Market Data

April 26, 2024

SMU survey: Buyers' Sentiment finishes April on the upswing

Written by Brett Linton

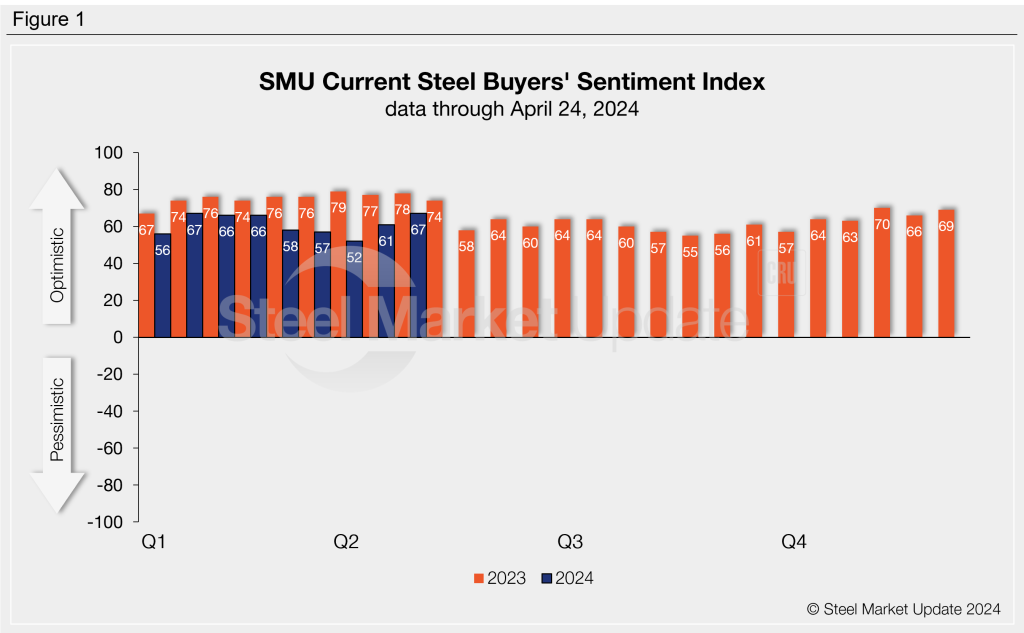

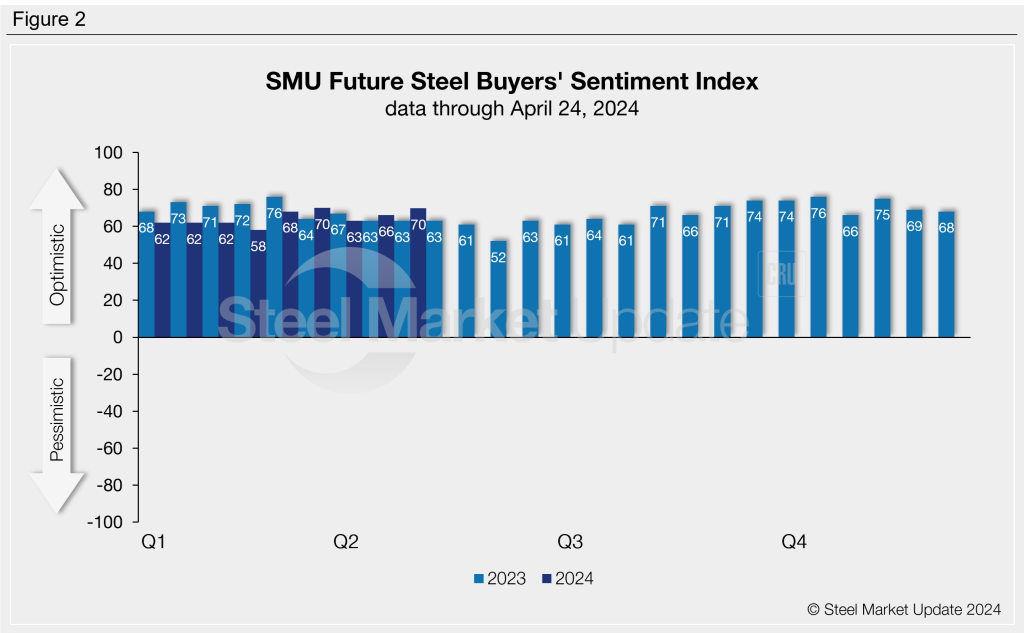

SMU’s Steel Buyers’ Sentiment Indices both rose this week to reach some of the highest levels observed this year.

