Market Data

June 20, 2025

Most steelmaking raw material prices decline through June

Written by Brett Linton

Editor’s note: Steel Market Update is pleased to share this Premium content with Executive members. For information on how to upgrade to a Premium-level subscription, contact Luis Corona at luis.corona@crugroup.com.

Prices for four of the seven steelmaking raw materials we track declined from May to June, according to our latest analysis. Collectively, these materials declined 3% month over month (m/m) and are down 9% compared to three months ago.

Pig iron, coking coal, iron ore, and zinc all saw m/m price declines in June, while busheling and shredded scrap held steady, and aluminum increased. Six of the seven materials are priced lower than they were three months ago, while prices are mixed compared to the same time last year.

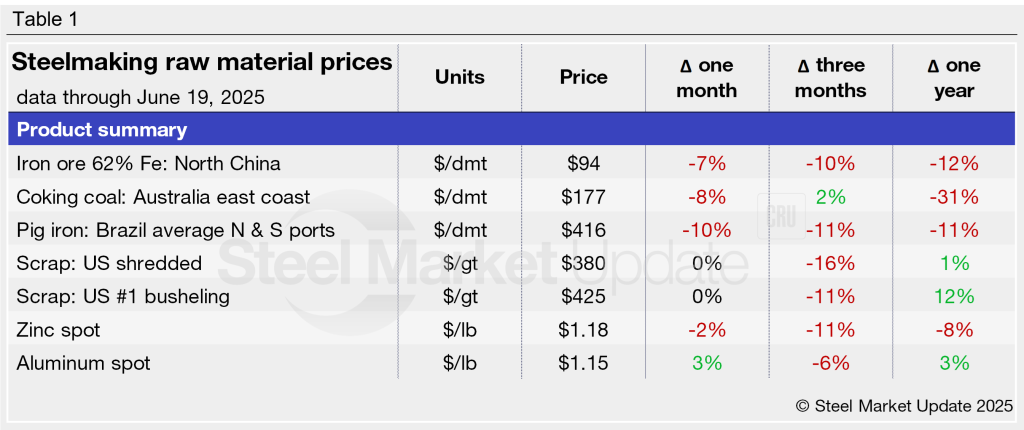

Table 1 shows the latest prices for each product and their changes from recent months.

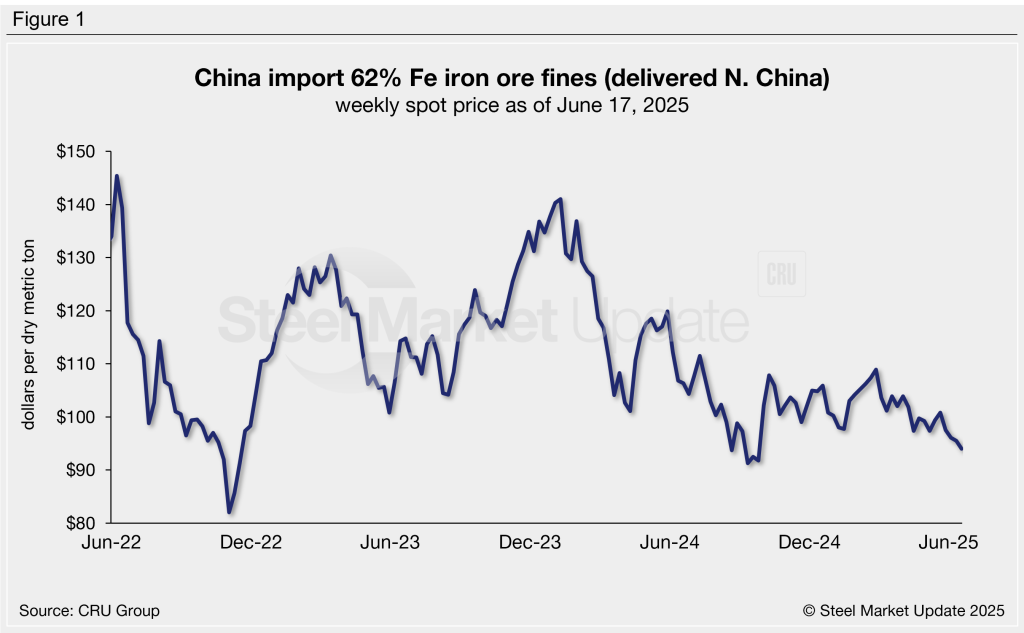

Iron ore

The import price of 62% Fe Chinese iron ore fines has trended lower since February, falling 7% across the past month. As of June 17, prices are down to an eight-month low of $94 per dry metric ton (dmt) delivered North China. Prior to June, iron ore had generally hovered between $97-109/dmt since October (Figure 1). Prices are 10% less expensive than they were three months ago and 12% lower than this time last year.

