Market Data

April 4, 2025

SMU Steel Survey: Sentiment Indices dip as buyer optimism softens

Written by Brett Linton

SMU’s Buyers’ Sentiment Indices declined. Current sentiment stands at its lowest level since the beginning of the year. And future sentiment at its lowest level in nearly two years.

Our Current Sentiment Index continued to decline from its February peak. It fell this week to the lowest measure recorded since just after President Trump’s inauguration in January.

While still strongly optimistic, Current Sentiment reflects that buyers are less confident about current business conditions than they had been over the past two months.

Our Future Buyers’ Sentiment Index also moved lower. It is now at its lowest reading since June 2023. This metric still reflects that buyers have a positive outlook for business conditions in the coming months. But their confidence has faded.

Every other week, we ask steel industry executives how they rate their companies’ current chances of success, as well as business expectations three to six months down the road. We use this data to calculate our Current and Future Steel Buyers’ Sentiment Indices, metrics we have measured since 2009.

Current Sentiment

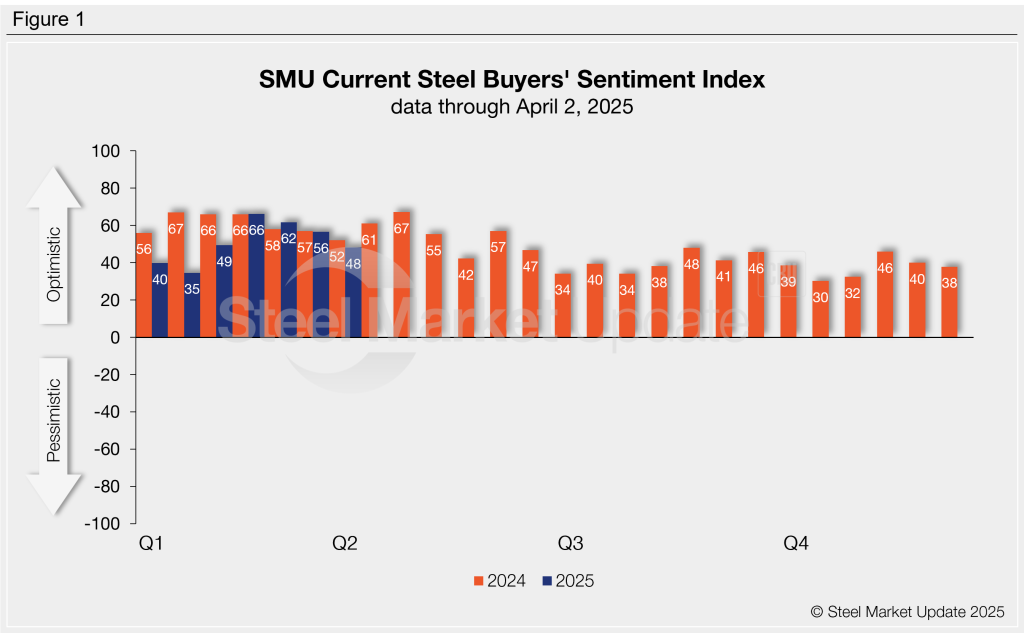

SMU’s Current Buyers’ Sentiment Index declined for the third-consecutive survey, falling eight points this week to a 10-week low of +48 (Figure 1). This represents the largest survey-to-survey decline seen since last October. Current Sentiment has been trending downward since peaking in mid-February. Despite the decline, it remains relatively strong compared to most readings over the past year. For comparison, Current Sentiment averaged +48 in 2024 and stood at +61 this time last year.

Future Sentiment

Future Sentiment decreased 11 points this week to +53, the lowest measure seen since June 2023. This index has generally trended lower since peaking late last year. But it continues to indicate that buyers have an optimistic outlook for the next three to six months (Figure 2). Future Sentiment averaged +65 throughout 2024 and was +66 one year ago.

What SMU survey respondents had to say:

“Too much uncertainty to be successful in this chaotic market.”

“We feel that late in the summer there will be more clarity on the market, economy, tariffs, etc. There is definitely dry powder out there on the sidelines. Folks are just waiting.”

“Fair, affected by tariffs.”

“Price increases help every service center in the near term.”

“We are remaining conservative and careful.”

“Successfully navigating the back side of this market will be the key to business success.”

“My company is in a great spot going forward.”

“Business could be better if there was a firm plan from the president on tariffs, allowing us the ability to manage a solution to the problem.”

“Hopefully things will be clearer tradewise in the next few months.”

“Concerns over inflation.”

Sentiment trends

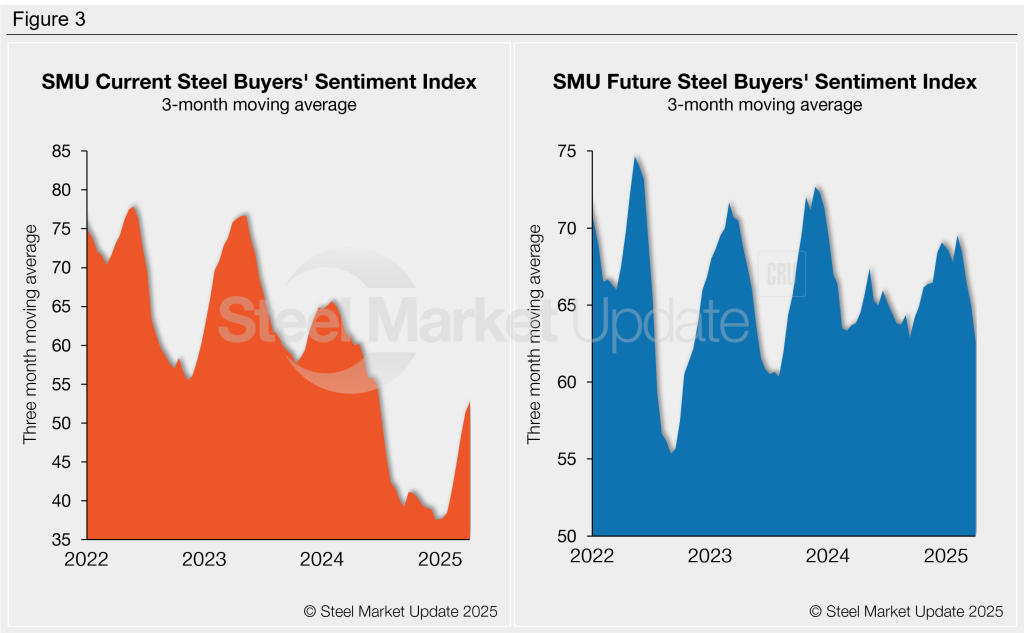

When viewed on a three-month moving average, our Sentiment Indices moved in differing directions this week (Figure 3). The Current Sentiment 3MMA continues to trend upward, as it has since the start of the year. It rose to a nine-month high of +52.76 this week. In contrast, the Future Sentiment 3MMA declined for the eighth consecutive week. It now stands at a 19-month low of +62.60.

About the SMU Steel Buyers’ Sentiment Index

The SMU Steel Buyers Sentiment Index measures the attitude of buyers and sellers of flat-rolled steel products in North America. It is a proprietary product developed by Steel Market Update for the North American steel industry. Tracking steel buyers’ sentiment is helpful in predicting their future behavior. A link to our methodology is here. If you would like to participate in our survey, please contact us at info@steelmarketupdate.com.