Analysis

May 4, 2025

Final Thoughts

Written by David Schollaert

We’ve talked about tariffs ad nauseam for much of the year. And I’m afraid this topic isn’t going away anytime soon. There’s a feeling that the tariff “can” could just be kicked down the road again and again, and again.

For all our sakes, let’s hope that’s not the case. Because there’s an old joke that says the road of life is paved with flat, indecisive squirrels.

There are varying opinions on what should happen with trade policy, but all this uncertainty is roiling the markets. Because, for all the hoopla around “Liberation Day,” it took just a week for the global economy to get a 90-day pause on those harsher “reciprocal” tariffs.

And we’ve all felt the whiplash of the on-again, off-again routine on tariffs. We got a preview of it – in real time at the Tampa Steel Conference – when Trump first gave Mexico and Canada a 30-day reprieve from 25% tariffs on exports to the US, back on Feb. 4.

And it’s been quite a ride since.

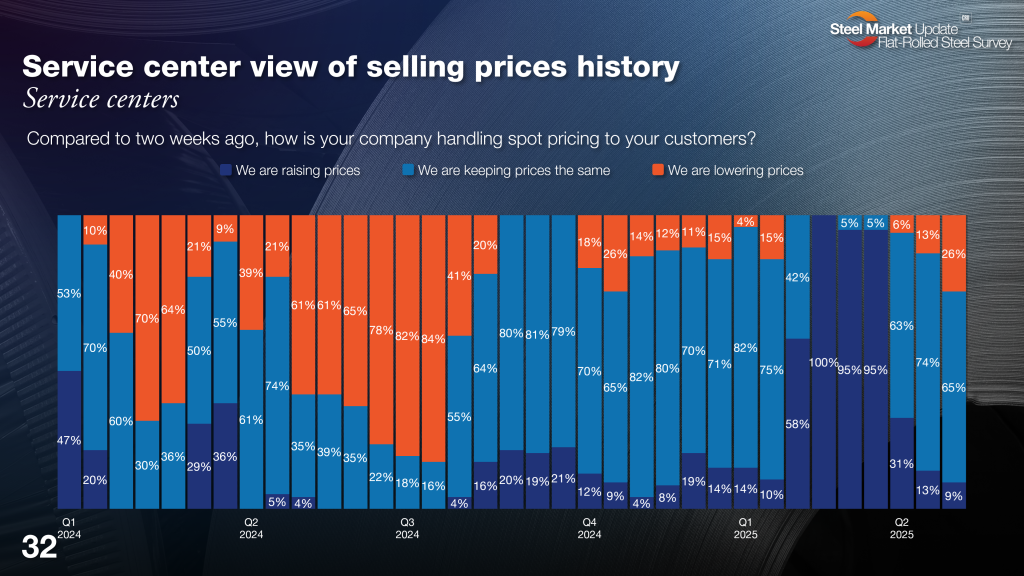

We’ve seen prices and market sentiment rocket up and then turn on a dime. Mills are still trying to hold the line, but the outlook has shifted. We saw a big jump in mills’ willingness to negotiate lower prices in our latest data.

For about a month, mills were resolute on pushing prices up. We saw that playing out as service centers and manufacturers alike reported higher prices. But “Liberation Day,” and the reprieves since, flipped the pricing stance almost instantly–something our surveys have captured clearly. (See chart below.)

