Market Data

August 2, 2024

SMU's July at a glance

Written by Brett Linton

SMU’s Monthly Review articles summarize important steel market metrics for the prior month. Our latest report contains figures updated through July 31.

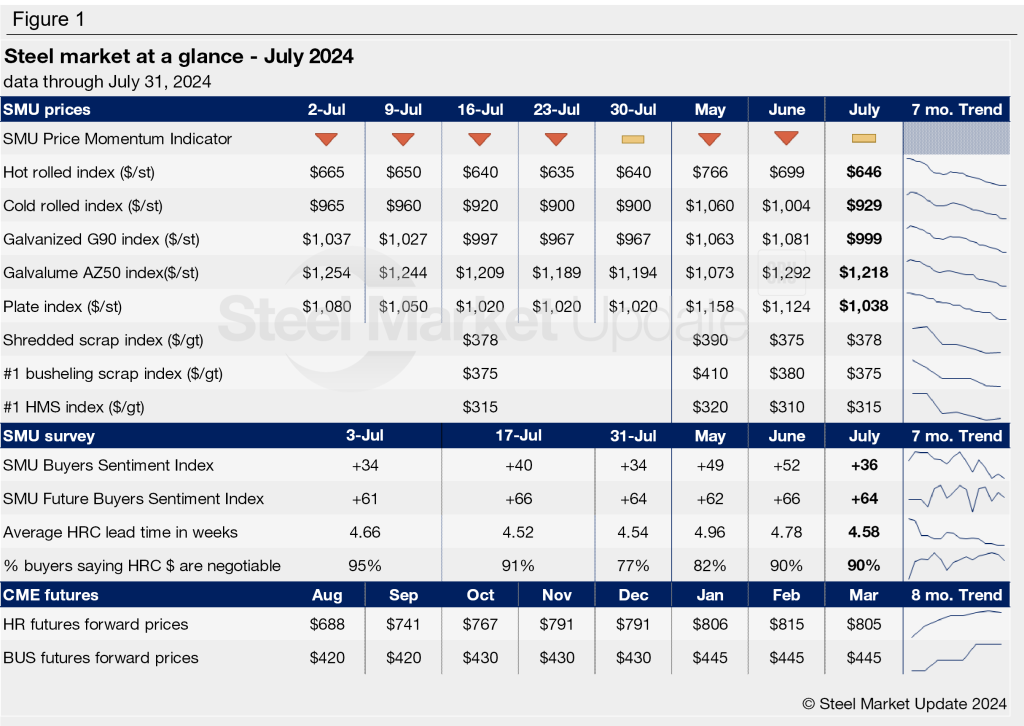

Steel prices gradually fell throughout the month of July, for both sheet and plate products. The SMU Price Momentum Indicator remained at lower for the majority of the month, but was adjusted to neutral last week.

Scrap prices were little changed from June to July, with buyers hopeful that this may be the bottom of the market.

We saw continued volatility in Steel Buyers’ Sentiment, with Current Sentiment retreating back to a four-year low by the end of July. Steel mill lead times remained relatively flat across the month, remain near multi-month lows. Meanwhile, the percentage of buyers reporting that mills were willing to negotiate decreased.

See the chart below for other key metrics for July. View historical Monthly Review tables here on our website.