Market Data

May 15, 2025

SMU Survey: Mill lead times edge lower

Written by Brett Linton

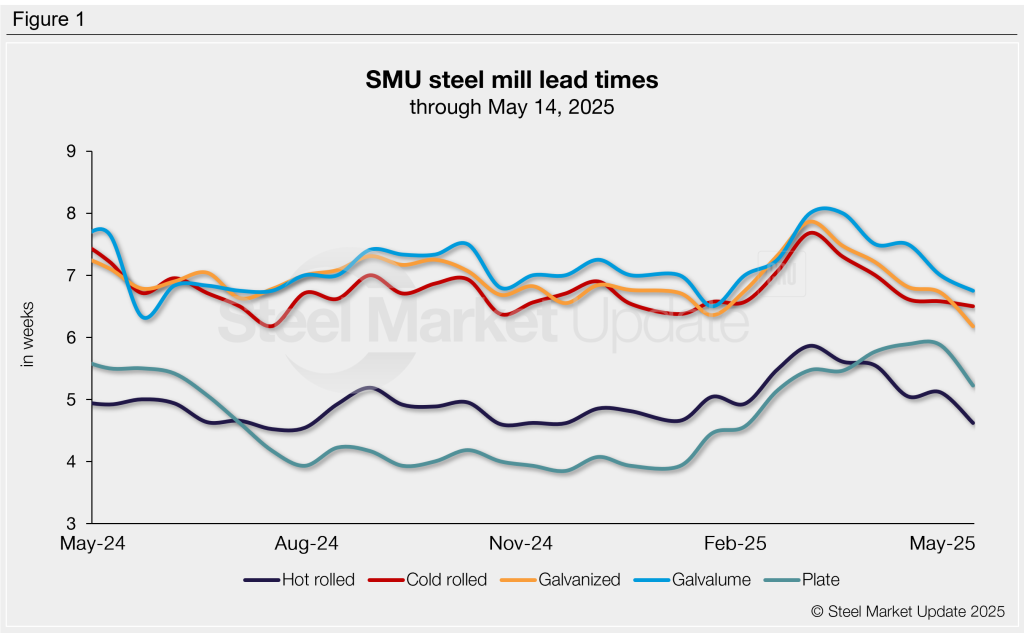

Sheet and plate lead times declined across the board this week, according to buyers responding to the latest SMU market survey. While our lead time ranges were unchanged compared to mid-April levels, average production times for each steel product we measure have declined from they were two weeks ago.

Recall that steel mill production times extended in February as buyers pulled forward orders amid tariff concerns. That surge was short-lived for sheet products, with lead times peaking in early March and contracting thereafter. Sheet production times are now approaching the mid-2024 lows, just days above the shortest levels seen in the past year. Plate lead times have been slower to come down, currently about a week and a half above their past-year low.

The average lead time for hot-rolled steel is just over four-and-a-half weeks. Cold-rolled and coated products range from six to seven weeks, while plate is down to just over five weeks.

Table 1 summarizes current lead times and recent changes by product (click to expand) Compared to our April 30 market check, all five of our lead time ranges were unchanged this week.

Buyers predict stability

The majority of buyers (64%) continue to predict lead times will stay stable over the next two months, though not as high a percentage as we saw in previous surveys. Of the remainder, 26% expect production times will contract further, up from 21% in late April. Almost 10% anticipate lead times will extend from here, up from 3% two weeks prior.

Here are some of the comments we collected:

“Contracting – spring outages were a non-issue. Mill price announcements were met with a general ‘shrug of the shoulders’ from the marketplace.”

“Flat, I only see lead times going out if trade agreements clarify manufacturers’ futures.”

“Lead times are very short right now. A mill that just had an unplanned outage took May orders in late April for galvanized.”

“Mills will always say they are at five weeks, so they don’t have to make ‘fire sales’ in the current month to keep the mills going.”

Trends

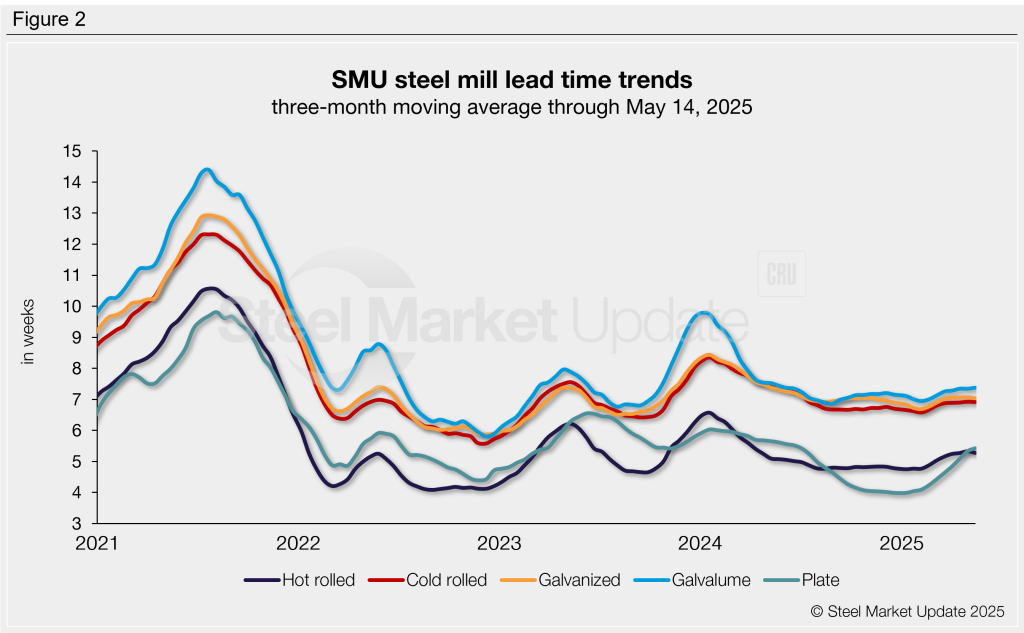

To smooth out biweekly fluctuations and better highlight trends, lead times can be calculated on a three-month moving average (3MMA). Most sheet 3MMAs declined this week, aside from Galvalume and plate, which moved slightly higher. This shifting trend follows six consecutive surveys in which 3MMA lead times increased (Figure 2).

Over the past three months, the average lead times by product are as follows: hot rolled at 5.28 weeks, cold rolled at 6.91 weeks, galvanized at 7.04 weeks, Galvalume at 7.38 weeks, and plate at 5.42 weeks.

Note: These lead times are based on the average from manufacturers and steel service centers participating in this week’s SMU market trends analysis survey. SMU measures lead times as the time it takes from when an order is placed with the mill to when it is processed and ready for shipping, not including delivery time to the buyer. Our lead times do not predict what any individual may get from any specific mill supplier. Consult your mill rep for actual lead times. To see an interactive history of our steel mill lead times data, visit our website. If you’d like to participate in our survey, contact us at info@steelmarketupdate.com.