Market Data

July 5, 2024

SMU survey: Buyers' Sentiment Indices drop, Current touches 4-year low

Written by Ethan Bernard

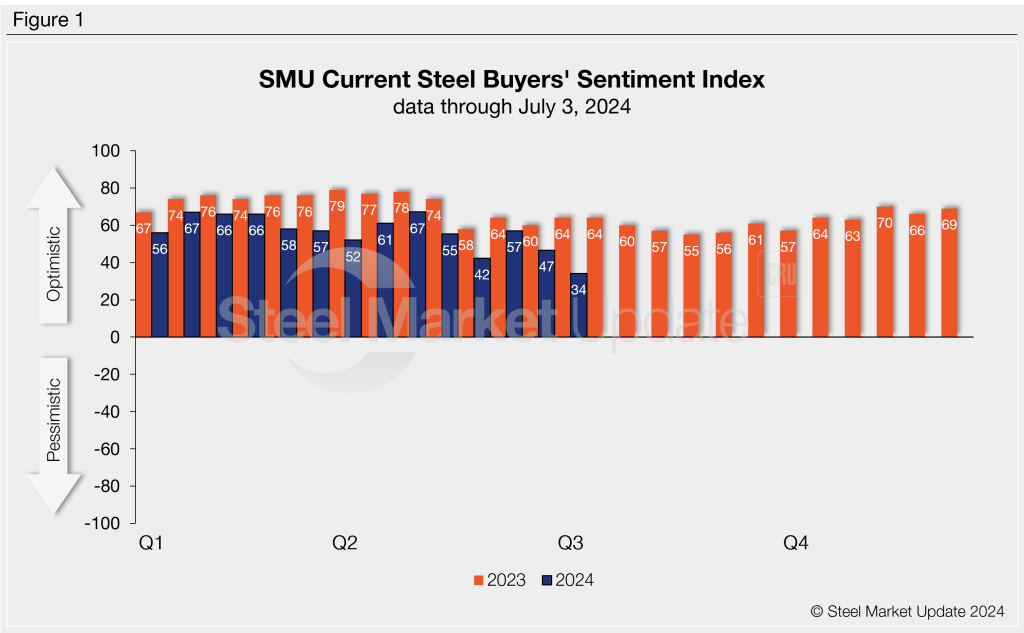

SMU’s Steel Buyers’ Sentiment Indices dropped this week, with Current Sentiment plummeting to a level not seen since the Covid-19 pandemic, according to our most recent survey data.

Every other week, we poll steel buyers about their companies’ chances of success in the current market as well as three to six months down the road. We use this information to calculate our Current Steel Buyers’ Sentiment Index and Future Sentiment Index. (We have historical data dating to 2008. You can find that here.)

SMU’s Current Buyers’ Sentiment Index was +34 this week, tumbling 13 points from two weeks earlier (Figure 1). This is the lowest reading since August 2020 when it also stood at +34. Since April this index has fluctuated wildly, going as high as +67 at the end of that month.

