Market Data

May 22, 2025

Architecture firms struggle through April

Written by Brett Linton

For the third month in a row, architecture firms reported a reduction in billings through April, according to the latest Architecture Billings Index (ABI) released by the American Institute of Architects (AIA) and Deltek.

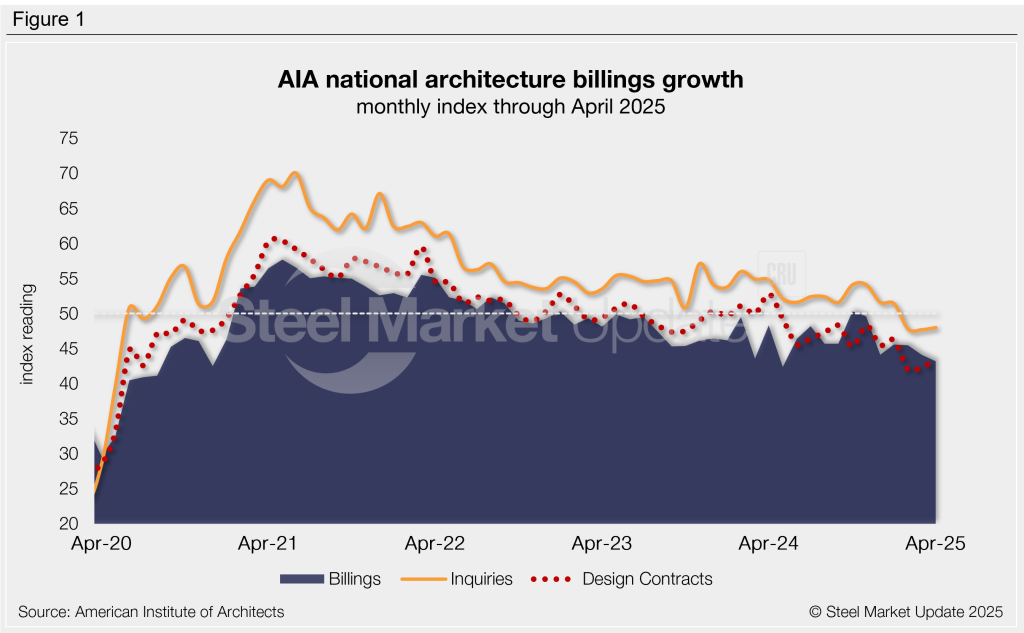

The April ABI fell nearly one point month over month (m/m) to 43.2, the lowest reading in 11 months (Figure 1). The Index has indicated declining business conditions for most of the past two and a half years following the post-pandemic surge, remaining in contraction for all but two months since October 2022.

“Uncertainty as to the economic outlook continues to hold back progress on new construction projects,” said AIA chief economist Kermit Baker. “Despite the slowdown in billing activity, architecture firms continue to navigate this business cycle quite effectively, as staffing at firms remains relatively stable and project backlogs are holding up better than expected.”

The AIA/Deltek release also noted that many architecture firms are experiencing business conditions that resemble those of a recession.

The ABI is a leading indicator for near-term nonresidential construction activity and projects business conditions approximately 9-12 months down the road (the typical lead time between architecture billings and construction spending). An index score above 50 indicates an increase in architecture billings, while a reading below 50 indicates a decrease.

Participant comments this month included:

- “Economic uncertainty is leading to project delays and deferrals, as clients have questions about available funding and the ultimate cost of construction in a tariff-fueled materials environment.” -Western institutional firm

- “We have projects under construction, but not much work on the boards.” -Midwestern firm with commercial/industrial specialization

- “Interest in new work is picking up, but we do not expect to see notice to proceed until the third or fourth quarter.” -Southern residential firm

- “Almost 40% of our contracted projects have officially gone on hold or are unofficially paused.” -Northeast firm with mixed specialization

Subindex trends

The new project inquiries index marginally improved to 48.0, indicating contraction for the third-consecutive month. The design contracts index also inched up in April to 43.3, marking one full year of declining billings.

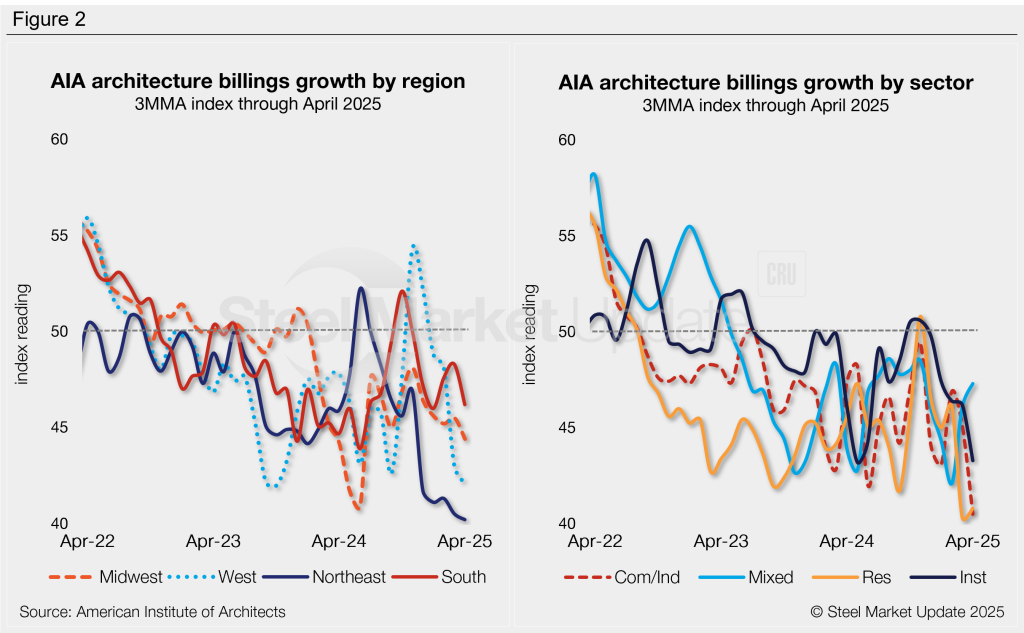

Each of the four regional indices declined from March to April, all remaining below the 50 threshold for the fourth straight month (Figure 2, left).

All four of the sub-sector indices saw a decrease in billings in April, though two improved from March (Figure 2, right). The residential, commercial/industrial, and institutional sectors are all at some of the lowest levels witnessed across the past five years.

An interactive history of the April Architecture Billings Index is available here on our website.