Market Data

November 12, 2024

SMU price ranges: Post-election prices look a lot like pre-election ones

Written by Brett Linton & Michael Cowden

The political world might have been turned upside down last week, but the steel market has taken it in stride.

Prices for sheet and plate products were mixed. While market participants have noted a post-election uptick in activity, most said that it was (so far) nothing to write home about.

“Tuesday came and went. The world didn’t end. And today is just a normal day in November,” a Midwest service center said.

Market sources also shrugged off published mill prices of $750 per short ton (st) for hot-rolled coil as not indicative of most spot transactions. They likewise didn’t see urgency around Cleveland-Cliffs closing books for 2024 – especially since contract tons remained available.

And while talk of Trump and tariffs might be consuming policy debates, steel buyers said that didn’t change stubborn facts such as increasing domestic capacity, so-so demand, and ample inventories. Some also noted the extension of preliminary duty deadlines in the coated trade case, which could allow imports of coated material to arrive into early 2025.

SMU’s price momentum indicator remains at neutral for both sheet and plate products, following our Oct. 28 adjustment.

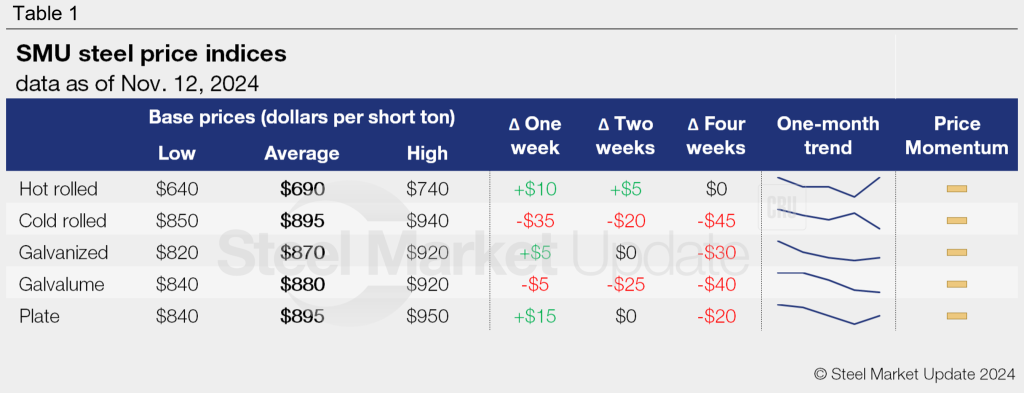

Refer to Table 1 for the latest SMU steel price indices and how they stack up against recent weeks.

Hot-rolled coil

The SMU price range is $640-740/st, averaging $690/st FOB mill, east of the Rockies. The lower end of our range is unchanged w/w, while the top end is up $20/st w/w. Our overall average is up $10/st w/w. Our price momentum indicator for hot-rolled steel remains at neutral, meaning we see no clear direction for prices over the next 30 days.

Hot rolled lead times range from 3-6 weeks, averaging 4.6 weeks as of our Nov. 6 market survey.

Cold-rolled coil

The SMU price range is $850–940/st, averaging $895/st FOB mill, east of the Rockies. The lower end of our range is down $50/st w/w, while the top end is down $20/st w/w. Our overall average is down $35/st w/w. Our price momentum indicator for cold-rolled steel remains at neutral, meaning we see no clear direction for prices over the next 30 days.

Cold rolled lead times range from 5-8 weeks, averaging 6.6 weeks through our latest survey.

Galvanized coil

The SMU price range is $820–920/st, averaging $870/st FOB mill, east of the Rockies. The lower end of our range is unchanged w/w, while the top end is up $10/st w/w. Our overall average is up $5/st w/w. Our price momentum indicator for galvanized steel remains at neutral, meaning we see no clear direction for prices over the next 30 days.

Galvanized .060” G90 benchmark: SMU price range is $917–1,017/st, averaging $967/st FOB mill, east of the Rockies.

Galvanized lead times range from 5-8 weeks, averaging 6.8 weeks through our latest survey.

Galvalume coil

The SMU price range is $840–920/st, averaging $880/st FOB mill, east of the Rockies. The lower end of our range is unchanged w/w, while the top end is down $10/st w/w. Our overall average is down $5/st w/w. Our price momentum indicator for Galvalume steel remains at neutral, meaning we see no clear direction for prices over the next 30 days.

Galvalume .0142” AZ50, grade 80 benchmark: SMU price range is $1,134–1,214/st, averaging $1,174/st FOB mill, east of the Rockies.

Galvalume lead times range from 6-7 weeks, averaging 7.0 weeks through our latest survey.

Plate

The SMU price range is $840–950/st, averaging $895/st FOB mill. The lower end of our range is unchanged w/w, while the top end is up $30/st w/w. Our overall average is up $15/st w/w. Our price momentum indicator for plate remains at neutral, meaning we see no clear direction for prices over the next 30 days.

Plate lead times range from 2-6 weeks, averaging 3.9 weeks through our latest survey.

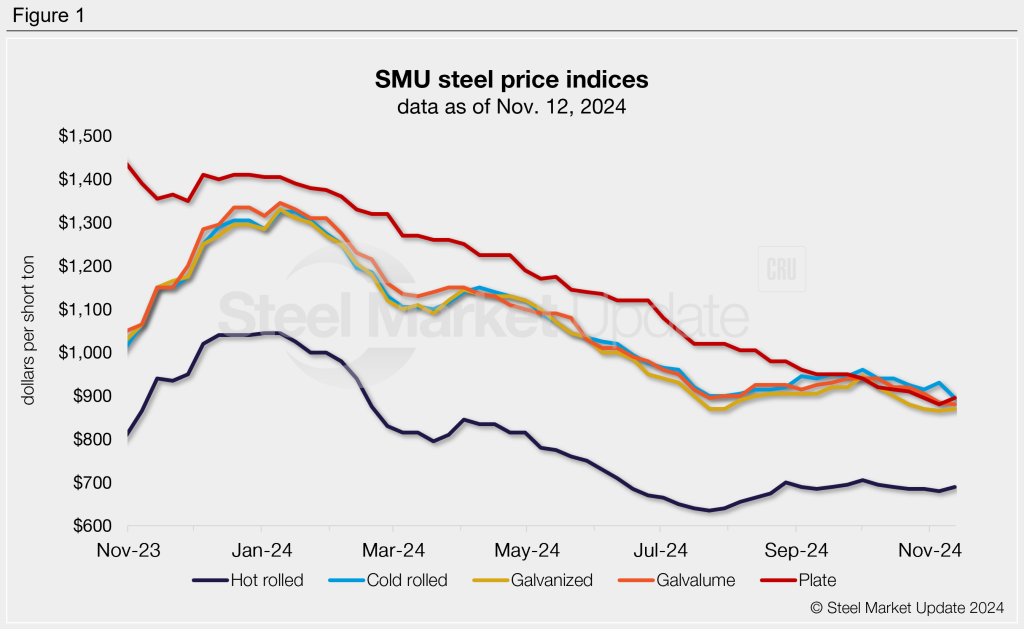

SMU note: Above is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is also available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.

Brett Linton

Read more from Brett Linton