Plate

February 28, 2023

SMU Price Ranges: The Sheet Rally Continues, Plate Joins

Written by David Schollaert

Last week’s mill price increases continue to make their way into the market. Cliffs’ latest this week – up another $100 per ton ($5 per cwt) and setting a new base price for hot band of $1,100 per ton – has yet to be reflected in today’s pricing. But that hasn’t stopped it from garnering attention and sparking market chatter.

There are mixed feelings about whether that price point will be seen in the near term. While some debate whether the sharply higher prices will stick, others contend that rising prices are justified by a supply-side squeeze.

The overarching theme: Higher prices reflect slightly improved demand coupled with new capacity being slow to ramp up. That, and limited output from a Mexican producer, means supply is unable and/or unwilling to respond to demand.

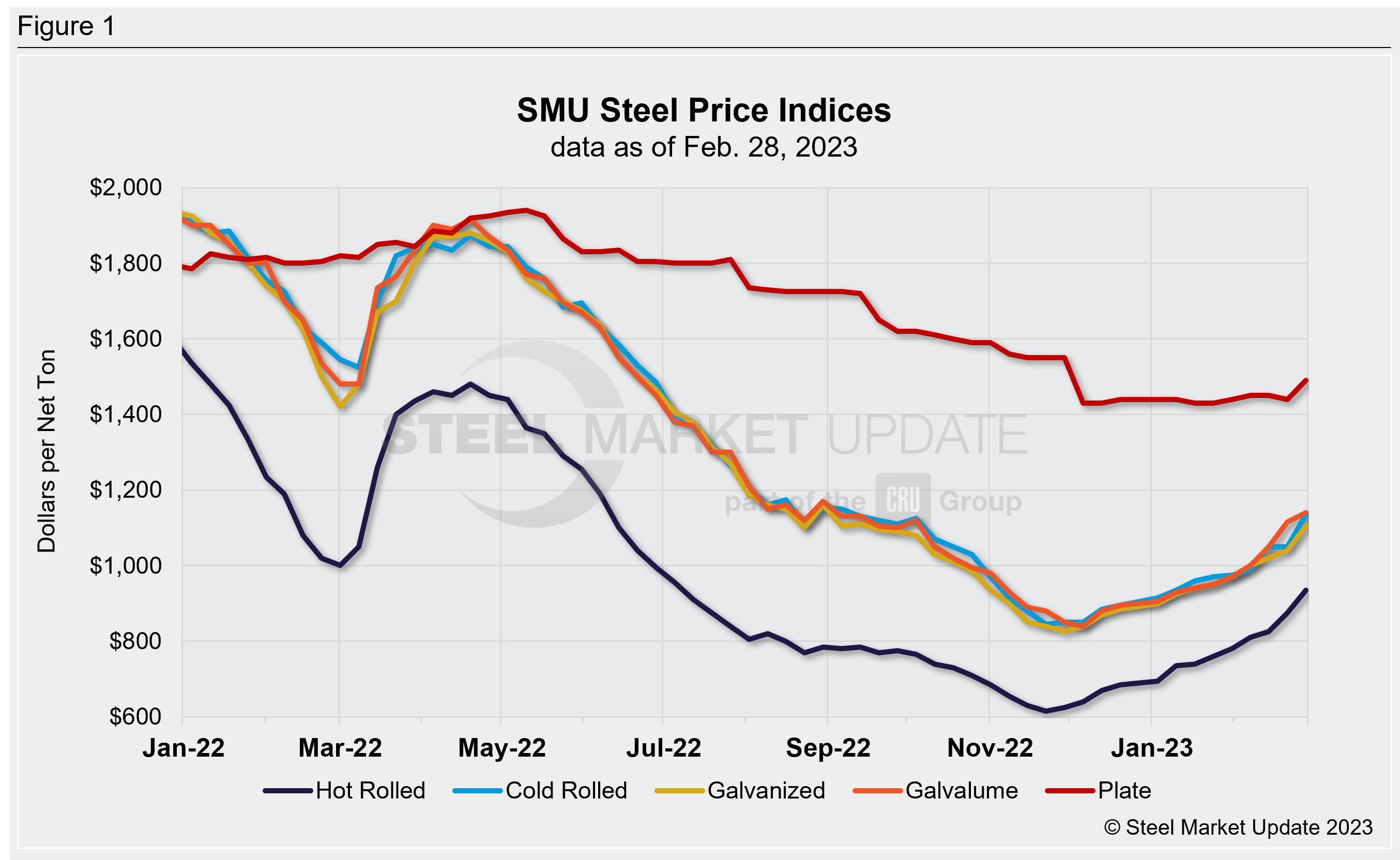

Steel Market Update’s hot-rolled coil price now stands at $935 per ton on average, up $60 per ton from last week, and hitting the $1,000-per-ton barrier on the top end for the first time since last June.