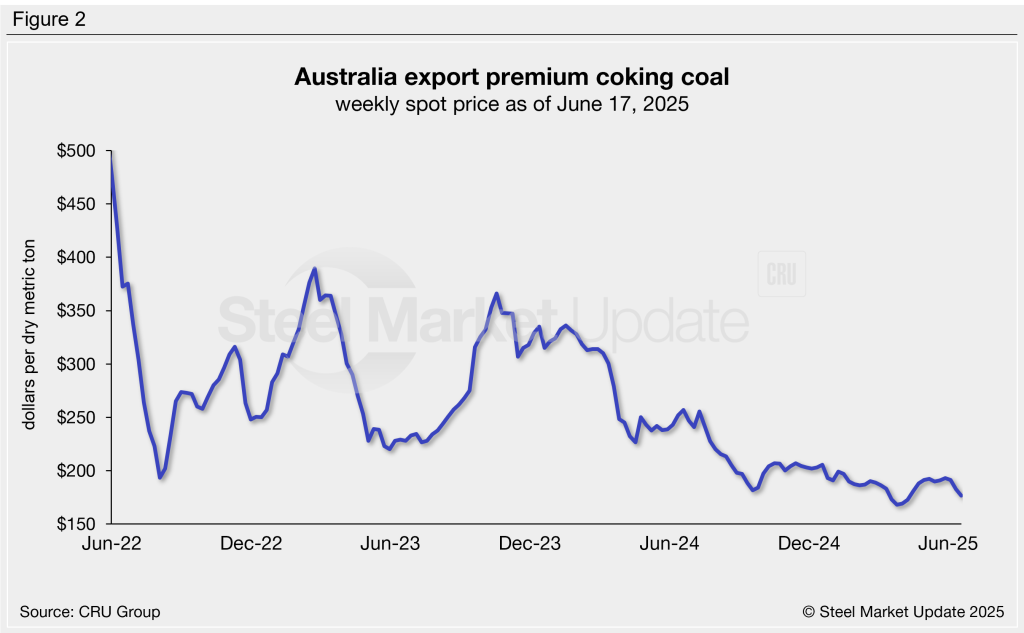

Coking coal

Premium hard coking coal prices have trended lower for over a year and a half, recently reaching a near four-year low of $168/dmt in late March. Prices marginally ticked higher through the end of May but have since eased 8%, down to $177/dmt this week (Figure 2). Coking coal is 2% more expensive than it was three months ago, but 31% cheaper than one year ago.

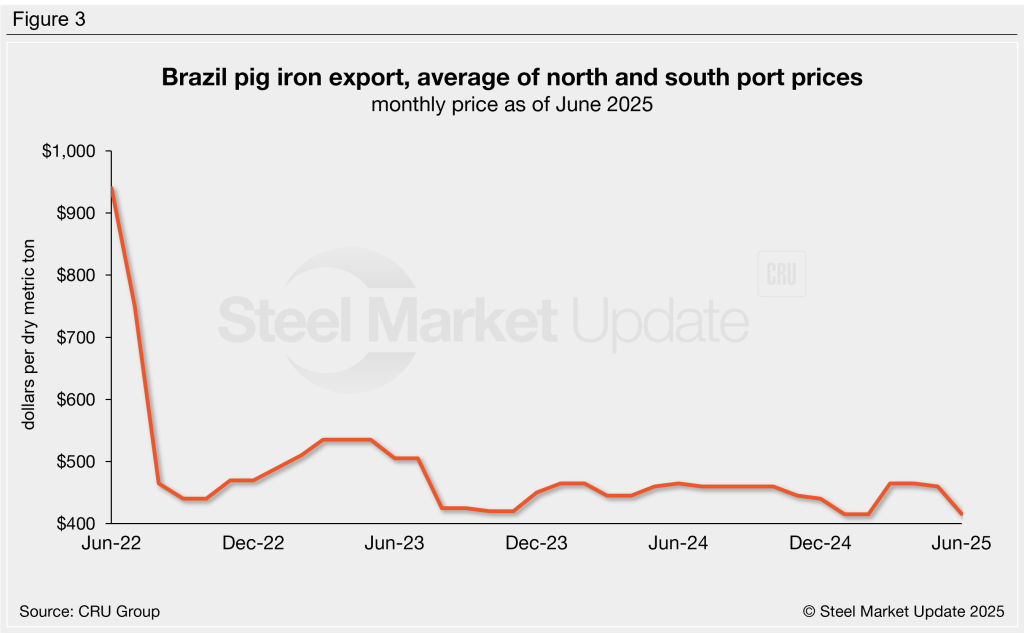

Pig iron

After falling to a four-year low of $415/dmt earlier this year, pig iron prices rebounded in March to $465/dmt and held steady through May. This recovery was completely erased in June, with prices falling 10% m/m to $416/dmt (Figure 3). Pig iron is 11% cheaper than it was both three months ago and in June 2024.

