Overseas

August 16, 2024

Domestic CRC prices grow even more expensive than offshore product

Written by David Schollaert

The price gap between US cold-rolled (CR) coil and imported CR widened this week after falling to a 10-month low in late July.

Domestic CR coil tags remain above offshore prices on a landed basis. Stateside prices have begun inflecting up after falling to their lowest levels since last October.

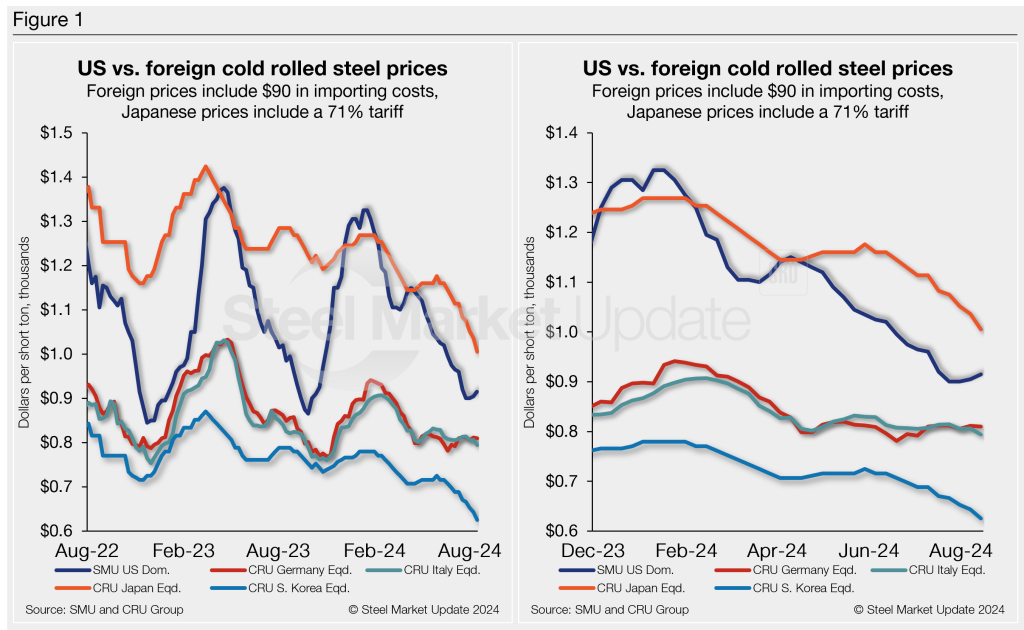

US CR coil prices averaged $915 per short ton (st) in our check of the market on Tuesday, Aug. 13, up $10/st from the week before. Despite the slight improvement of late, CR tags are still down roughly $390/st from a year-to-date high of $1,325/st in January.

Domestic CR prices are, theoretically, 15.3% more expensive than imports. That’s up marginally from 11.9% last week. While US CRC prices are still higher than offshore material, the US CR premium is down from a 31.5% premium in early January.

In dollar-per-ton terms, US CR is now, on average, $107/st more expensive than offshore product (see Figure 1). That compares to $81/st costlier on average last week. That’s still down from a recent peak of $311/st in mid-January.

