Market Data

March 4, 2025

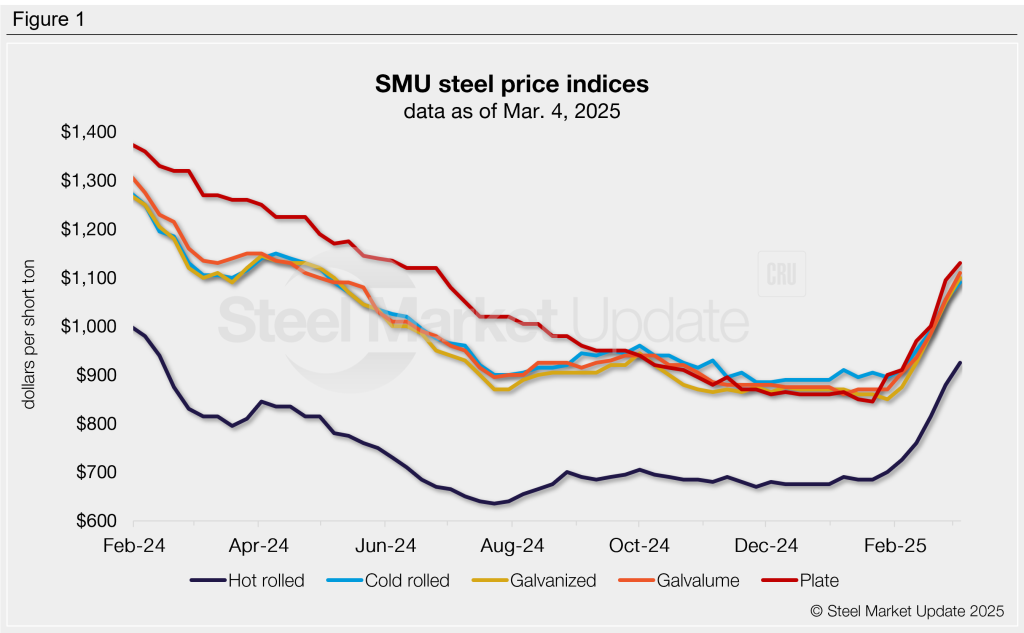

SMU price ranges: $1,000/ton HRC is back!

Written by Brett Linton

Steel prices climbed across the board this week, with prices for every steel product tracked by SMU rising to multi-month highs.

Our sheet and plate price indices increased by 3-5% on average compared to last week. Over the past month, steel prices have surged as much as 28% across the products we monitor.

Hot rolled prices rose for the sixth consecutive week, averaging $925 per short ton (st) this week. The upper end of our hot rolled range has reached $1,000/st – the last time we recorded quadruple-digit hot rolled prices was more than a year ago.

Tandem products are moving higher alongside one another. Our cold rolled, galvanized, and Galvalume indices average between $1,090-1,110/st this week, highs not seen in nearly 10 months.

Following last week’s $95/st jump, plate prices continued to move higher this week, but at a slower pace. Our index rose $35/st from the prior week to $1,130/st. The last time plate prices were in this ballpark was in June of last year.

SMU’s price momentum indicator remains at higher for all sheet and plate products, indicating we expect prices to increase in the short term.

Refer to Table 1 for the latest SMU steel price indices and how prices have trended in recent weeks (click to expand).

Hot-rolled coil

The SMU price range is $850-1,000/st, averaging $925/st FOB mill, east of the Rockies. The lower end of our range is up $10/st w/w, while the top end is up $80/st w/w. Our overall average is up $45/st w/w. Our price momentum indicator for hot-rolled steel remains at higher, meaning we expct prices to increase over the next 30 days.

Hot rolled lead times range from 4-8 weeks, averaging 5.5 weeks as of our Feb. 19 market survey. We will publish updated lead times on Thursday.

Cold-rolled coil

The SMU price range is $1,020–1,160/st, averaging $1,090/st FOB mill, east of the Rockies. The lower end of our range is up $10/st w/w, while the top end is up $60/st w/w. Our overall average is up $35/st w/w. Our price momentum indicator for cold-rolled steel remains at higher, meaning we expect prices to increase over the next 30 days.

Cold rolled lead times range from 6-9 weeks, averaging 7.1 weeks through our latest survey.

Galvanized coil

The SMU price range is $1,040–1,160/st, averaging $1,100/st FOB mill, east of the Rockies. The lower end of our range is up $40/st w/w, while the top end is up $60/st w/w. Our overall average is up $50/st w/w. Our price momentum indicator for galvanized steel remains at higher, meaning we expect prices to increase over the next 30 days.

Galvanized .060” G90 benchmark: SMU price range is $1,137–1,257/st, averaging $1,197/st FOB mill, east of the Rockies.

Galvanized lead times range from 6-9 weeks, averaging 7.3 weeks through our latest survey.

Galvalume coil

The SMU price range is $1,070–1,150/st, averaging $1,110/st FOB mill, east of the Rockies. The lower end of our range is up $60/st w/w, while the top end is up $50/st w/w. Our overall average is up $55/st w/w. Our price momentum indicator for Galvalume steel remains at higher, meaning we expect prices to increase over the next 30 days.

Galvalume .0142” AZ50, grade 80 benchmark: SMU price range is $1,364–1,444/st, averaging $1,404/st FOB mill, east of the Rockies.

Galvalume lead times range from 7-8 weeks, averaging 7.3 weeks through our latest survey.

Plate

The SMU price range is $1,060–1,200/st, averaging $1,130/st FOB mill. The lower end of our range is up $70/st w/w, while the top end is unchanged w/w. Our overall average is up $35/st w/w. Our price momentum indicator for plate remains at higher, meaning we expect prices to increase over the next 30 days.

Plate lead times range from 3-8 weeks, averaging 5.1 weeks through our latest survey.

SMU note: Above is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is also available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.