Market Data

May 29, 2025

SMU Survey: Mill willingness to negotiate keeps on climbing

Written by Brett Linton

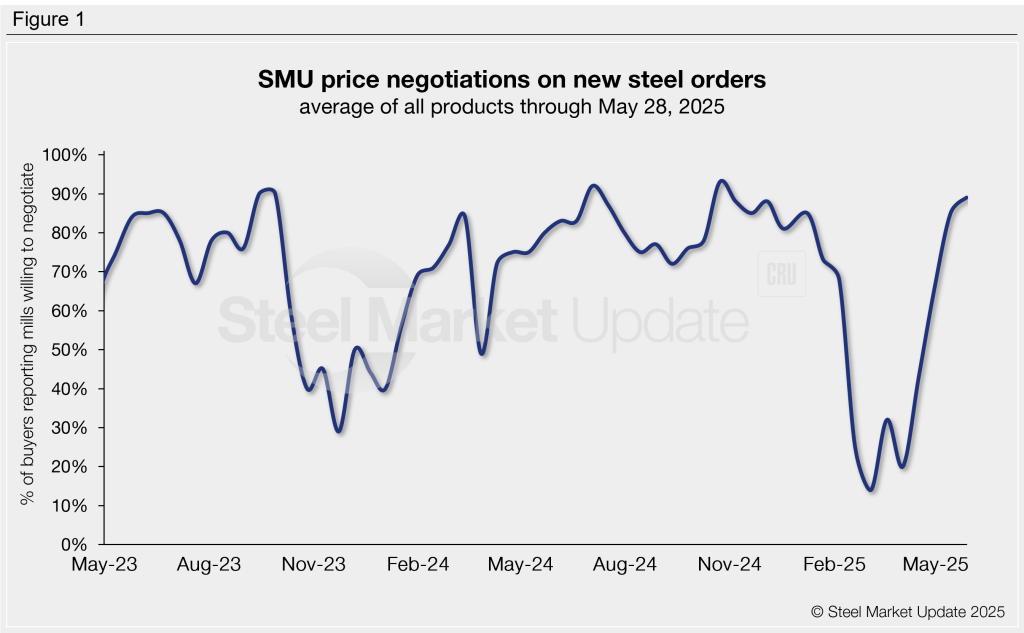

Most steel buyers responding to our latest market survey report that domestic mills are willing to talk price to secure new orders. Mill negotiability has continued to rise across all sheet and plate products we track, now at some of the highest levels recorded since late 2024.

Since April, buyers have regained the bargaining power on new spot orders, a noticeable shift from February and March when tariff headlines pushed the market higher and mills held the upper hand.

SMU polls thousands of buyers every other week asking if domestic mills are negotiable on new order pricing. In our latest survey, nearly 90% of our respondents said that mills were willing to budge on price (Figure 1). This is four percentage points higher than our previous survey and an increase of 23 points from levels seen one month prior. Back in March we had seen rates as low as 14%.

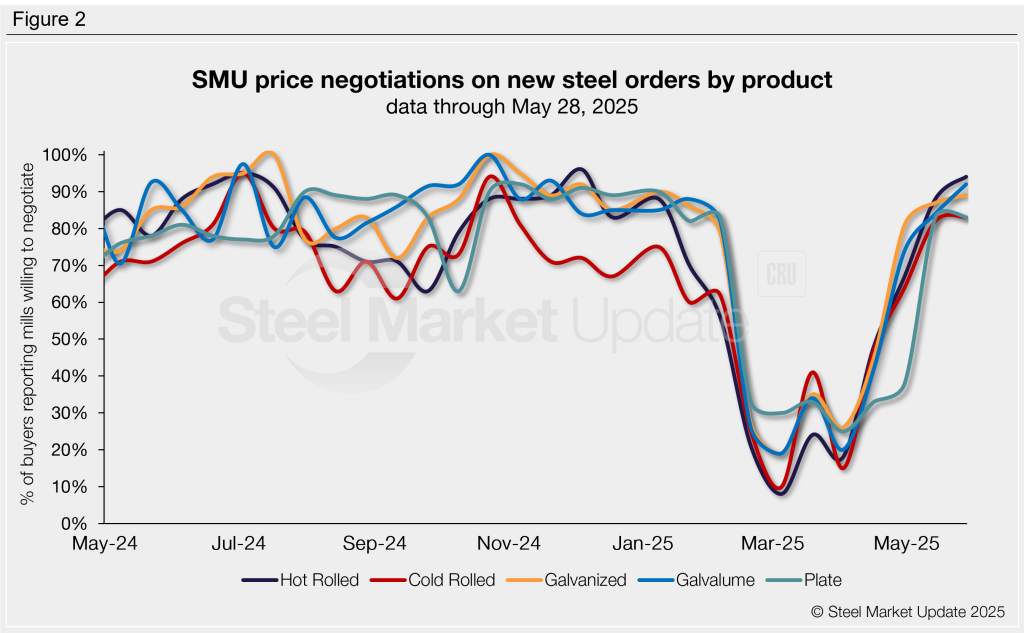

Negotiation rates by product

Negotiation rates rose for all of the sheet products we track and held stable on plate (Figure 2). Current rates are as follows:

- Hot rolled: 94% of buyers said mills are negotiable on price, up 21 percentage points from mid-May, and the highest rate seen in five months.

- Cold rolled: 83%, up one point and the highest since October.

- Galvanized: 89%, up two points and the highest since January.

- Galvalume: 92%, up eight points and the highest since November.

- Plate: 83%, holding at one of the strongest levels this year.

Steel buyer remarks:

“We are hearing veerrryyyy low numbers for big [hot rolled] tonnages. We are staying away from mill buys right now, just because we feel the market will continue to go down from here.”

“Negotiable on hot rolled for 2,000-3,000-ton orders.”

“Depending on size of the buy [hot rolled] and what mill you are dealing with.”

“So far neither US or Canadian G-235 [galvanized] mills negotiating.”

Note: SMU surveys active steel buyers every other week to gauge their steel suppliers’ willingness to negotiate new order prices. The results reflect current steel demand and changing spot pricing trends. Visit our website to see an interactive history of our steel mill negotiations data.