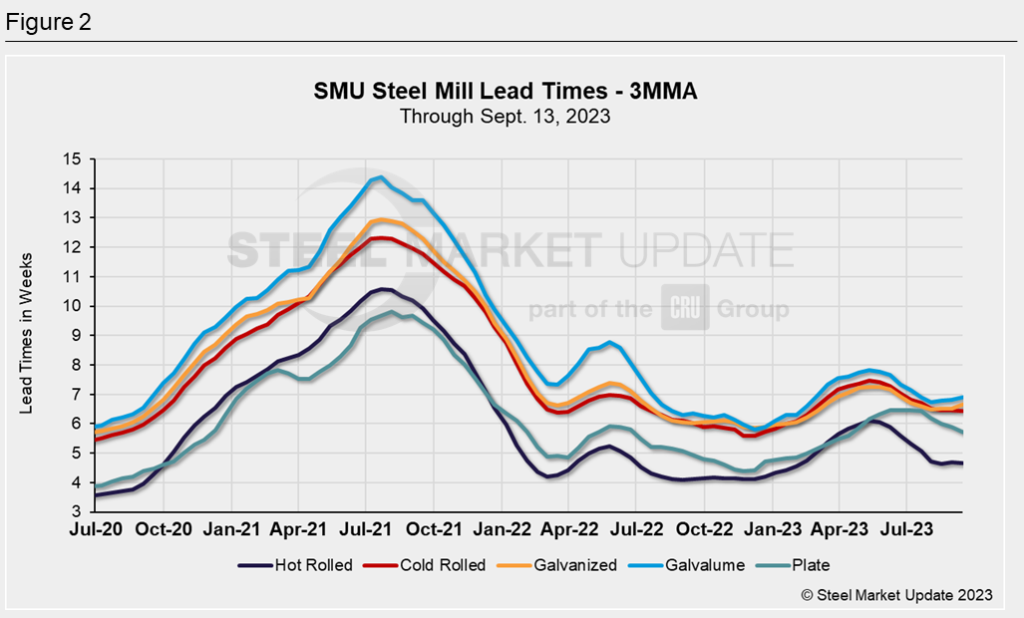

3MMA Lead Times

Analyzing lead times on a three-month moving average (3MMA) basis can smooth out the variability in SMU’s biweekly readings.

The latest 3MMAs for all four sheet products tracked by SMU have been steady since August at 4.7 weeks for hot rolled, 6.4 weeks for cold rolled, 6.7 weeks for galvanized, and 6.9 weeks for Galvalume.

Plate’s 3MMA lead time was 5.7 weeks this week, down from 5.9 weeks two weeks earlier. That’s the lowest it has been since early May.

Note: These lead times are based on the average from manufacturers and steel service centers participating in this week’s SMU market trends analysis. SMU measures lead times as the time it takes from when an order is placed with the mill to when the order is processed and ready for shipping, not including delivery time to the buyer. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. To see an interactive history of our Steel Mill Lead Times data, visit our website here.