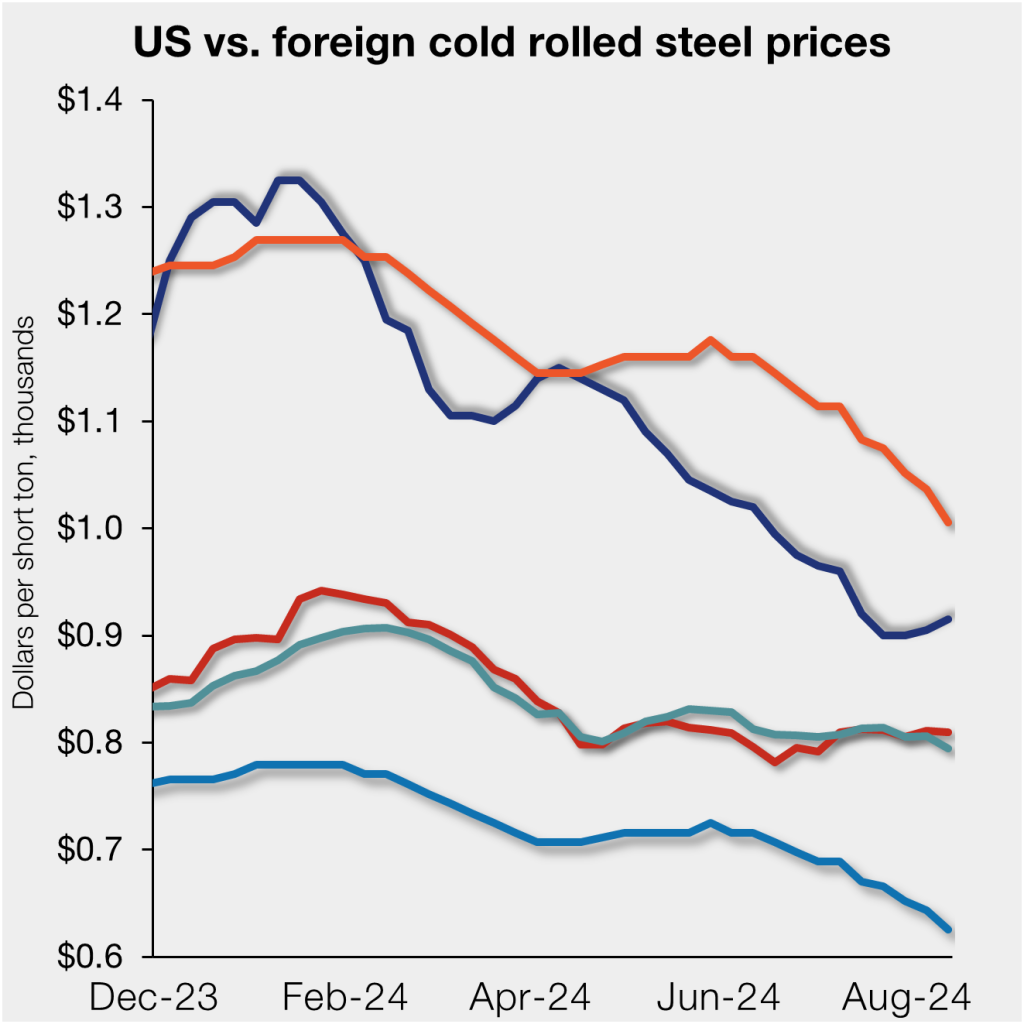

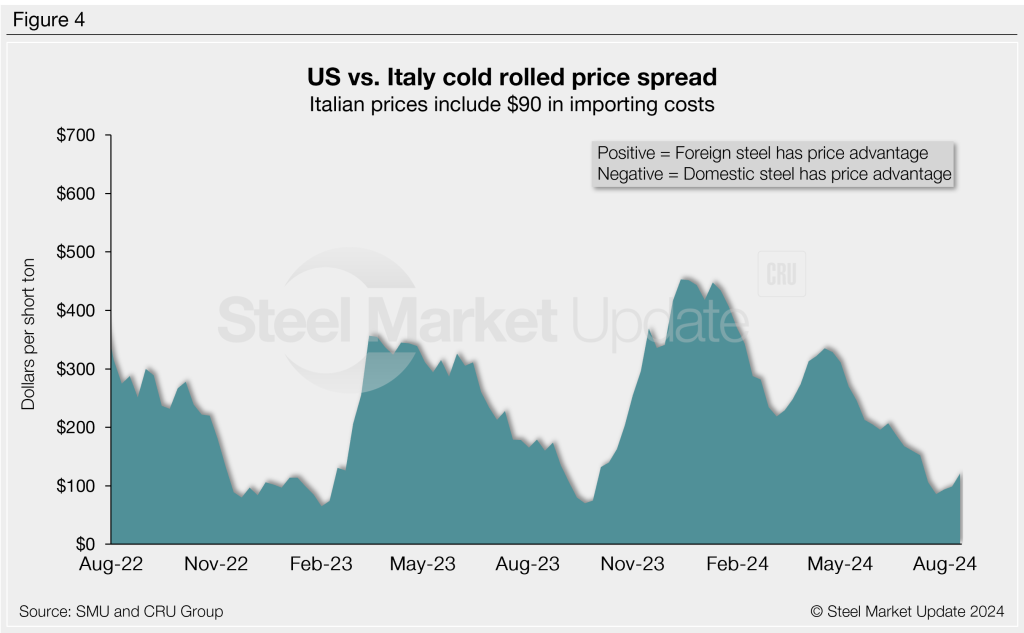

The charts below compare CR coil prices in the US, Germany, Italy, South Korea, and Japan. The left-hand side highlights prices over the last two years. The right-hand side zooms in to show more recent trends.

Methodology

This is how SMU calculates the theoretical spread between domestic CR prices (FOB domestic mills) and foreign CR prices (delivered to US ports): We compare SMU’s US CR weekly index to the CRU CR weekly indices for Germany, Italy, and East Asia (Japan and South Korea). This is only a theoretical calculation. Import costs can vary greatly, influencing the true market spread.

We add $90/st to all foreign prices as a rough means of accounting for freight costs, handling, and trader margin. This gives us an approximate CIF US ports price to compare to the SMU domestic CR price. Buyers should use our $90/st figure as a benchmark and adjust up or down based on their own shipping and handling costs. (Editor’s note: If you import steel and want to share your thoughts on these costs, please get in touch with the author at david@steelmarketupdate.com.)

