Prices

January 16, 2024

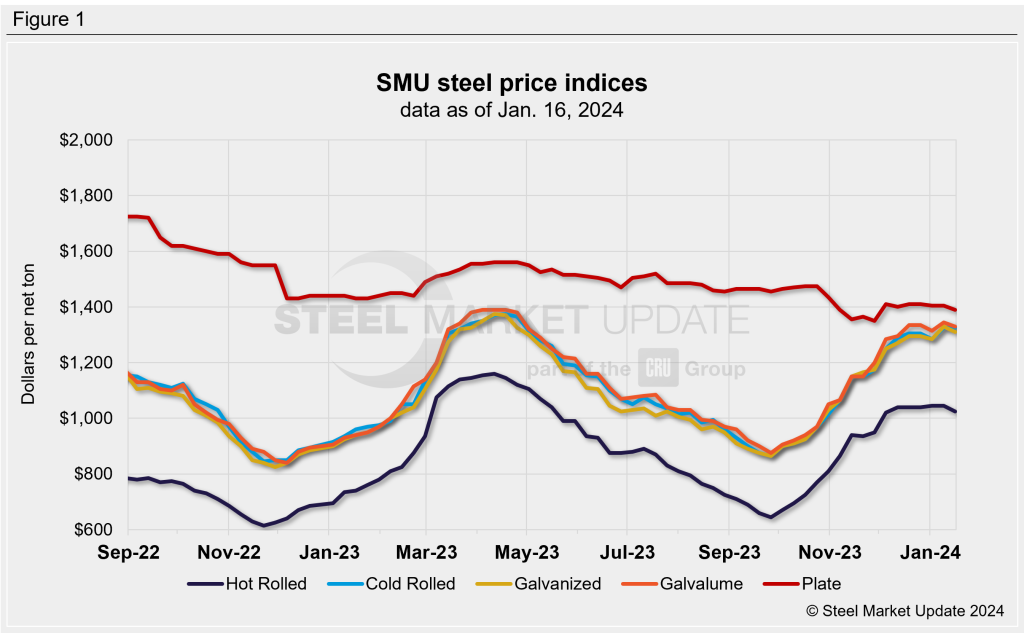

SMU price ranges: Sheet slides, momentum indicators move lower

Written by David Schollaert & Michael Cowden

US hot-rolled (HR) coil prices fell noticeably this week for the first time since late September.

SMU’s hot-rolled coil price now stands at $1,025 per ton on average, down $25 per ton from last week. Cold-rolled (CR) coil was unchanged at $1,325 per ton.

Coated products also recorded declines. Galvanized base prices were $1,310 per ton on average, down $20 per ton from a week ago. Galvalume prices were $1,330 per ton on average, off $15 per ton from last week.

Plate, meanwhile, stands at $1,390 per on average, down $20 per ton from a week ago.

Some market participants said they expected sheet prices to flatten out and move downward going forward. Others said that prices could continue to bounce around at current levels for a few more weeks.

Given that prices for most products have declined – and with most sources we contacted saying that the market was at a peak or had already peaked – SMU has shifted its price momentum indicators from sideways to lower.

Hot-rolled coil

The SMU price range is $970–1,080 per net ton, with an average of $1,025 per ton FOB mill, east of the Rockies. The bottom end and the top end of our range were down $20 per ton vs. one week ago. Our overall average has, as a result, declined $20 per ton week on week (w/w). Our price momentum indicator for HRC has shifted from neutral to lower, meaning SMU expects prices will move lower over the next 30 days.

Hot rolled lead times: 6–8 weeks

Cold-rolled coil

The SMU price range is $1,300–1,350 per net ton, with an average of $1,325 per ton FOB mill, east of the Rockies. The lower end and the top end of our range were unchanged vs. the prior week. Our overall average, as a result, is sideways when compared to last week. Our price momentum indicator for CRC has shifted from neutral to lower, meaning SMU expects prices will move lower over the next 30 days.

Cold rolled lead times: 6–12 weeks

Galvanized coil

The SMU price range is $1,280-1,340 per ton, with an average of $1,310 per ton FOB mill, east of the Rockies. The bottom end and the top end of our range were down $20 per ton vs. one week ago. Our overall average is down $20 per ton vs. the week prior. Our price momentum indicator for galvanized has shifted from neutral to lower, meaning SMU expects prices will move lower over the next 30 days.

Galvanized .060” G90 benchmark: SMU price range is $1,377–1,437 per ton with an average of $1,407 per ton FOB mill, east of the Rockies.

Galvanized lead times: 6-11 weeks

Galvalume coil

The SMU price range is $1,300–1,360 per net ton, with an average of $1,330 per ton FOB mill, east of the Rockies. The lower end of our range was unchanged vs. the prior week, while the top end of our range was down $30 per ton. Thus our overall average is $15 per ton lower vs. the week prior. Our price momentum indicator for Galvalume has shifted from neutral to lower, meaning SMU expects prices will move lower over the next 30 days.

Galvalume .0142” AZ50, grade 80 benchmark: SMU price range is $1,594–1,654 per ton with an average of $1,624 per ton FOB mill, east of the Rockies.

Galvalume lead times: 6-15 weeks

Plate

The SMU price range is $1,340–1,440 per net ton, with an average of $1,390 per ton FOB mill. The lower end of our range was down $40 per ton w/w, while the top end of our range was $10 per ton higher vs. the prior week. Our overall average is down $15 per ton vs. one week ago. Our price momentum indicator for plate has shifted from neutral to lower, meaning SMU expects prices will move lower over the next 30 days.

Plate lead times: 4-7 weeks

SMU note: Above is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is also available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.

David Schollaert

Read more from David Schollaert