Analysis

June 12, 2025

Dodge Momentum Index recovered in May

Written by Brett Linton

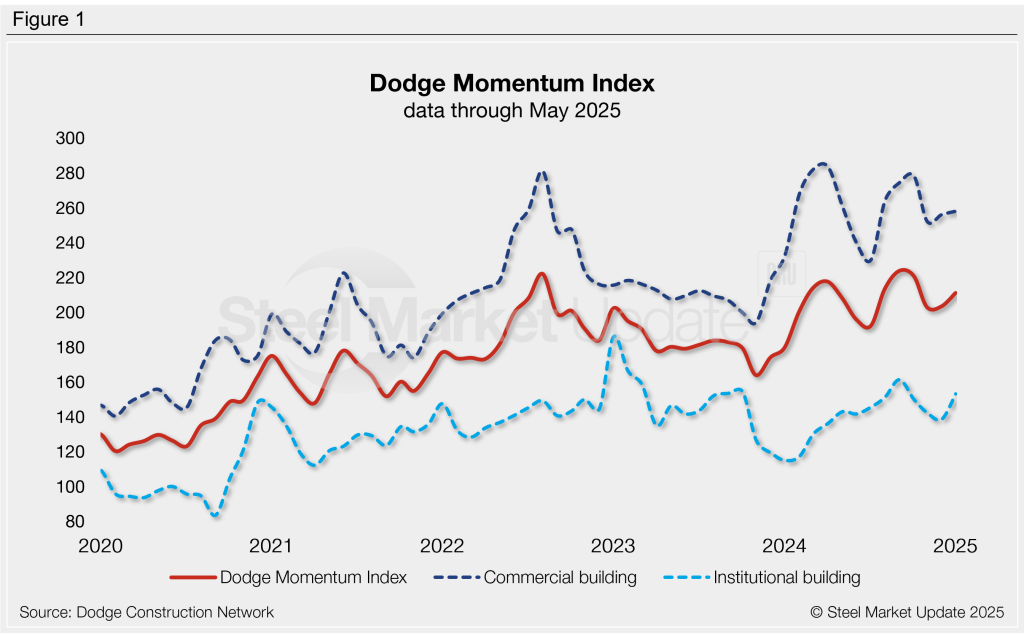

Following three months of little to no growth, the Dodge Momentum Index (DMI) increased in May, according to the latest data released by Dodge Construction Network.

Institutional construction planning saw stronger gains than commercial projects did in May, though both sectors continue to show improvement in the nonresidential construction market.

The May DMI rose to 211.2, a 4% increase from April’s revised reading of 203.5 and 17% higher than levels seen one year prior. Compare this to the record-high reading of 223.9 measured back in January.

“Nonresidential planning continued to accelerate in May, primarily driven by strong project activity on the institutional side of the DMI,” said Dodge’s associate director of forecasting Sarah Martin.

“Planning momentum moderately improved on the commercial side as well, following subdued growth in that sector over the last few months – outside of data centers,” she added.

Martin noted that while economic and policy uncertainty continues to drive data volatility, overall planning activity remains solid.

The institutional segment of the index grew 11% from April to May to a four-month high of 153.2, up 33% compared to one year ago. The commercial building segment rose 1% month over month to 258, 11% greater than May 2024 levels.

Dodge said that data center projects returned to typical levels in May, but if those projects were excluded, the commercial segment would have increased 5% from April to May and the DMI would have risen 7%.

Dodge reported that a total of 33 projects valued at $100 million or more entered planning in May, up from 32 in April.

It is the leading index for commercial real estate. It uses the data of planned nonresidential building projects to track spending in this important steel-consuming sector for the next 12 months. An interactive history of the DMI is available on our website.