Market Data

October 24, 2024

SMU Survey: Overall mill negotiation rate at highest point on record

Written by Brett Linton

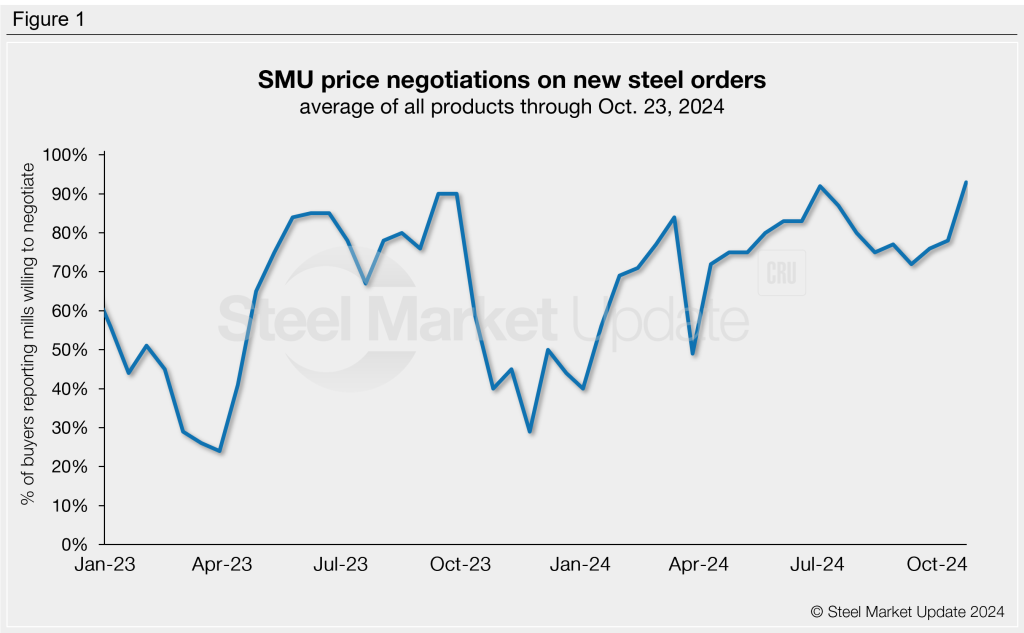

More than nine out of every 10 steel buyers polled by SMU this week reported that mills are flexible on prices for new orders. Negotiation rates have been strong since April and on the rise since early September.

SMU polls hundreds of steel market executives every two weeks, asking if domestic mills are willing to negotiate prices on new spot orders. As shown in Figure 1, 93% of all buyers surveyed this week reported that mills were willing to talk price. This is the highest overall negotiation rate recorded since we started tracking this measure in early 2021, surpassing the early July high of 92%.

Negotiation rates by product

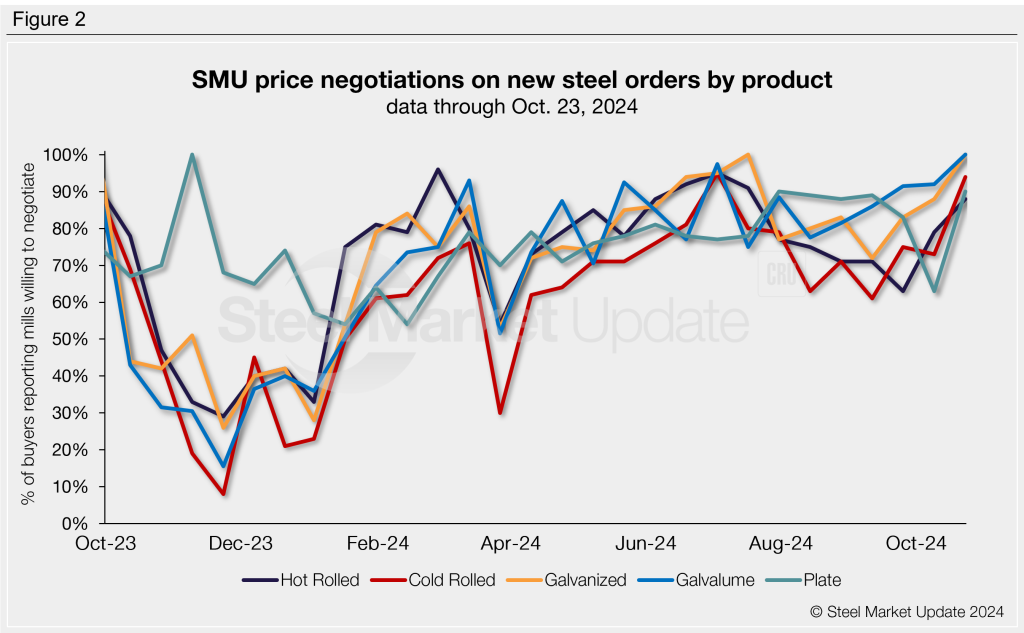

As seen in Figure 2, negotiation rates increased this week for all sheet and plate products and are now up to levels last seen in July. Negotiation rates were highest for coated and cold-rolled products. The largest gains from our prior survey were seen in plate and cold-rolled rates. Negotiation rates by product this week are:

- Hot rolled: 88%, up nine percentage points from Oct. 9 and the highest rate recorded since mid-July.

- Cold rolled: 94%, up 21 percentage points and the highest rate since early July.

- Galvanized: 100%, up 12 percentage points and the highest rate since mid-July.

- Galvalume: 100%, up eight percentage points and the highest rate seen since May 2023.

- Plate: 90%, up 27 percentage points from an eight-month low and the highest rate since late July.

Here’s what some survey respondents had to say:

“Depends on the mill, but volume [hot rolled] orders carry a discount.”

“Larger buys are getting better prices.”

“Plate mills are hungry for work. Mills who haven’t been participants are now calling regularly.”

“Can buy much lower pricing for significant tons.”

“Depends on how many [hot rolled] tons you want to buy.”

Note: SMU surveys active steel buyers every other week to gauge their steel suppliers’ willingness to negotiate new order prices. The results reflect current steel demand and changing spot pricing trends. Visit our website for an interactive history of our steel mill negotiations data.