Product

August 20, 2024

Near-term headwinds seen after domestic scrap tags ticked up in August

Written by Brett Linton & Ethan Bernard

US scrap prices were a strong sideways in August, though near-term demand is expected to remain weak, scrap sources told SMU.

SMU’s August scrap pricing stands at:

- Busheling at $390-400/gross ton (gt), averaging $395, up $20 from July.

- Shredded at $380-385/gt, averaging $382.50, up $5 from July.

- HMS at $320-340/gt, averaging $330, up $15 from July.

For HMS, one source commented that there are “some lower numbers and some higher ones.”

“That grade was in relatively shorter supply in the Midwest,” he said.

A second source noted that HMS in the Midwest was bought as high as $360/gt.

Exports, outlook

The first source said export pricing has been at a premium to domestic until the last two weeks or so. At that point, it started to come down due to less of an appetite in Turkey

He remarked that Turkish mills still need scrap, but less than they did in Q2 and July.

“Lots of cheap Chinese billets have made and will make their way to Turkey, which reduces Turkish scrap demand, especially in an environment where they have trouble lifting rebar prices,” the source added.

He thinks that, in the medium term, governments will crack down on “cheap” Chinese steel exports.

The source noted this could lead to those mills trying to find other ways to export steel, “but also more scrap demand to feed mills ex-China.”

He said there could be some downside potentially for US scrap in September and October as a result of that, and “continued weak demand here, which will manifest in lots of outages coming up.”

A third source said the “sentiment in the market is pessimistic as mills don’t seem to be needing much scrap due to cutbacks and planned outages.”

He added that the “export numbers have sharply declined also.”

Looking at the near-term pricing outlook, the first source remarked that scrap prices have been lackluster all year.

“I don’t see much downside but either side of $20 is reasonable over the next 60-70 days in my opinion,” he added.

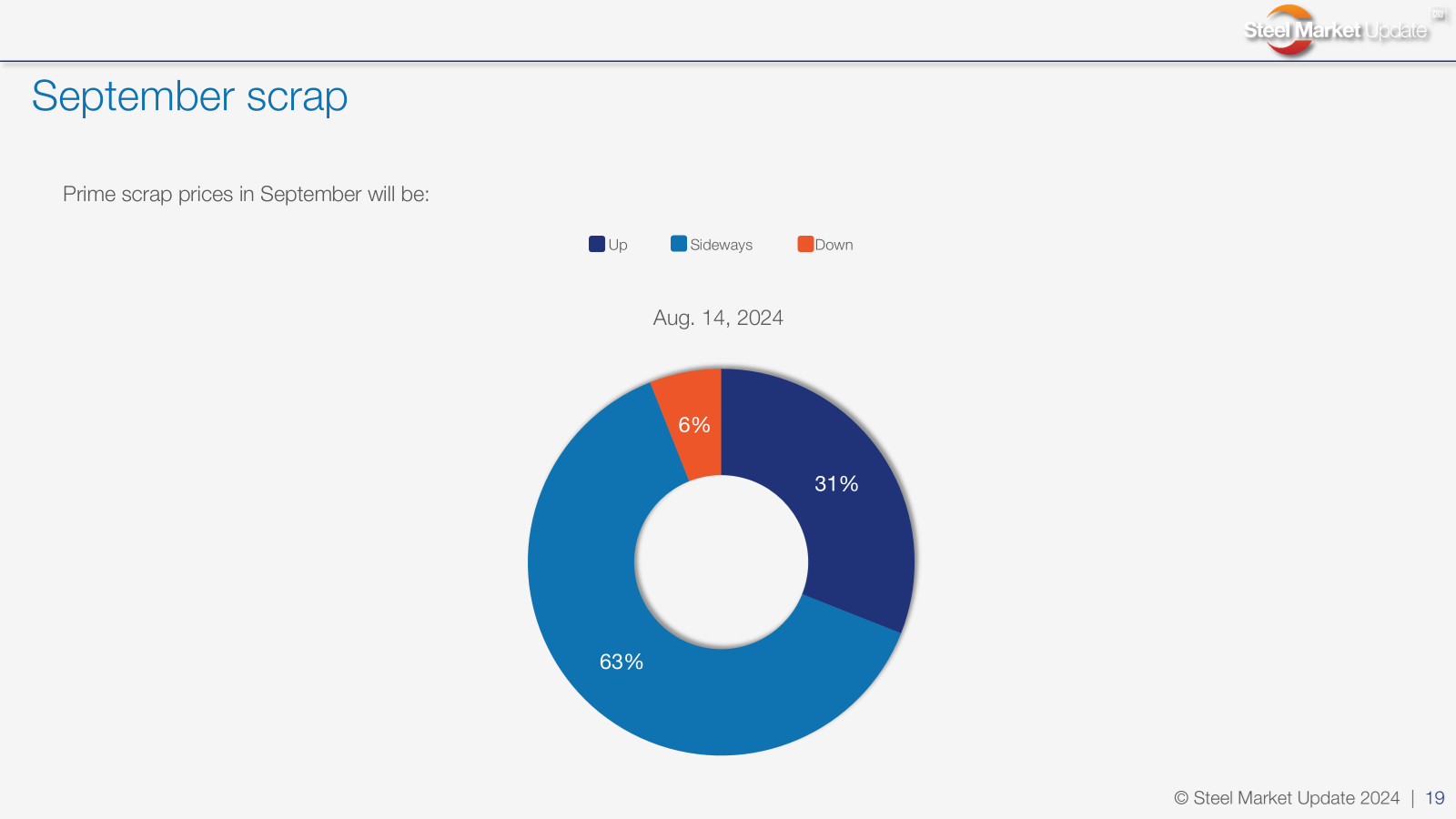

SMU survey outlook for prime in September

Participants in SMU’s survey last week were asked their outlook for September busheling prices. A majority thought prices would be sideways in September.

Brett Linton

Read more from Brett Linton