Recall, however, that the market was in a very different position then. Prices had begun a nosedive that would carry on for 24 straight weeks. HRC prices fell from a high of $1,480 per ton last April to just over $600 per ton in mid-November.

Note also that our high/low spreads tend to balloon out when prices are inflecting. This time, however, there is little doubt that they are inflecting upward. It’s just a question of how much.

If we include Cliffs’ most recent price notice, mills will have announced sheet increases totaling $300 per ton in a matter of 25 days. It’s pricing surge on par with what we saw in first half of 2021 and/or in March and April last year, when the market panicked about the initial fallout of the war in Ukraine.

It wasn’t just HRC that was up this week. Cold-rolled followed suit (up $85 per ton vs. last week) as did galvanized (up $65 per ton) and Galvalume (up $25 per ton). Plate prices also joined the party, up $50 per ton vs. the prior week, largely in response to SSAB’s late-Friday price hike announcement.

All our sheet momentum indicators continue to point upward. Our plate momentum indicator is now also pointing upward too. We anticipate more increases.

Hot-Rolled Coil: The SMU price range is $870–1,000 per net ton ($43.50–50.00/cwt), with an average of $935 per ton ($46.75/cwt) FOB mill, east of the Rockies. The bottom end of our range increased by $40 per ton, while the top end rose $80 per ton vs. one week ago. Our overall average is up $60 per ton week on week (WoW). Our price momentum indicator on hot-rolled steel points to Higher, meaning we expect prices to increase over the next 30 days.

Hot-Rolled Lead Times: 4–8 weeks

Cold-Rolled Coil: The SMU price range is $1,070–1,200 per net ton ($53.50–60.00/cwt) with an average of $1,135 per ton ($56.75/cwt) FOB mill, east of the Rockies. The lower end of our range was up by $70 per ton, while the top end rose by $100 per ton compared to one week ago. Our overall average is up $85 per ton WoW. Our price momentum indicator on cold-rolled steel points to Higher, meaning we expect prices to increase over the next 30 days.

Cold-Rolled Lead Times: 6–10 weeks

Galvanized Coil: The SMU price range is $1,050–1,160 per net ton ($52.50–58.00/cwt) with an average of $1,105 per ton ($55.25/cwt) FOB mill, east of the Rockies. The lower end of the range rose by $50 per ton WoW, while the top end of our range increased $80 per ton vs. one week ago. Our overall average is up $65 per ton WoW. Our price momentum indicator on galvanized steel points to Higher, meaning we expect prices to increase over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,147–1,257 per ton with an average of $1,202 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 6–9 weeks

Galvalume Coil: The SMU price range is $1,080–1,200 per net ton ($54.00-60.00/cwt) with an average of $1,140 per ton ($57.00/cwt) FOB mill, east of the Rockies. The lower end of the range was uncahnged vs. the week prior, while the top end of our range was up $50 per ton compared to one week ago. Our overall average is up $25 per ton from one week ago. Our price momentum indicator on Galvalume steel points to Higher, meaning we expect prices to increase over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,374–1,494 per ton with an average of $1,434 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 7–9 weeks

Plate: The SMU price range is $1,450–1,530 per net ton ($72.50–76.50/cwt), with an average of $1,490 per ton ($74.50/cwt) FOB mill. The lower end of the range was up $50 per ton WoW, while the top end of our range also rose by $50 per ton compared to one week ago. Our overall average increased by $50 per ton WoW. Our price momentum indicator on steel plate is now pointing Higher, meaning we expect prices to increase over the next 30 days.

Plate Lead Times: 5–8 weeks

SMU Note: Below is a graphic showing our hot-rolled, cold-rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.

By David Schollaert, david@steelmarketupdate.com