Market Data

October 3, 2025

SMU Survey: Buyers’ Sentiment slips again, future outlook improves

Written by Brett Linton

SMU’s Steel Buyers’ Sentiment Indices diverged yet again this week. The Current Steel Buyers’ Sentiment Index edged lower, just a few points higher than the five-year low seen in August. Meanwhile, Future Buyers’ Sentiment improved to one of the highest measures seen in months.

Each of our Sentiment Indices continues to reflect that steel buyers are positive about their present and future business prospects, though that confidence has fallen considerably compared to the beginning of the year.

Every two weeks, SMU polls thousands of steel industry executives asking them to rate their companies’ chances of success today and three to six months down the road. Their responses are used to calculate our Current and Future Steel Buyers’ Sentiment Indices, metrics we have tracked since 2009.

Current Sentiment

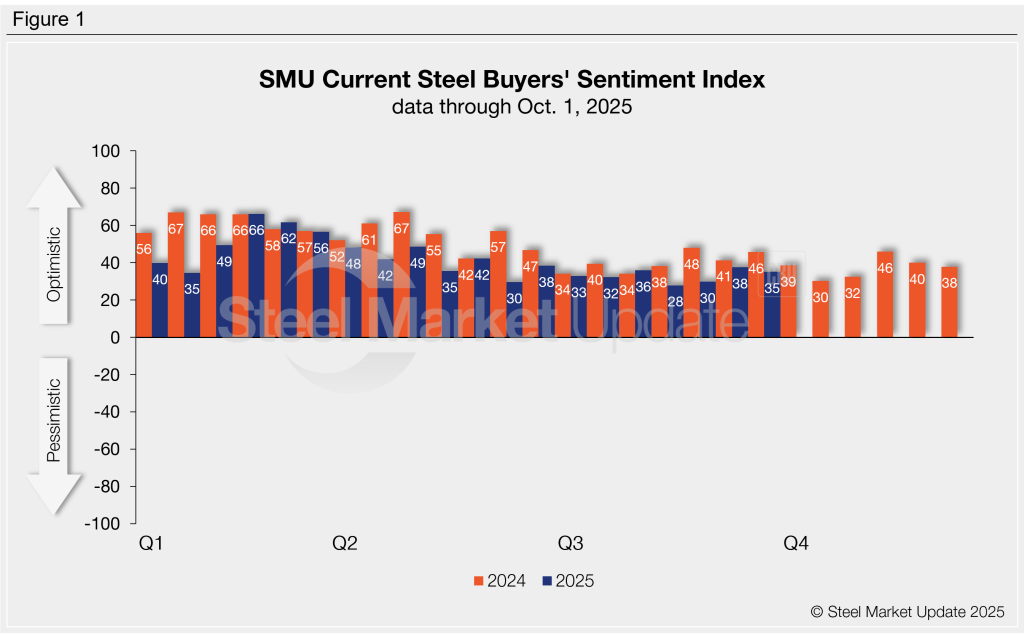

The Current Sentiment Index slipped three points this week to +35 (Figure 1). Recall that in mid-August it had fallen to a five-year low of +28. Sentiment has consistently matched or fallen short of year-ago levels in every survey conducted since March. It has averaged +41 across the first ten months of the year, down ten points from the same time period in 2024. This time last year Sentiment was higher at +46.

Future Sentiment

Future Sentiment ticked three points higher to +53 (Figure 2). Future Sentiment readings have also remained at or below 2024 levels since March. It has averaged +55 so far this year, down from +65 in the first ten months of 2024. This time last year Future Sentiment was significantly stronger at +69.

What respondents are saying:

“Our business volume is down, and our costs have increased.”

“We have relatively low overhead and haven’t gotten desperate in our pricing.”

“This is historically our busy time of the year. I think we’ll do just ok, not good or excellent.”

“Business is fair. The tariff impact is difficult to assess.”

“The future all depends on 232 derivatives.”

Sentiment trends

Sentiment indices can be analyzed on a three-month moving average (3MMA) basis to smooth out short-term swings.

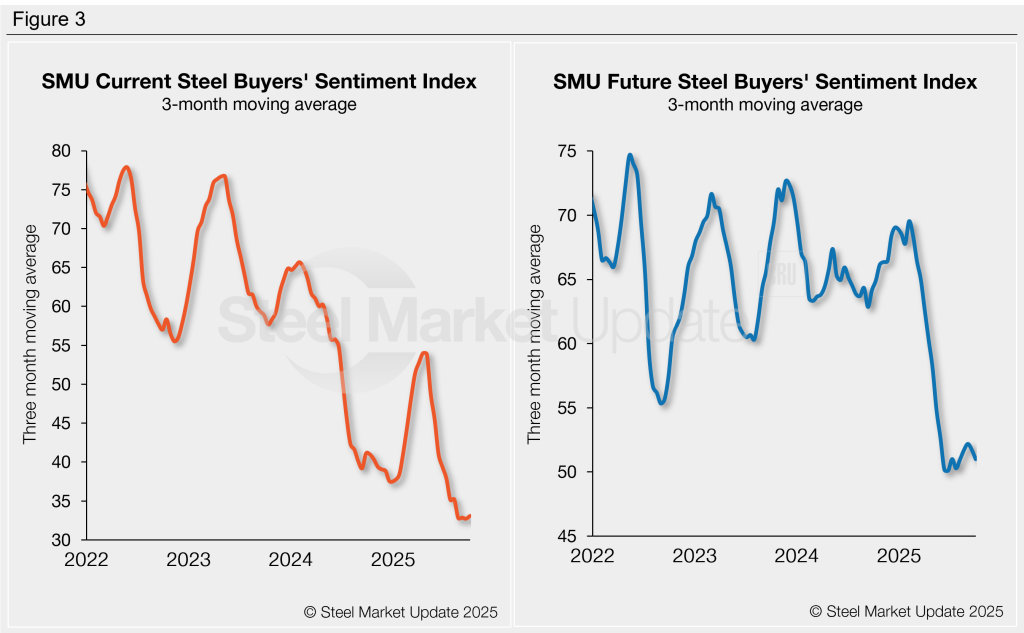

The Current Sentiment 3MMA marginally recovered to +33.07, less than half of a point higher than the five-year low of +32.71 set two weeks ago (Figure 3, left). Compare this to the nine-month high 3MMA of +53.97 seen back in April.

The Future Sentiment 3MMA eased for the second survey in a row to +50.99. This reading is marginally higher than the near-five-year low 3MMA of +50.11 recorded back in June (Figure 3, right).

About the SMU Steel Buyers’ Sentiment Index

The SMU Steel Buyers’ Sentiment Index measures the attitude of buyers and sellers of flat-rolled steel products in North America. It is a proprietary product developed by Steel Market Update for the North American steel industry. Tracking steel buyers’ sentiment is helpful in predicting their future behavior. View our methodology here. If you would like to participate in our survey, please contact us at info@steelmarketupdate.com.