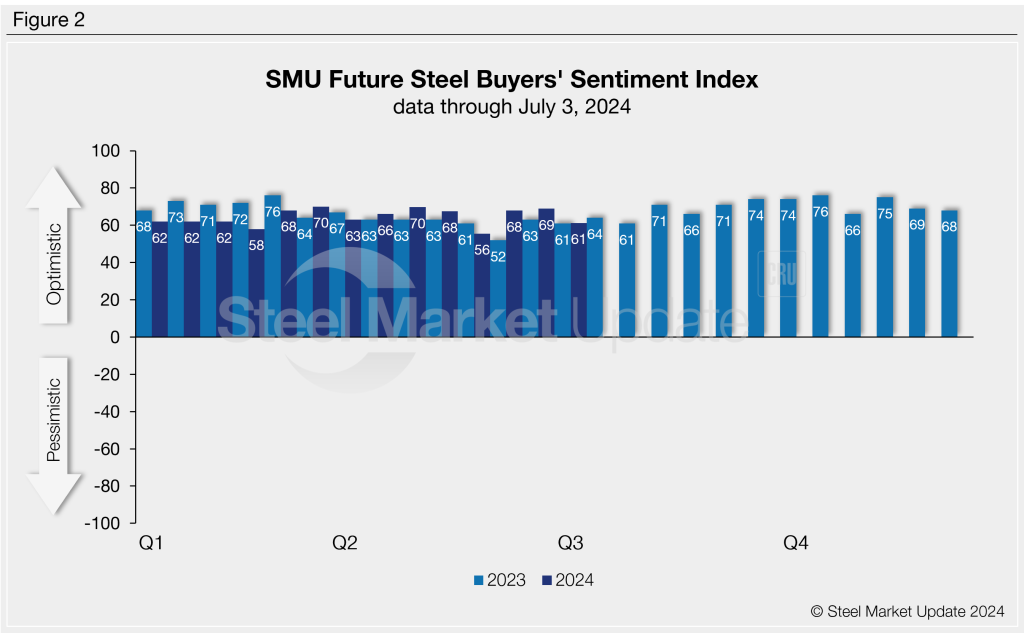

SMU’s Future Buyers’ Sentiment Index measures buyers’ feelings about business conditions three to six months in the future. This index stands at +61 this week, off eight points from our prior market check. (Figure 2). While not having the same swings as Current Sentiment, it has still varied up to 14 points since April. It touched +70 at the end of that month and +56 at the end of May.

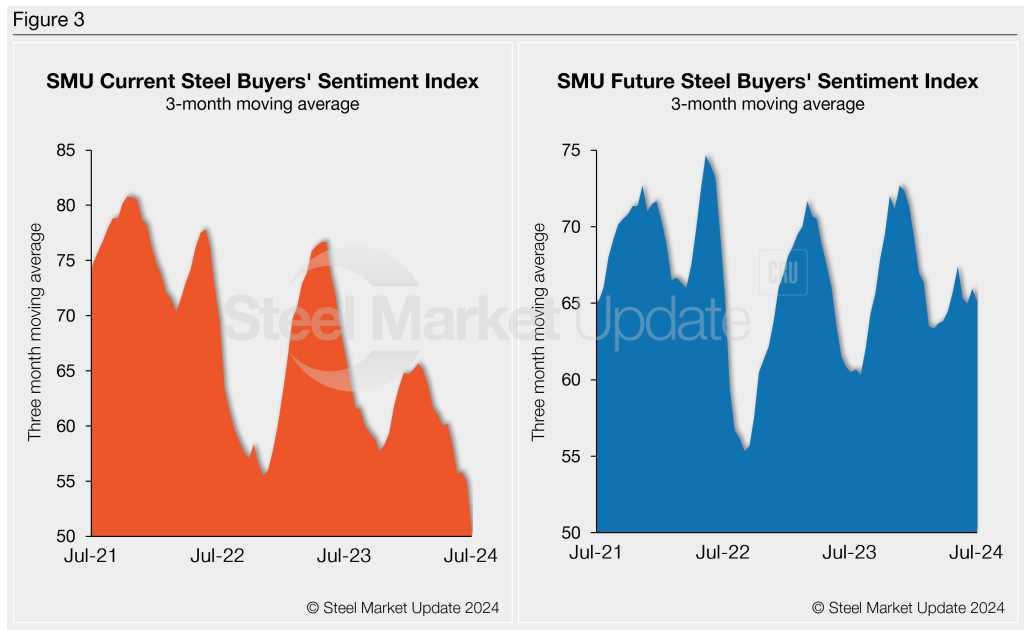

Measured as a three-month moving average, the Current Sentiment 3MMA dropped to +50.42 from +54.89 two weeks earlier.

Meanwhile, this week’s Future Sentiment 3MMA fell to +65.15 from +65.94 at the previous market check (Figure 3).

What SMU survey respondents had to say:

“Continued deflationary mill pricing creates panic.”

“With so much volatility in price, it’s hard to pick an entry point that will be in our favor by the time the material comes ready.”

“We have a modest backlog, so will survive.”

“Our peers have lost confidence and it shows in their pricing.”

“I think our industry will start to bounce back.”

“I don’t see any reason for much better until interest rates are cut and construction demand increases.”

“Demand will determine our success. We will have plenty of low-cost steel.”

About the SMU Steel Buyers’ Sentiment Index

The SMU Steel Buyers Sentiment Index measures the attitude of buyers and sellers of flat-rolled steel products in North America. It is a proprietary product developed by Steel Market Update for the North American steel industry. Tracking steel buyers’ sentiment is helpful in predicting their future behavior. A link to our methodology is here. If you would like to participate in our survey, please contact us at info@steelmarketupdate.com.