East Asian CR coil

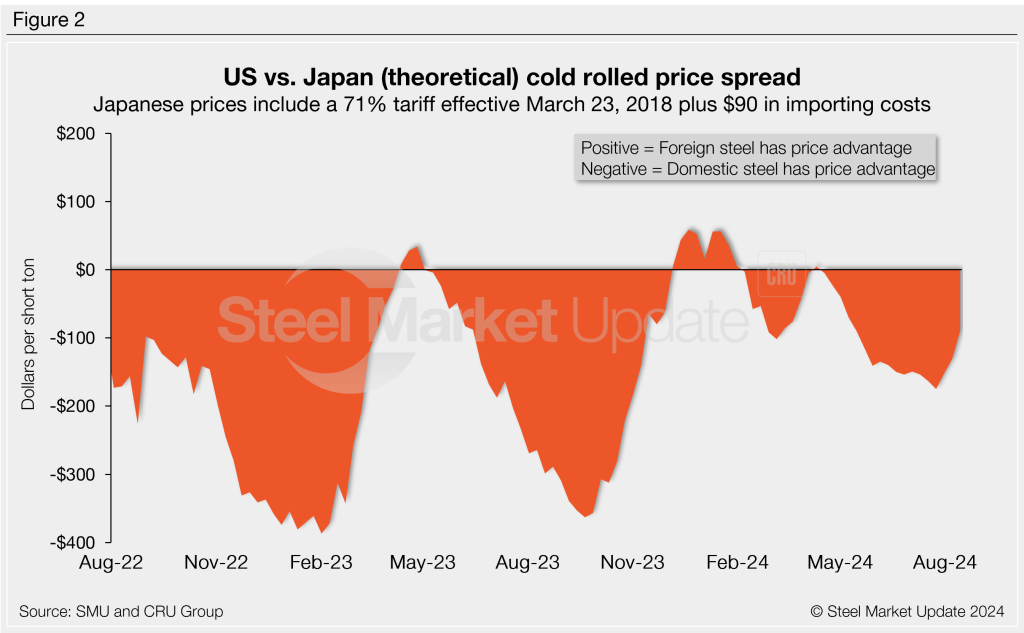

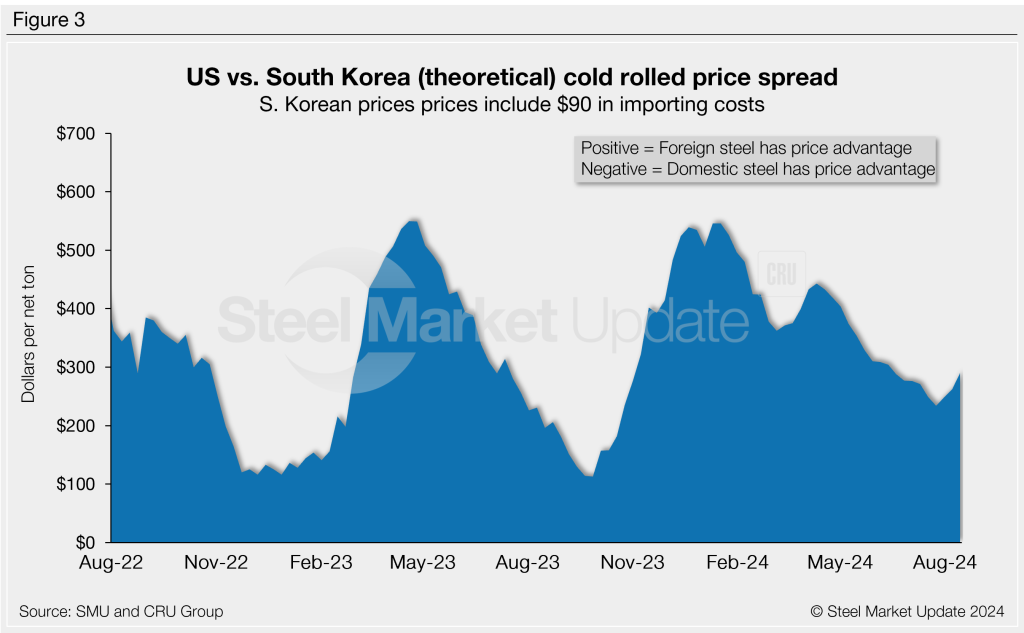

As of Thursday, Aug. 15, the CRU Asian CR price was $535/st, down $18/st week over week (w/w) and down $64/st over the past month. Adding a 71% anti-dumping duty (Japan, theoretical) and $90/st in estimated import costs, the delivered price to the US is $1,005/st. The theoretical price of South Korean CR exports to the US is $625/st.

The latest SMU CR average of $915/st theoretically puts US-produced CR $90/st below CR product imported from Japan. But US tags are still $290/st more expensive than CR imported from South Korea.

Italian CR coil

Italian CR prices were down $12/st to roughly $704/st this week. After adding import costs, the price of Italian CR delivered to the US is, in theory, $794/st.

That means domestic CR is theoretically $121/st more expensive than CR coil imported from Italy. The spread is up $22/st from last week but still $359/st below a recent high of $453/st mid-December.

German CR coil

CRU’s German CR price was largely flat, down just $1/st vs. last week. After adding import costs, the delivered price of German CR is, in theory, $810/st.

The result: Domestic CR is also theoretically $105/st more expensive than CR imported from Germany. The spread is up $11/st w/w but still well below a recent high of $431/st in the first week of 2024.

Notes: We reference domestic prices as FOB the producing mill, while foreign prices are CIF the port (Houston, NOLA, Savannah, Los Angeles, Camden, etc.). Inland freight from either a domestic mill or a port is important to keep in mind when deciding where to source from. It’s also important to factor in lead times. In most market cycles, domestic steel will deliver more quickly than foreign steel. Note also that, effective Jan. 1, 2022, the blanket 25% Section 232 tariff was removed from most imports from the European Union. It was replaced by a tariff rate quota (TRQ). Therefore, the German and Italian price comparisons in this analysis no longer include a 25% tariff. A similar TRQ with Japan went into effect on April 1, 2022. South Korea is subject to a hard quota rather than a tariff.