Recall that pig iron prices soared to a historic high of $975/dmt in May 2022 following the invasion of Ukraine. Most of the pig iron imported to the US was imported from Russia, Ukraine, and Brazil. This report uses Brazilian prices (now the primary source of US pig iron imports) and averages prices from the country’s northern and southern ports.

Scrap

Like pig iron, steel scrap prices have trended lower since peaking in March, slipping 7-10% from April to May and holding steady in June. SMU’s latest shredded scrap price was $380 per gross ton (gt) through June and busheling scrap was $425/gt, down 11-16% compared to three months prior (Figure 4). Compared to this time last year, busheling scrap prices are 12% higher today, while shredded scrap is up just 1%.

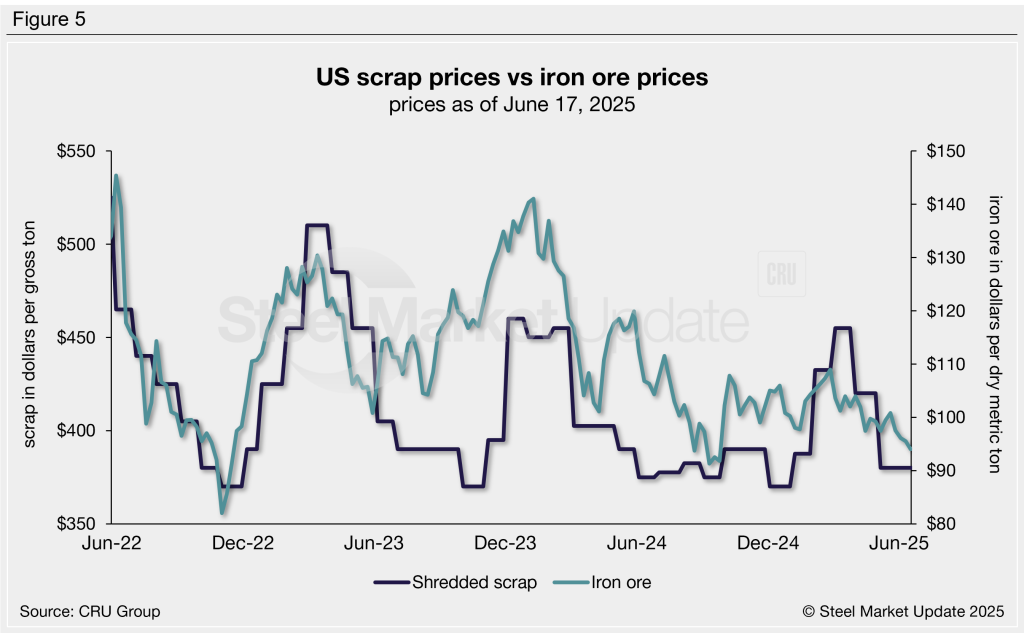

Fluctuations in scrap and iron ore prices provide insight into the competitiveness of integrated (blast furnace) mills, whose primary feedstock is iron ore, vs. mini-mills (electric-arc furnace), whose primary feedstock is scrap. Figure 5 compares the prices of these two mill raw materials.

