Market Data

July 22, 2025

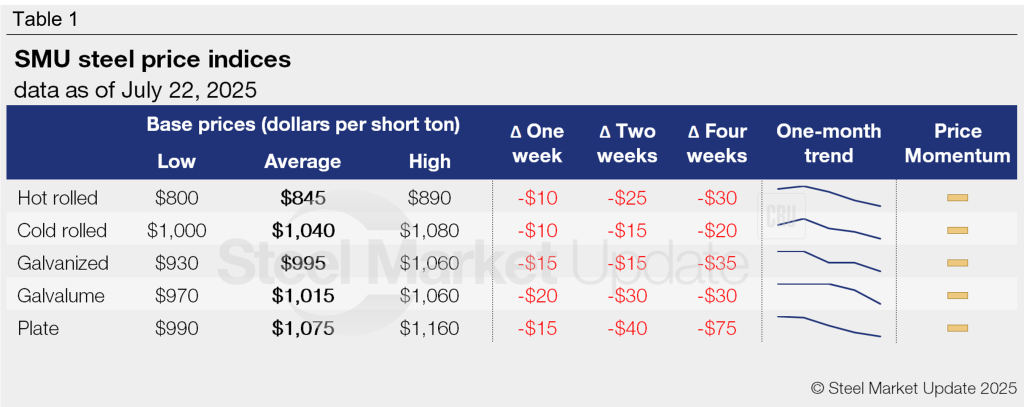

SMU Price Ranges: Sheet and plate drift lower as summer lull continues

Written by Brett Linton

Steel prices continued to decline this week across all of the sheet and plate products tracked by SMU, pressured by short lead times and the typical summer slowdown.

The pullback seen over the past month has been relatively modest, with lower inventories, declining imports, and raw material cost concerns providing some price support. Compared to the steep decline seen last summer, prices are holding up better this year.

Hot-rolled and cold-rolled coil prices each dropped $10 per short ton (st) to eight-week lows of $845/st and $1,040/st, respectively.

Coated prices saw moderately steeper declines, easing to five-month lows. Galvanized declined $15/st week over week (w/w) to $995/st, while Galvalume fell $20/st to $1,015/st. As we mentioned last week, a gap has developed between hot-rolled galvanized and cold-rolled galvanized substrate products, a typical pattern in softer markets that has kept our galvanized range wide this week.

Plate prices fell $15/st from last week to $1,075/st, down to levels last seen in February.

SMU’s price momentum indicator remains at neutral for all sheet and plate products, signaling that we see no clear direction for prices over the next 30 days.

Refer to Table 1 (click to enlarge) for our latest price indices and trends.

Hot-rolled coil

The SMU price range is $800–890/st, averaging $845/st FOB mill, east of the Rockies. The lower end of our range is unchanged w/w, while the top end is down $20/st. Our overall average is down $10/st w/w. Our price momentum indicator for hot-rolled steel remains at neutral, meaning we see no clear direction for prices over the next 30 days.

Hot-rolled lead times range from 3–6 weeks, averaging 4.5 weeks as of our July 10 market survey. We will publish updated lead times on Thursday.

Cold-rolled coil

The SMU price range is $1,000–1,080/st, averaging $1,040/st FOB mill, east of the Rockies. The lower end of our range is unchanged w/w, while the top end is down $20/st. Our overall average is down $10/st w/w. Our price momentum indicator for cold-rolled remains at neutral, meaning we see no clear direction for prices over the next 30 days.

Cold-rolled lead times range from 5–8 weeks, averaging 6.4 weeks through our latest survey.

Galvanized coil

The SMU price range is $930–1,060/st, averaging $995/st FOB mill, east of the Rockies. The lower end of our range is down $10/st w/w, while the top end is down $20. Our overall average is down $15 w/w. Our price momentum indicator for galvanized steel remains at neutral, meaning we see no clear direction for prices over the next 30 days.

Galvanized .060” G90 benchmark: SMU price range is $1,008–1,138/st, averaging $1,073/st FOB mill, east of the Rockies.

Galvanized lead times range from 5–8 weeks, averaging 6.4 weeks through our latest survey.

Galvalume coil

The SMU price range is $970–1,060/st, averaging $1,015/st FOB mill, east of the Rockies. The lower end of our range is unchanged w/w, while the top end is down $40/st. Our overall average is down $20/st w/w. Our price momentum indicator for Galvalume steel remains at neutral, meaning we see no clear direction for prices over the next 30 days.

Galvalume .0142” AZ50, grade 80 benchmark: SMU price range is $1,238–1,328/st, averaging $1,283/st FOB mill, east of the Rockies.

Galvalume lead times range from 5–7 weeks, averaging 6.3 weeks through our latest survey.

Plate

The SMU price range is $990–1,160/st, averaging $1,075/st FOB mill. The lower end of our range is up $10/st w/w, while the top end is down $40/st. Our overall average is down $15/st w/w. Our price momentum indicator for plate remains at neutral, meaning we see no clear direction for prices over the next 30 days.

Plate lead times range from 3–8 weeks, averaging 5.2 weeks through our latest survey.

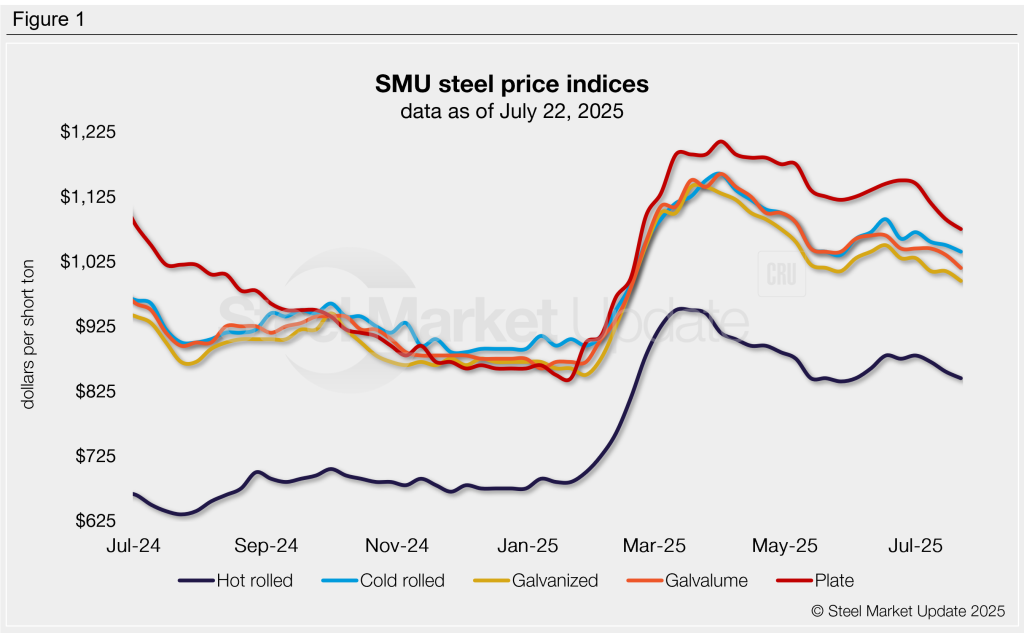

SMU note: The graphic above shows a history of our hot rolled, cold rolled, galvanized, Galvalume, and plate prices. This data is also available on our website with our interactive pricing tool. If you need help navigating the site or logging in, contact us at info@steelmarketupdate.com.