The pricing seesaw

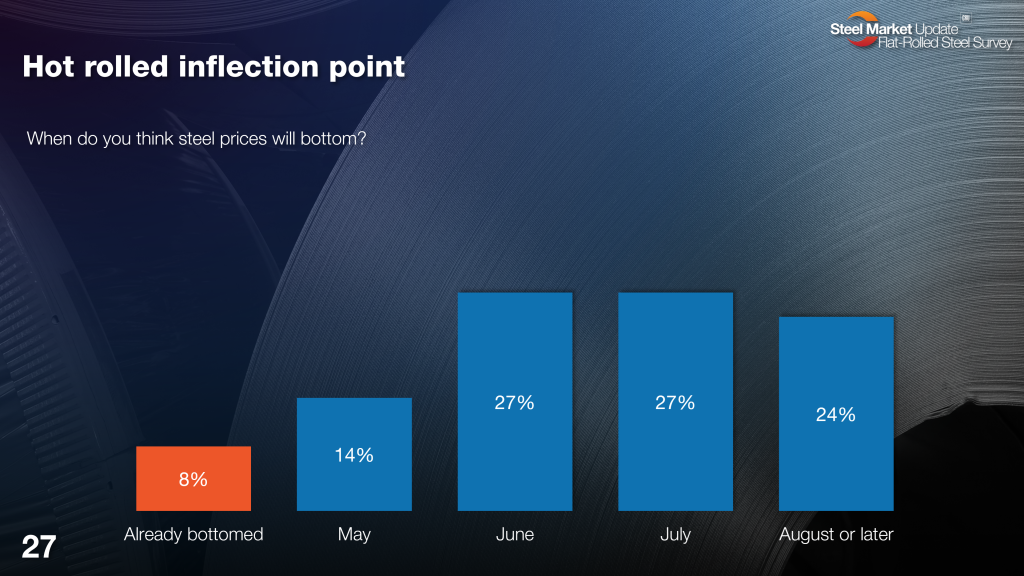

It wasn’t long ago – March 19 to be exact – that nearly two-thirds of survey respondents expected prices to surge well above $1,000 per short ton. But now we’ve gone from asking data providers when prices would peak to when they would bottom. Most don’t think they will bottom out anytime soon, and the bottom will be well below where they are now. See the following two charts.

It seems many believe a lot of demand was pulled forward. Here’s just some of what survey respondents had to say:

“Hard to know. It depends on the negotiation of tariffs and how true demand is affected.”

“Demand isn’t strong enough to support higher prices. But tariff uncertainty may keep prices up as it’s unclear whether or not imports are a choice.”

“Nobody has clarity right now due to the administration’s changing messages.”

“No clue, actually.”

“I think the lack of sales will cause the mills to drop pricing, when in reality, it is because we stocked up and jobs slowed.”

“I’m pretty bearish on overall demand from now through the ‘Summer Doldrums.’ And I have NO idea what late summer/fall looks like. Just a total guessing game when we get into Q3/Q4.”

“Still some downside to come unless all tariffs are negotiated and settled.”

“We are expecting pretty gradual but steady decreases for the next few months. We have forecasted sub-$800/ton HRC in the summer.”

“I think due to unsettled tariffs, there are still corrections coming. If settled, prices could begin climbing again.”

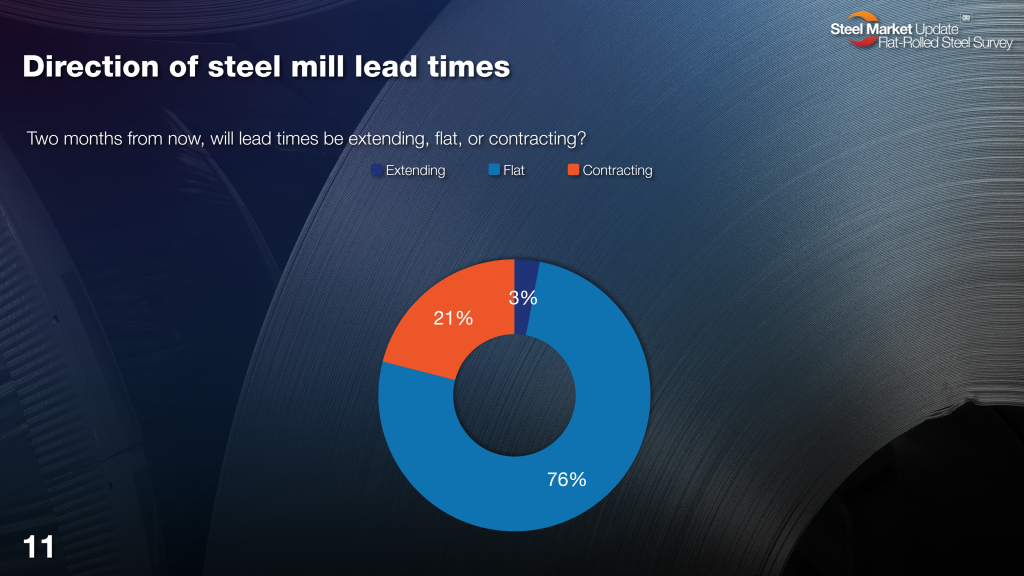

Lead time outlook

The market whipsaw has been evident in some markets, others not so much. But sentiment around some of those is that the other shoe is ultimately going to drop.