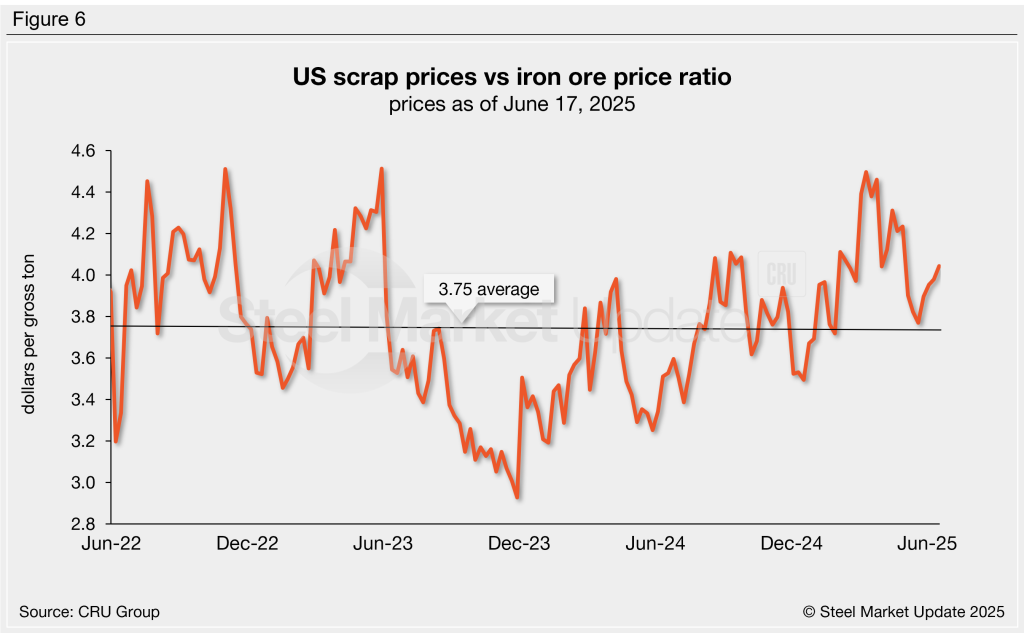

To compare these two mill feedstocks, SMU divides the shredded scrap price by the iron ore price to calculate a ratio. A higher ratio favors the integrated mills, a lower ratio favors the mini-mill producers.

Integrated mills generally held the cost advantage from late 2021 through mid-2023, then it briefly shifted to mini-mill producers in the second half of 2023 through the first few months of 2024 (Figure 6). After bouncing around, the ratio has slightly favored integrated mills since early 2025. It has trended lower since March’s near-two-year high of 4.50, standing at 4.04 as of June 17.

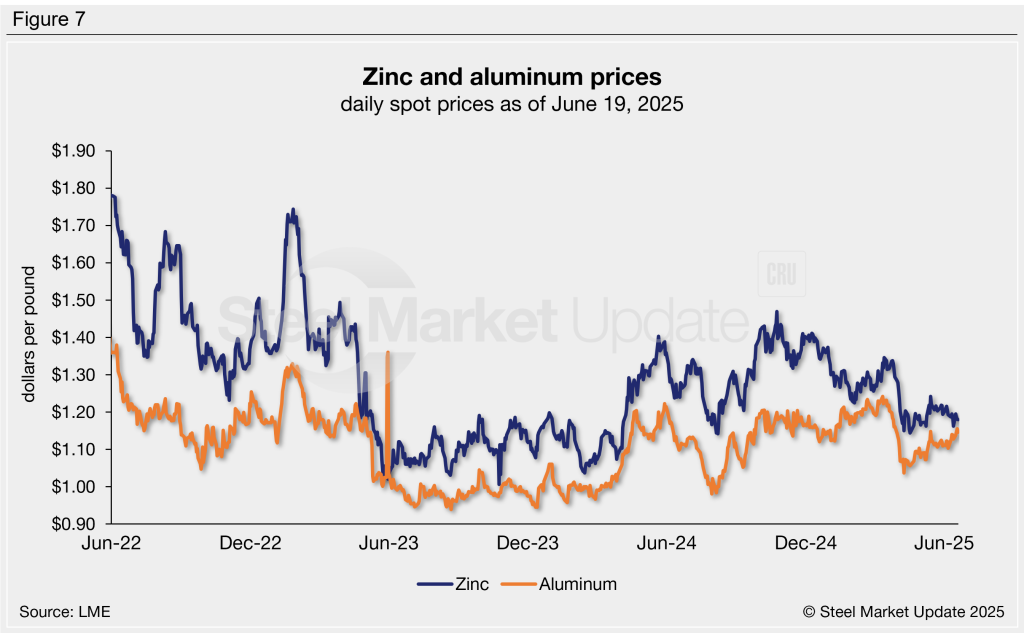

Zinc and aluminum

Zinc and aluminum are used in some coated steel products. Fluctuations in spot prices can prompt steel mills to adjust their galvanized and Galvalume coating extras.

Zinc prices have remained relatively stable since May, easing 2% across the past month and holding near some of the lowest levels recorded in the last nine months. The latest LME zinc cash price is $1.18 per pound as of June 19, 11% lower than three months ago and 8% cheaper than prices seen one year ago (Figure 7).

Aluminum price movements had mostly followed zinc for the first five months of the year but have trended higher in the past two weeks. The latest LME cash price is $1.15/lb, up 3% m/m. Aluminum prices are 6% lower than they were three months ago, but 3% higher than June 2024 levels. Note that aluminum spot prices can be volatile at times, though sharp swings typically correct within a few days, as seen once in Figure 7.