Market Data

April 17, 2025

SMU Survey: Buyers report more price flexibility from mills

Written by Brett Linton

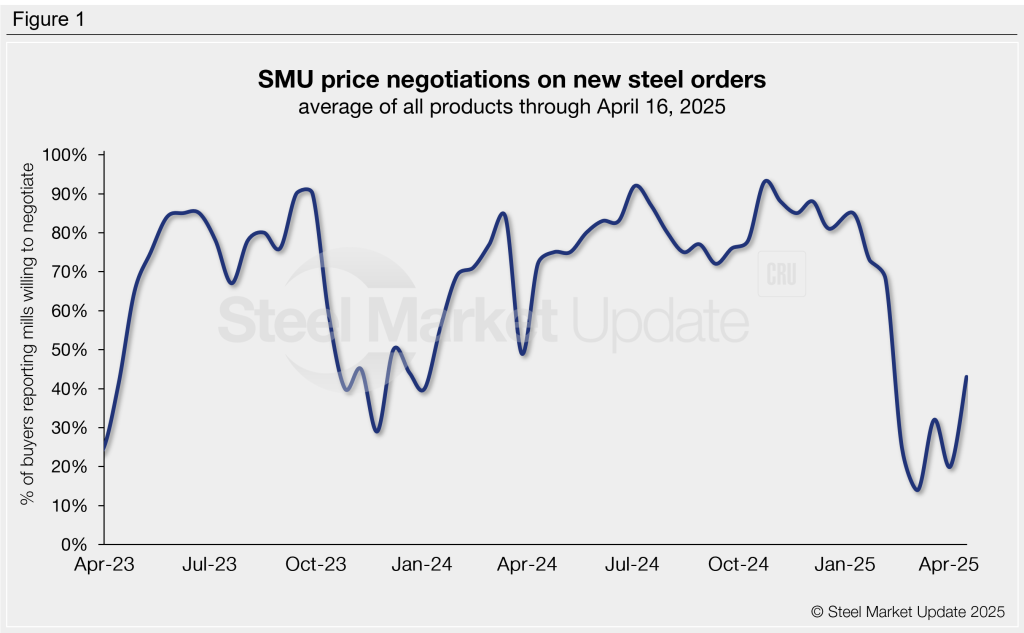

Nearly half of the steel buyers responding to this week’s SMU market survey say domestic mills are showing increased willingness to negotiate pricing on new spot orders. This marks a significant shift from the firmer stance mills held in prior weeks.

Mills had shown lesser willingness to budge on prices since February, when tariff announcements by President Trump drove domestic prices upward and shifted negotiating power back to the mills. Prior to that, buyers had held the upper hand for nearly a year.

The percentage of buyers reporting room for negotiation dropped to a near two-year low by early March. Negotiation activity appears to have now reached a turning point, with this week marking the highest rate seen since early February.

Every two weeks, SMU polls thousands of steel buyers asking if domestic mills are negotiable on new order pricing. In our latest survey, 43% of respondents said mills were willing to talk price (Figure 1). This represents a 23-percentage point rebound from our early-April survey, when we saw one of the lowest rates recorded in two years.

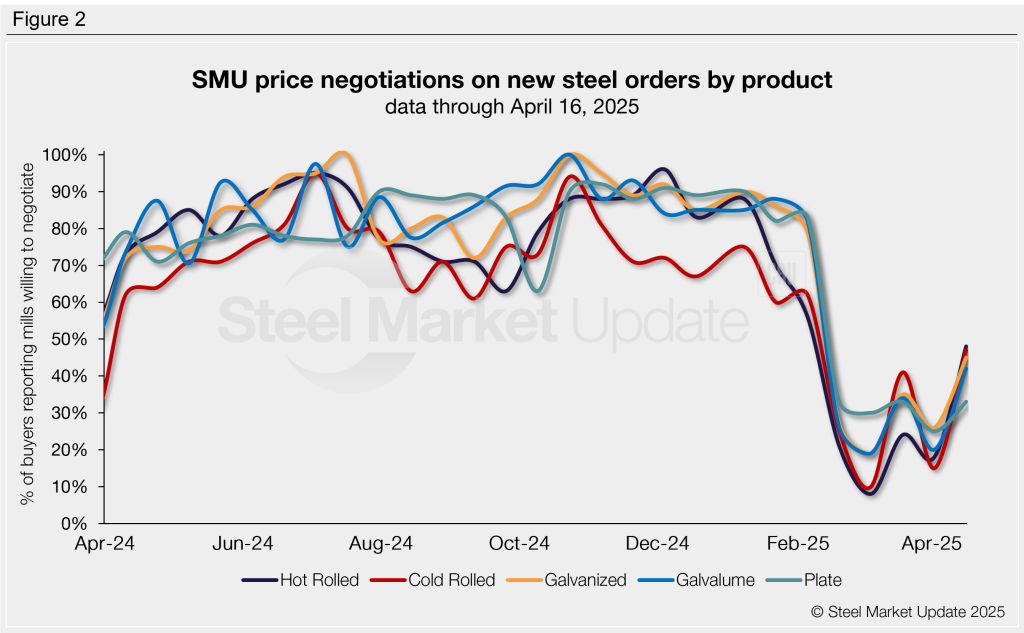

Negotiation rates by product

Negotiation rates were broadly similar across all sheet products this week, each rising to the 40%-50% range. Plate saw a more modest recovery. Just six weeks ago, negotiation rates across all products had fallen to lows not seen in over a year (Figure 2). Current rates are as follows:

- Hot rolled: 48% of buyers report mills are negotiable on prices, up 30 percentage points from early-April. This is a sharp rebound from the three-and-a-half-year low of 8% recorded six weeks ago.

- Cold rolled: 47%, rising 32 percentage points from the second-lowest rate of the past year.

- Galvanized: 45%, up 19 percentage points after nearing an 18-month low.

- Galvalume: 42%, a 22-percentage point recovery from a near 16-month low.

- Plate: 33%, improving 8-percentage points from a two-year low.

Steel buyer remarks:

“Negotiable depending on the mill.”

“Most mills we talk to are hungry, but we honestly aren’t bringing in any mill-direct HRC right now.”

“Mills have holes to fill in their order books [hot rolled, cold rolled and galvanized].”

“With the anti-dumping cases in play, the domestic mills don’t want to let go of higher [Galvalume] prices.”

Note: SMU surveys active steel buyers every other week to gauge their steel suppliers’ willingness to negotiate new order prices. The results reflect current steel demand and changing spot pricing trends. Visit our website to see an interactive history of our steel mill negotiations data.