Market Data

November 27, 2023

SMU survey: Mills less willing to talk price on sheet, plate

Written by Ethan Bernard

The percentage of steel buyers saying mills were willing to negotiate spot pricing has fallen for all products SMU surveys, according to our most recent survey data.

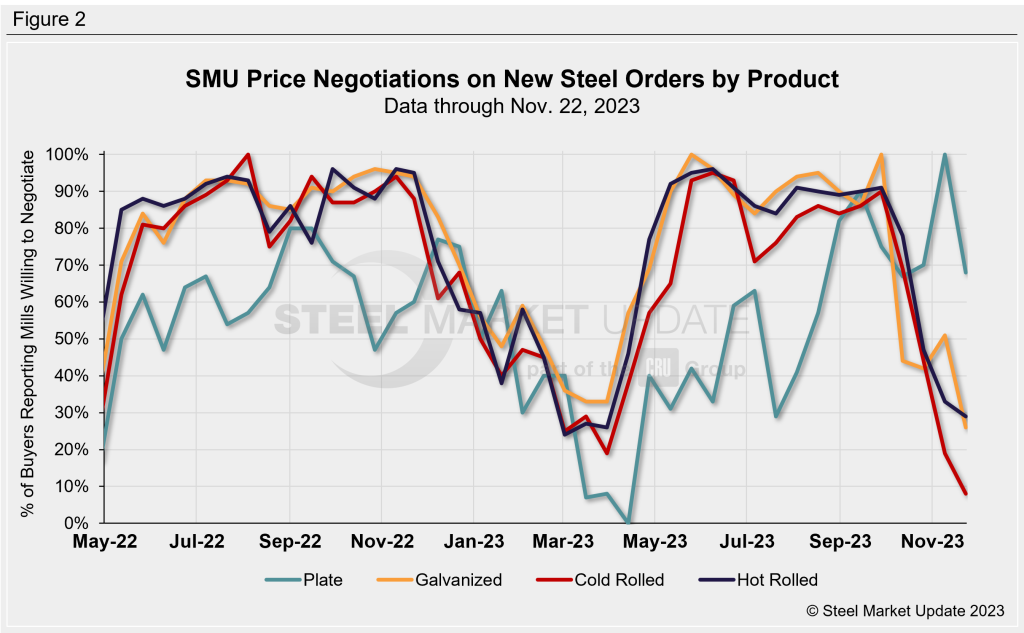

The negotiation rate for steel plate notched a steep decline, our survey data through Nov. 22 shows. It tumbled 32 percentage points from two weeks earlier to 68% of surveyed buyers saying mills were open to discussing lower spot prices.

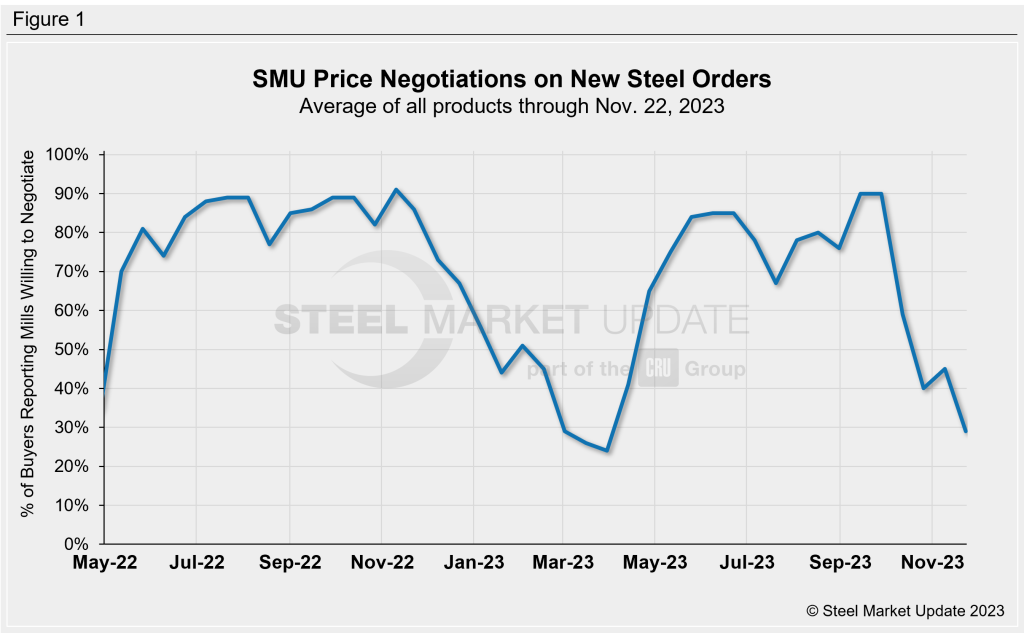

Every two weeks, SMU asks steel buyers whether domestic mills are willing to negotiate lower spot pricing on new orders. Last week, 29% of participants surveyed by SMU reported mills were willing to negotiate prices on new orders, down from 45% from two weeks prior (Fig. 1). This is the lowest reading since the end of March when it stood at 24%.

Fig. 2 below shows negotiation rates by product. Hot rolled’s rate slipped four percentage points to 29% of buyers saying mills were willing to talk price; cold rolled dropped 11 percentage points to 8%; galvanized tumbled 25 percentage points to 26%; and Galvalume fell five percentage points to 5%. We have averaged Galvalume with the previous market check because of fewer market participants and to reduce volatility.

Here’s what some survey respondents had to say:

“We are going the service center route right now, as they haven’t raised numbers as quickly as the mills have.”

“Not buying spot (galvanized) at the moment.”

“On a limited basis (mills will talk spot price on plate) and depends on mill.”

“I think in pockets there is a minimum discount to be had (on spot hot rolled), but it is very small compared to expectations.”

“Have seen a slight reduction in price (on spot hot rolled) from at least one mill already.”

“Very limited availability (of spot cold rolled).”

Note: SMU surveys active steel buyers every other week to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data, visit our website here.