Every other week, we poll steel buyers about their companies’ chances of success in the current market as well as three to six months down the road. We use this information to calculate our Current Steel Buyers’ Sentiment Index and our Future Sentiment Index, which we have been tracking since 2008.

SMU’s Current Buyers’ Sentiment Index bounced up to +67 this week, up six points from two weeks earlier. Current sentiment is up 15 points from the 17-month low recorded one month ago (Figure 1). This week’s measure is tied with mid-February for the highest mark of 2024.

SMU’s Future Buyers’ Sentiment Index measures buyers’ feelings about business conditions three to six months in the future. The index increased four points this week to +70, now seven points higher than one month prior (Figure 2). Future Sentiment is tied with our mid-March reading for the highest measure of the year.

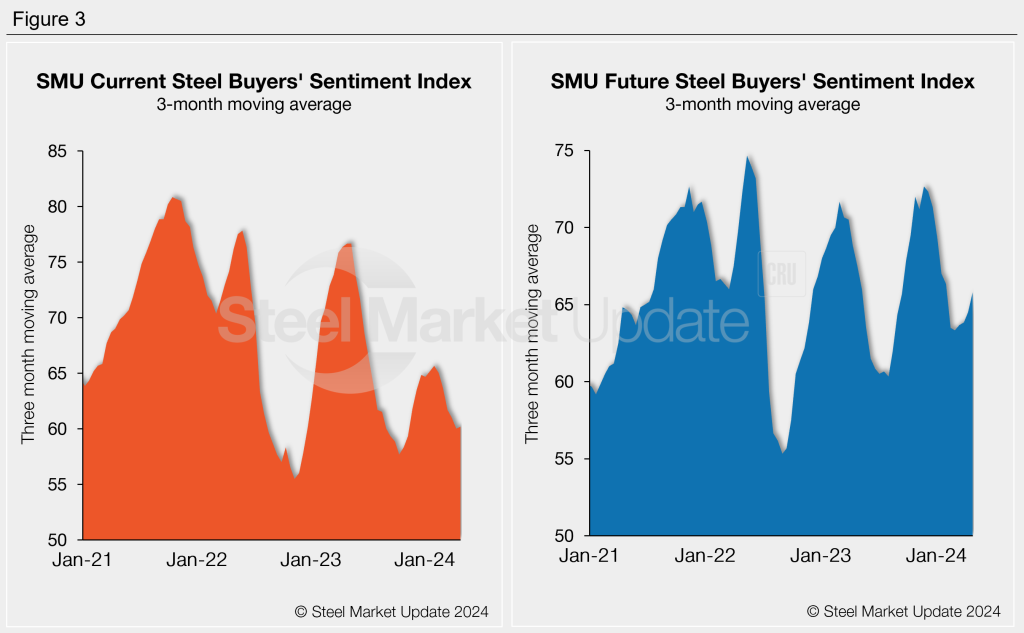

Measured as a three-month moving average, the Current Sentiment 3MMA showed signs of recovery this week, up slightly to +60.19. This week’s Future Sentiment 3MMA increased three points to +65.79, now at a three-month high (Figure 3).

What SMU survey respondents had to say:

“Too much volatility in pricing, hard to gauge three-month window.”

“Margin compression. Still moving higher-cost inventory due to a flurry of late mill deliveries in first quarter.”

“Depends on domestic demand the supply/demand balance.”

“Need to find the right opportunities.”

“Have had a stronger than expected April.”

About the SMU Steel Buyers’ Sentiment Index

The SMU Steel Buyers Sentiment Index measures the attitude of buyers and sellers of flat-rolled steel products in North America. It is a proprietary product developed by Steel Market Update for the North American steel industry. Tracking steel buyers’ sentiment is helpful in predicting their future behavior. A link to our methodology is here. If you would like to participate in our survey, please contact us at info@steelmarketupdate.com.