Market Data

June 19, 2025

Architecture firms still struggling, ABI data shows

Written by Brett Linton

Architecture firms reported a modest improvement in billings through May, yet business conditions remained soft, according to the latest Architecture Billings Index (ABI) release from the American Institute of Architects (AIA) and Deltek.

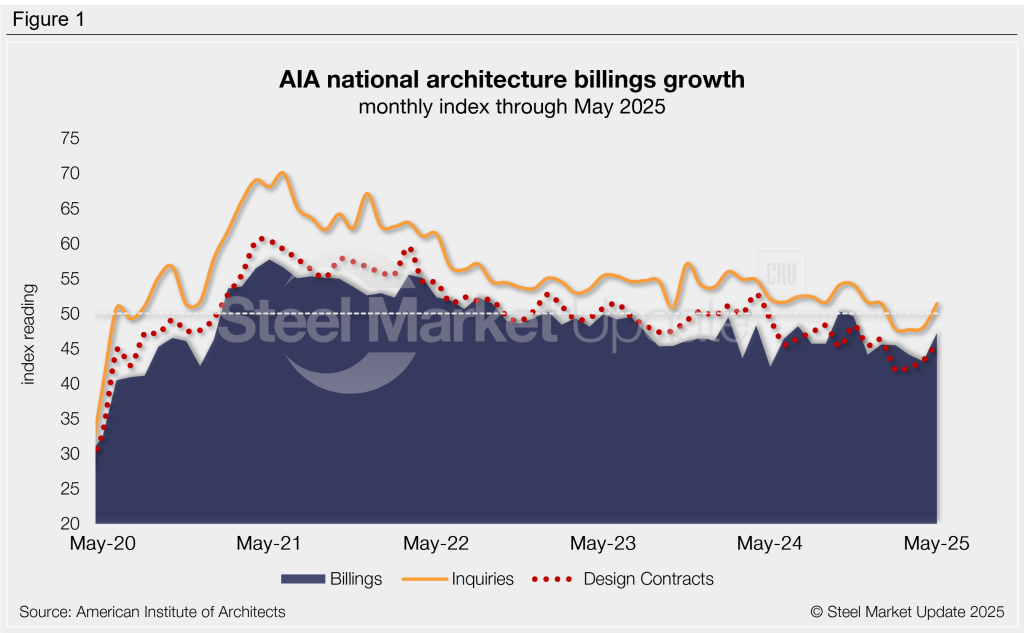

The May ABI rose four points month over month (m/m) to 47.2, recovering from an 11-month low to a six-month high (Figure 1). This marks the largest month-to-month recovery seen since October. The ABI has remained in contraction for all but two months since October 2022, indicating persistent declines in business conditions since the post-pandemic surge.

“Business conditions remained sluggish nationwide in May, with nonresidential construction activity continuing to decline in several major metro areas,” said AIA chief economist Kermit Baker. “Firms across all specializations reported declining billings this month.”

The multifamily residential and institutional sectors are likely to be the first to return to growth once business conditions recover, he said.

The ABI is a leading indicator for nonresidential construction activity and projects business conditions approximately 9-12 months down the road. (The typical lead time between architecture billings and construction spending.) An index score above 50 indicates an increase in architecture billings, while a reading below that indicates a decrease.

Participant comments this month included:

- “Very slow to get contracts signed. We’re branching outward beyond our regular project types and clients.” – Southern firm with commercial/industrial specialization

- “We continue to receive lots of inquiries and leads. Many have converted into studies and/or preliminary design, but projects are still very slow to get going.” – Northeast firm with institutional specialization

- “Work is definitely slowing down. We have had two people leave the firm for other opportunities, and we have no plans to replace them.” – Western firm with institutional specialization

- “Market opportunities and billable contracts are picking up more and more from the bumpy ride we had in 2024. Pent up demand slowly releasing.” – Midwestern firm with residential specialization

Subindex trends

The new project inquiries index improved to 51.4, indicating growth after three months of contraction. The design contracts index also inched up in May to 45.9, but remains in contraction, as it has for 13 months now.

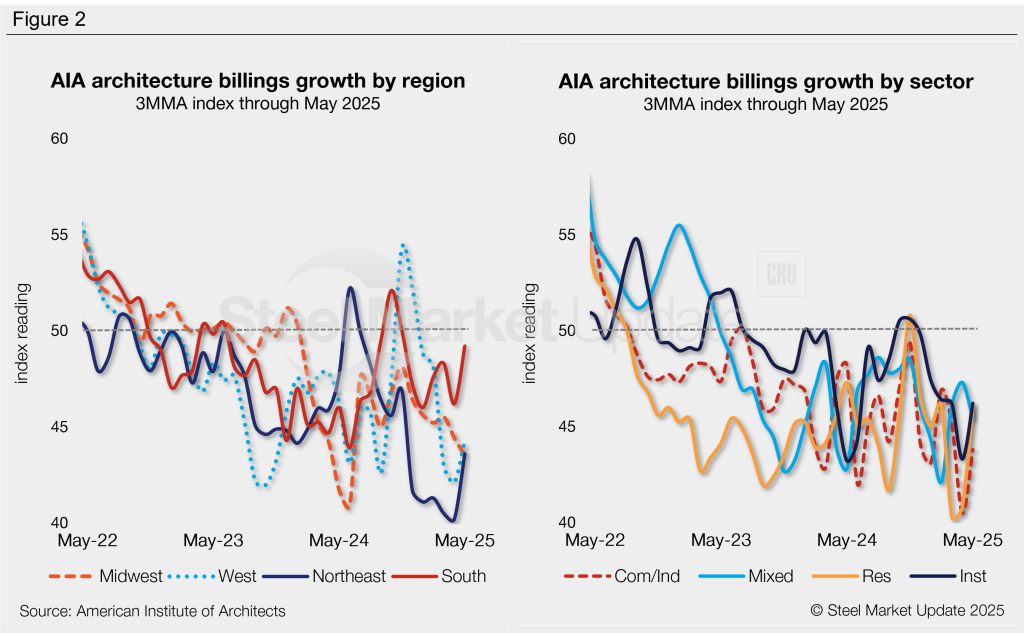

Three of the four regional indices increased from April to May (except the Midwest), though all remain below the 50 threshold (Figure 2, left).

Three of the four of the sub-sector indices also saw an increase in billings in May, with the exception of the mixed-practice sector (Figure 2, right). Recall that in April the residential, commercial/industrial, and institutional sectors saw some of the lowest levels witnessed across the past five years.

An interactive history of the May Architecture Billings Index is available here on our website.