Analysis

September 17, 2024

Final thoughts

Written by Michael Cowden

Cleveland-Cliffs is seeking $750 per short ton (st) for hot-rolled coil. That’s $20/st above where the steelmaker had been. It’s also $30/st higher than Nucor’s published price of $720/st.

We’ve seen prices increase incrementally this week. SMU’s HR price, for example, stands at $690/st on average, up $5/st from last week. The questions now are whether a number well above $700/st will stick, whether other mills will follow Cliffs, and whether there is enough demand to support higher prices.

Keep tabs on the negotiation rate

To help answer that, I’ll be keeping an eye out for the mill negotiation rate when we release our next full steel market survey to premium members on Friday, Sept. 27.

Why? Mills, since late July, have been steadily pushing prices higher, as you can see in our price announcement calendar. During that time, SMU’s sheet price assessments have stabilized and moved higher as well – but never quite as high as mills’ list prices.

Perhaps that’s to be expected. Most buyers continue telling us that mills remain willing to negotiate lower prices. And this week, we’ve heard from some market participants that certain mills were offering discounts just before Cliffs announced its price increase on Tuesday.

Was that a case of trying to bring in large volumes at low prices in hopes of stretching out lead times, thus giving higher prices a better shot at sticking on smaller orders?

But back to the negotiation rate. In early July, when HR prices were falling on their way down to as low as $600/st, 95% of surveyed buyers told us that mills were willing to negotiate on HRC. Mills aren’t as willing to negotiate now as they were then. Nonetheless, 71% of buyers told us last week that their mill suppliers remained open to cutting deals.

If numbers significantly north of $700/st are to gain traction, the negotiation rate should go down. Case in point: Prices sustained a rally in Q4 of last year. In late November of 2023, only 29% of buyers surveyed said mills were willing to negotiate lower HR prices. The negotiation rates were even lower for cold rolled (8%) and galvanized (16%).

We have not seen anything like that yet. To be fair, perhaps we haven’t seen the coated trade case and the expected hot idling of Cliffs’ C-6 furnace impact our survey results yet. Maybe we will see that more clearly next week.

High inventories weighing on futures?

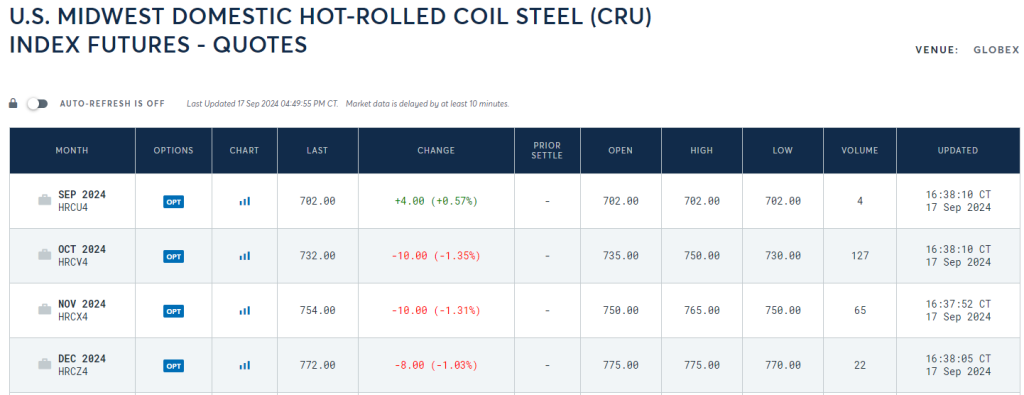

One thing is already clear. Futures markets have not reacted to Cliffs’ price announcement in the bullish way they did to reports of C-6 being hot idled:

Yes, September was seeing some modest gains on Tuesday afternoon trading. But prices for Q4 slipped. Last week, following news of the hot idling, everything moved up.

Futures, of course, don’t predict the future. But they do perhaps reflect the sentiment that a furnace outage is more meaningful than a price increase announcement.

Also, there is the matter of inventories. As our premium members know, August sheet inventories came in high. SMU’s David Schollaert has the details here. Here is one key figure: Service centers had 66.3 shipping days of supply in August. That’s the highest level since May 2020, when shipping days of supply reached 67.7.

I’m guessing that number will decrease in September, as we’ve also seen indications that more steel buyers are destocking. But in the meantime, how much can sheet prices increase with a potential inventory overhang like that? Are supply constraints – the coated trade case, an expected furnace idling, and maintenance outages – enough to offset it?

Please share your thoughts with us at info@steelmarketupdate.com. (We thank you ahead of time for keeping the feedback professional.)

SMU membership levels and Hedging 101

I’ve been referring to some of our “premium” content and data. If you’re an “executive” member, things like our survey results and service center inventories report are good reasons to consider upgrading to premium. Please reach out to SMU senior account executive Luis Corona at luis.corona@crugroup.com if interested.

Also, as most of you know, SMU features regular columns on HR and scrap futures. If you’d like to learn more about the topic, consider attending our Hedging 101 Workshop next week (Wednesday, Sept. 25) at Hyatt Centric The Loop Chicago (100 West Monroe St.) from 8 a.m. to 5 p.m.

Lunch is included. And here’s a fun fact: The course will be taught by Spencer Johnson, one of our columnists and a veteran futures broker at StoneX. Luis and I will be there too. You can register here.