Prices

June 30, 2022

Hot Rolled Futures: Bullwhip or Whipsaw, Further Volatility Ahead

SMU contributor Bryan Tice is a partner at Metal Edge Partners, a firm engaged in Risk Management and Strategic Advisory. In this role, he and the firm design and execute risk management strategies for clients along with providing process and analytical support. Prior to Metal Edge Partners, Bryan held a variety of commercial leadership roles involving purchasing, sales, and risk management for Feralloy Corp., Cargill Steel Service Centers, and Plateplus Inc. You can learn more about Metal Edge @ www.metaledgepartners.com. Bryan can be reached at Bryan@metaledgepartners.com for queries/comments/questions.

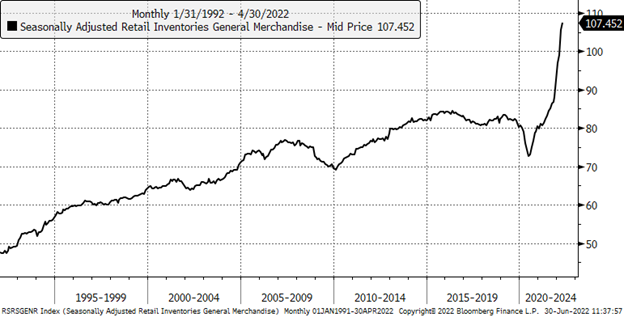

There have been some interesting articles written recently about the bullwhip effect, which is loosely defined as the distortion of demand and increasing volatility that occurs as forecasts and orders move through the supply chain. The thesis of many of these articles has been that inflation may be less of a headwind to the economy as you look at some of the economic data, though ramifications for the metals industry could be a bit more problematic. The chart below shows the seasonally adjusted growth in retail inventories of general merchandise for the last three decades. Many of these retailers are those that pride themselves on being supply chain experts (e.g., Wal-Mart, Target, etc.). This recent spike in inventories seems ominous to us.

I have long thought that the metals industry is the perfect analog for economics 101 – supply and demand. But it is possible that sentiment plays a larger role in a commodity market like the metals industry. Many of us in the steel industry are just traders at heart. These articles have dusted off just how “distorted” our markets have become over the past five years because of Section 232, Covid, and the Ukraine-Russian war. From a demand perspective, Covid sent people scrambling in fear that demand for everything would collapse. But as we learned, we stimulated and shifted spending patterns/consumption to other things, and those left out in the cold retrenched and cut capacity. Then we experienced massive shortages causing consumers, manufactures, and distributors to hoard. That further complicated determining what was real or artificial demand for products and services. The shortage theme played out similarly with Section 232 in 2018 and with the Ukraine-Russian war this year. Many US buyers feared we would lack sufficient supply. After each of these disruptions, the steel market has seen some pretty hefty corrections.

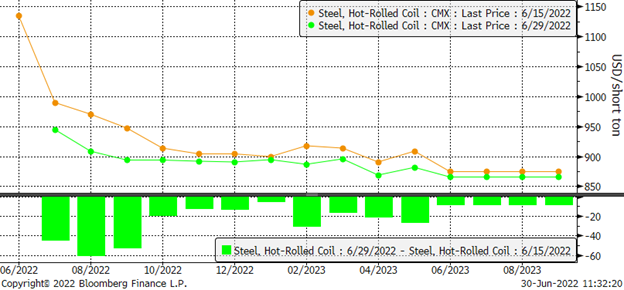

That brings us back to the volatility that lies ahead. The tone from mills and service centers continues to be mostly bearish. Even if demand is stable, a falling price environment always puts the industry in a bad mood. End users, on the others hand, seem to be signaling a slightly better outlook. However, when you look at the change in HRC futures over the last few weeks, the market has become only slightly more bearish in the near term with pricing grinding lower by $40-$60/t. Pricing levels are in the mid/high $800s per ton for most of 2022 and into 2023. Given all the negativity, it is a bit surprising that these further out levels have been supported.

On the one hand, it is possible that manufacturers and distributors have been so conditioned to expect high prices and supply disruptions that they are content locking in prices above the historical average. We can also attribute some of this to the inflationary environment we are experiencing now. On the other hand, one could surmise that fear of steel mill labor negotiations turning into strikes has the natural sellers debating whether the low prices they’d have to reach to sell to protect inventory losses are worth risking should we see a spike in pricing driven by a work stoppage at any of the four mills negotiating labor contracts between now and the end of August.

