Market Segment

October 20, 2020

Steel Dynamics: Order Books Indicate Healthy Recovery

Written by Sandy Williams

Steel Dynamics’ CEO Mark Millett was upbeat on the prospects for steel demand in the fourth quarter and beyond. “You can clearly see what is happening in the marketplace through one’s order book—ours is in pretty good shape,” said Millett.

Nonresidential construction has been incredibly strong along with HVAC, appliances and DIY renovation projects. There has been a change in consumer spending, said Millett. People are spending cash closer to home instead of going out or on vacation. That is a positive change for the market that will be continue into next year, he said.

Steel Dynamics reports strong demand for nonresidential construction, which is reflected in SDI’s heavy construction and fabricator businesses. Steel joist demand is up and warehouse expansion continues to increase due to e-commerce. Steel fabrication had record operating income of $39 million due to record shipments and metal spread expansion. The customer order backlog remains strong and higher than 2018 or 2019 levels.

SDI’s Sinton, Texas, EAF project is on schedule for completion in mid-2021. Three customers, to date, have located facilities at the Sinton site. SDI is excited about the potential for market share growth in the regions the new mill will serve. “The general economics and value to customers will be massive,” said Millett.

Steel Dynamics recently acquired the Zimmer recycling assets in Mexico, a part of the Texas steel mill strategy. The addition will increase scrap flow and quality and improve melt efficiency.

Metals recycling improved significantly as shelter-in-place measures were rescinded and automotive production resumed. Operating income from recycling operations increased to $15 million compared to a loss of $6 million in Q2. The average ferrous scrap cost per ton melted at the company’s steel mills decreased $7 sequentially to $259 per ton. SDI expects scrap prices to remain fairly stable through the rest of the year with some price appreciation in December and January.

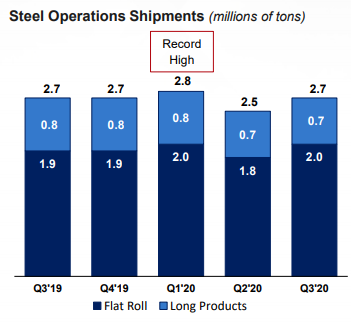

The company posted net sales of $2.3 billion for the third quarter and net income of $100 million. Operating income for steel operations was 17 percent lower than in the second quarter due to metal spread compression caused by lower selling prices in the flat roll segment, mostly related to lagged contract arrangements, said SDI. Average steel selling price was $734 per ton, down $21 from Q2.

SDI’s overall capacity utilization was at 85 percent in the third quarter and flat rolled utilization was at 99 percent, compared to an average of 64 percent for the domestic steel industry.

“The domestic economy is recovering from the shock of COVID-19 although it is still difficult to know the full extent of its eventual impact. However, we are currently seeing a solid recovery in domestic steel demand,” said Millett. “The automotive sector has seen the strongest improvement, and the construction sector has remained resilient. We are seeing pentup demand, as steel service center inventories were extremely low and still remain low compared to historical norms. Energy remains the weakest end market.

“Flat rolled steel spot prices rebounded during the third quarter, as customer inventory levels were extremely low and demand steadily improved. We expect to see continued price strength and customer demand throughout 2020 and into 2021.”