Market Data

October 30, 2025

SMU Survey: Mills less negotiable on spot prices

Written by Brett Linton

Most steel buyers responding to our market survey this week reported domestic mills are considerably less willing to talk price on sheet and plate products than in recent weeks.

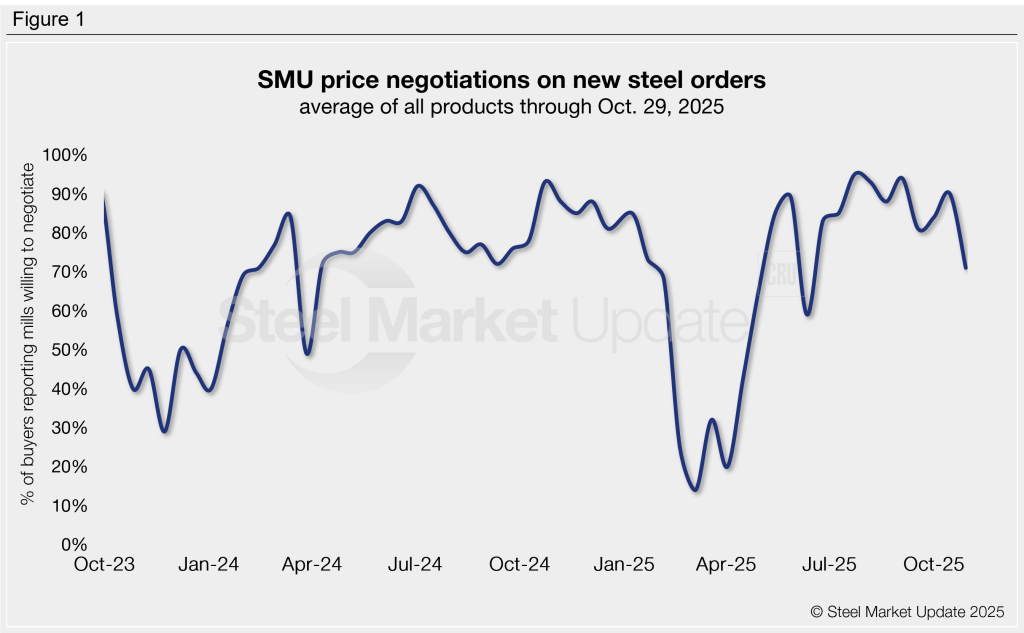

SMU polls hundreds of service center and manufacturer buyers every other week to see if domestic mills are negotiable on new spot order prices. This week, 71% of respondents said mills were willing to talk price to secure an order. This is down 19 points from our previous survey and the lowest rate measured since June (Figure 1).

Mills briefly held pricing power back in February and March when tariff headlines pushed prices higher. That leverage shifted back to buyers across April and May and mostly remained there through mid-October, aside from a brief interruption in June.

Negotiation rates higher on sheet than plate

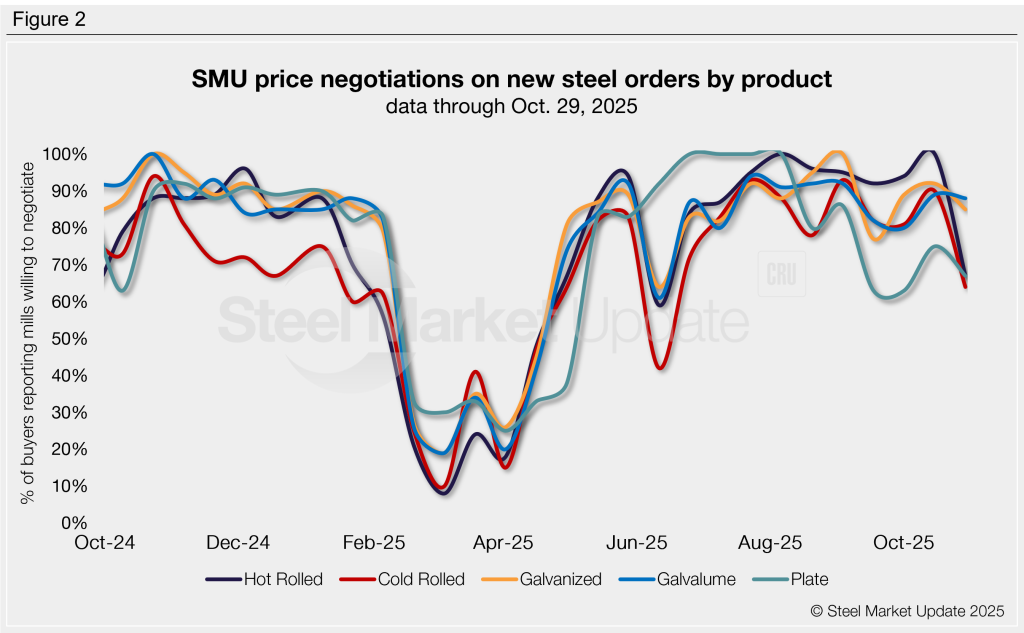

Of the five products we track, all saw lower negotiation rates this week. Coated products remain more negotiable than other products (Figure 2). Current rates are:

- Hot rolled: 67% of buyers said mills are negotiable on price, down 33 points from mid-October and the lowest since June.

- Cold rolled: 64%, down 26 points and also the lowest since June.

- Galvanized: 85%, down seven points.

- Galvalume: 87%, down two points.

- Plate: 67%, down eight points.

Buyer remarks:

“Only negotiable [on hot rolled] in limited instances as they are trying to close out the year with a facade of limited availability.”

“They are seeing the HR books fill up, so they’re not as willing to negotiate.”

“Tons still can be negotiated, but mills are not as aggressive as last month.”

“I believe they will be looking for [galvanized] orders once again in January. Some mills did have success booking tons in the last few weeks.”

“Sort of negotiable [on cold rolled].”

Note: SMU surveys active steel buyers every other week to gauge their steel suppliers’ willingness to negotiate new order prices. The results reflect current steel demand and changing spot pricing trends. Premium members can visit our website to see an interactive history of our steel mill negotiations data.