Take lead times as an example.

Mill lead times have relatively stable when compared to pricing and buying patterns. In our latest analysis, sheet and plate lead times flattened out vs. mid-April levels. And, on average, are roughly down about half a week over the past month.

But expectations on future lead times (see chart below) are pretty bearish.

And what some had to say:

“Lead times will pull back in the next few months, then flatten out.”

“Demand is too weak to cause lead times to extend, and they can’t drop too much more.”

“We are already seeing lead times slip. And coming out of spring outages with demand so weak, they’ve got nowhere to go but lower from here.”

“Average demand and plenty of supply.”

“I believe they will contract over the next two months, and then be flat to up again.”

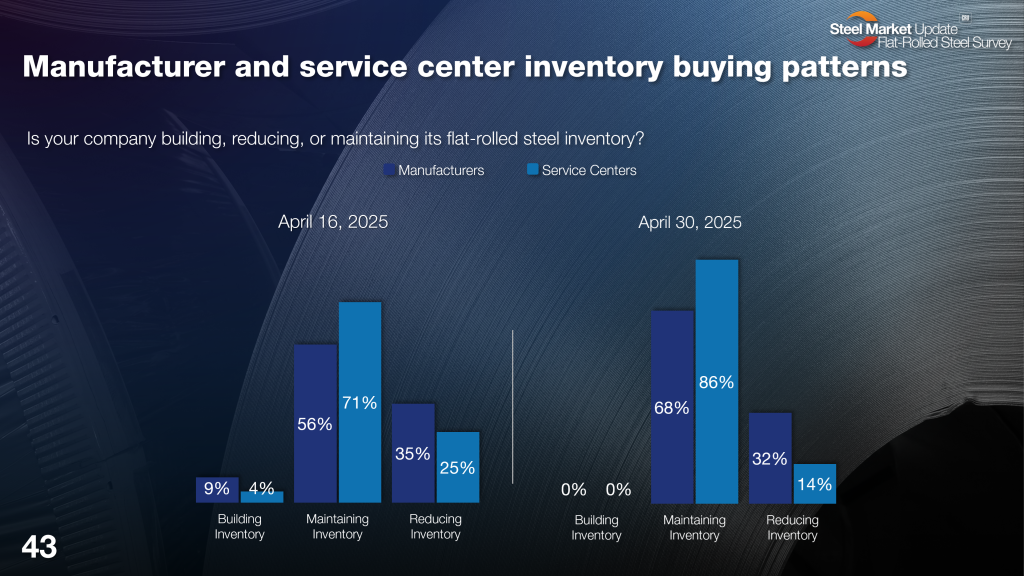

Buying has shifted… for the time being

A major shift we captured in our latest survey was how few steel buyers are building inventory. Usually there are at least some service centers or manufacturers reporting that they are building stocks. In our last survey, neither reported restocking – something we haven’t seen since a swoon in prices last summer.

The takeaway here is that it’s not any one thing but a confluence of them: tariff uncertainty, demand being pulled forward as people sought to buy ahead of tariffs in Q1, and the impending summer doldrums.

In the meantime, most are maintaining their inventories, watching closely, and hoping for clarity before jumping into rebuild stocks.

A few comments:

“Maintaining only due to heading into our busy season.”

“We anticipate a pullback in pricing as buyers stay on the sidelines, so we are waiting to gain more clarity.”

“Maintaining and April bookings are down.”

“Everyone is waiting to see what tariffs stick and which don’t, and how demand reacts along with price.”

“Buying less due to demand being lower, which is what we forecasted.”

Steel 101 Workshop

Join us in Memphis, Tenn., this June and learn about the steel industry inside and out.

If you’re new to the industry or looking to strengthen your knowledge, look no further. Our Steel 101 workshop is the go-to training course for professionals across industries looking to deepen their understanding of steel production, pricing, and market dynamics.

SMU’s next Steel 101 will be held on June 10-11 in Memphis, and features a tour of Nucor Steel Arkansas, just across the Mississippi River in Blytheville, Ark.

You can get more info and register here. But don’t delay, space is limited and it’s going fast.

And, as always, all of us here at Steel Market Update truly appreciate your business.