Market Data

May 2, 2025

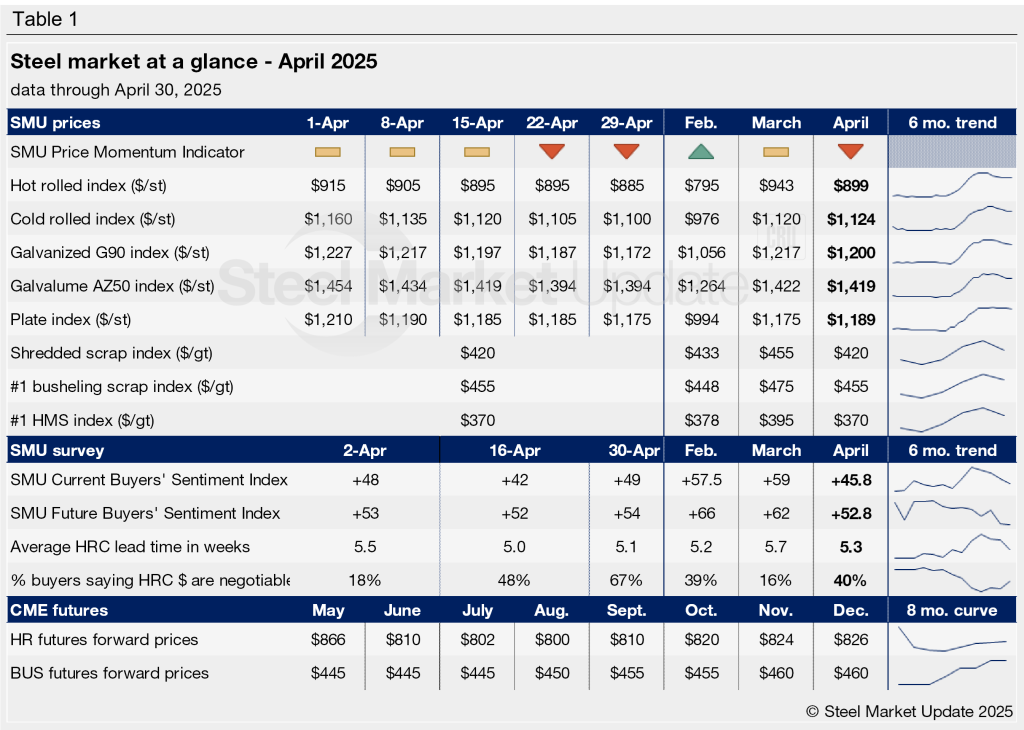

SMU's April at a glance

Written by Brett Linton

SMU’s Monthly Review provides a summary of our key steel market metrics for the previous month, with the latest data updated through April 30.

Following the February and March rally, steel prices ticked lower across the month of April. SMU’s Price Momentum Indicator was adjusted from Higher to Neutral on hot-rolled steel products in the last week of March, with all other sheet products following suit in early April. Sheet momentum then shifted to Lower in the third week of April, while plate momentum remained at Neutral.

Steel scrap prices broke their three-month gain streak in April, retracting from March’s one-year high. Early signs point to another drop in May, driven by weakening demand, oversupply, and softer finished steel prices.

Our Steel Buyers’ Sentiment Indices started April on a soft note, dipped in mid-April alongside the stock market, then partially recovered by month’s end. Both the Current and Future Sentiment Indices remain optimistic, reflecting that buyers are positive for their companies’ chances of success in today’s market as well as in the near future.

After stabilizing in March, sheet steel mill lead times shortened across April and flattened out by the end of the month. Plate lead times held firm near one-year highs. Lead times had extended earlier this year on tariff-fueled buying. As purchasing patterns return to normal, lead times are expected to normalize.

Throughout April, we also saw more buyers reporting that mills were willing to negotiate on new spot order pricing. Prior to this, mills had largely held all of the pricing power in February and March, when tariff announcements drove domestic prices upward.

See the table below for other key April metrics (click here to expand). Historical monthly review tables can be found on our website.