Market Data

April 1, 2025

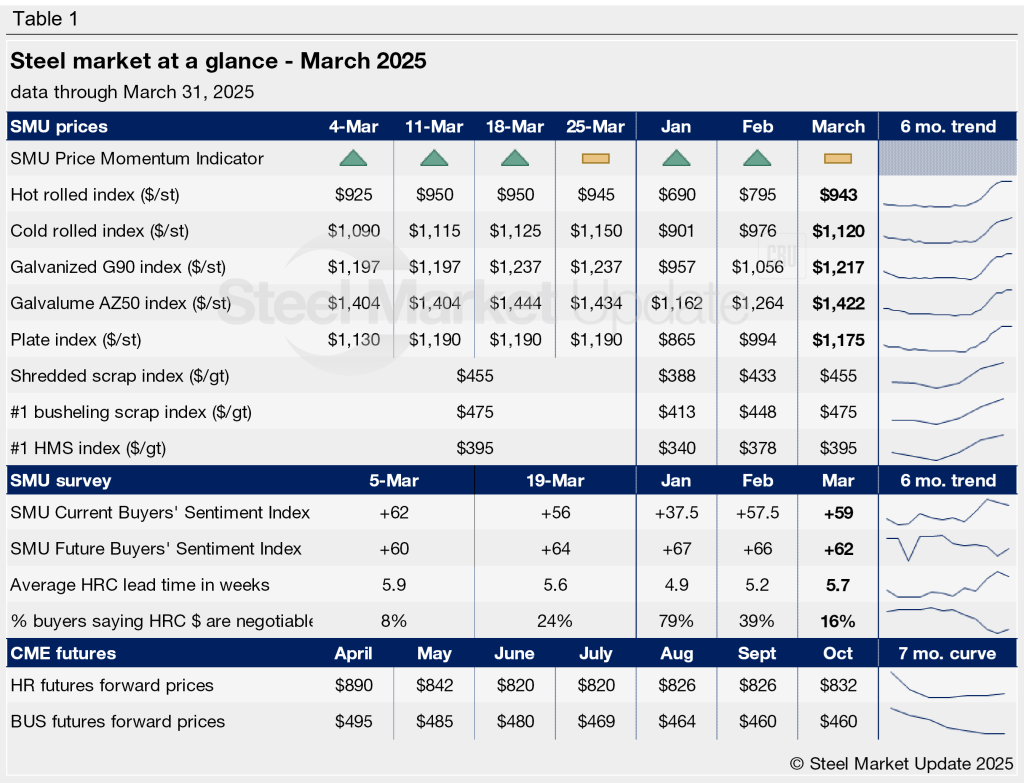

SMU's March at a glance

Written by Brett Linton

SMU’s Monthly Review provides a summary of our key steel market metrics for the previous month, with the latest data updated through March 31.

Following February’s sharp gains, steel prices plateaued in March, showing signs of stabilizing or easing by the end of the month. The SMU Price Momentum Indicator was adjusted from Higher to Neutral on hot-rolled steel products in the fourth week of March. Price momentum for the remaining sheet and plate products remained at Higher.

Steel scrap prices maintained their upward momentum through March, driven by limited supply and tariff uncertainty. This pushed prices to their highest level seen in over a year. Looking ahead, future scrap market expectations are less optimistic. Early indications suggest a slowdown as steelmakers prepare for a weakening automotive market.

Our Steel Buyers’ Sentiment Indices remained strong through March. Both our Current and Future Sentiment Indices continue to indicate that buyers are optimistic about their companies’ chances of success in both today’s market and the first half of the year.

After stretching out in February, steel mill lead times stabilized by the end of March across all five sheet and plate products we measure. Lead times began to extend in February due to a tariff-driven buying surge. As purchasing patterns return to normal, lead times are expected to follow suit.

Most steel buyers report that mills remain unwilling to negotiate new spot order prices. Following President Trump’s tariff actions and rising mill prices, negotiation rates plummeted in mid-February, reaching a near-two-year low by early March.

See the table below for other key March metrics (click here to expand). Historical monthly review table can be found on our website.