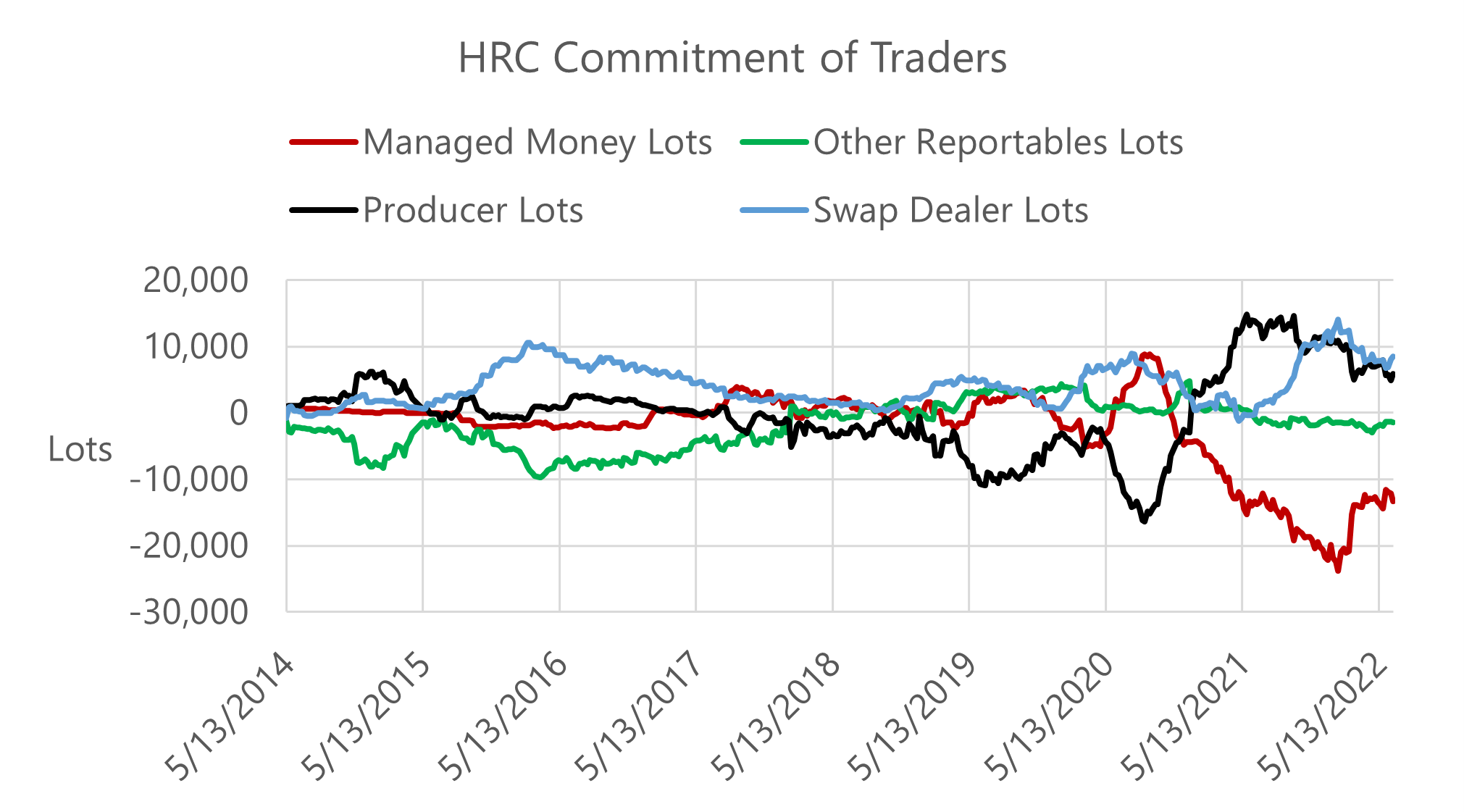

Looking at activity among those trading futures via the commitment of traders report, you’ll see that managed money did some short covering in mid-Q1 but have been holding fairly stable at around 13,000 contracts short. Producers seem to be slowly decreasing their long positions. But neither of the two have been doing so with any real urgency as of late.

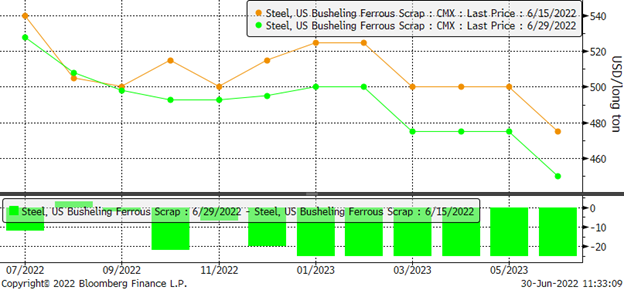

As for the outlook on the busheling scrap trade, things are less congruent with HRC futures. Those price expectations are suggesting little movement in scrap prices in the short term but further deterioration as we get into Q4 2022 and the first half 2023.

I am sure many of you have been reeling for the whipsaw that we have seen since late February, with pricing spiking and then collapsing. That is why we encourage steel buyers and sellers to have a robust risk management strategy to help navigate these wild swings.

With that we will close for the week, and we wish you and your families a wonderful Independence Day holiday.

Disclaimer: The information in this write-up does not constitute “investment service,” “investment advice,” or “financial product advice” as defined by laws and/or regulations in any jurisdiction. Neither does it constitute nor should be considered as any form of financial opinion or recommendation. The views expressed in the above article by Metal Edge Partners are subject to change based on market and other conditions. The information given above must be independently verified and Metal Edge Partners does not assume responsibility for the accuracy of the information.