US HR premium widens on lower offshore tags

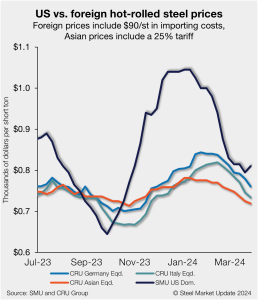

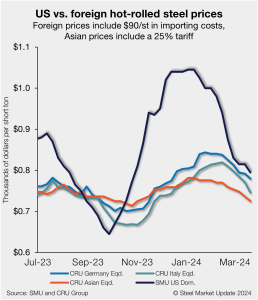

US hot-rolled (HR) coil has become gradually more expensive than offshore hot band in recent weeks, as stateside prices have stabilized while imports moved lower.

US hot-rolled (HR) coil has become gradually more expensive than offshore hot band in recent weeks, as stateside prices have stabilized while imports moved lower.

Earlier this week, SMU polled steel buyers on an array of topics, ranging from market prices, demand, and inventories to imports and evolving market chatter.

The steel market appears to be finding a new, higher normal with the shocks of the pandemic and the Ukraine in the rearview mirror. The good news: a more profitable and consolidated post-Covid US steel industry has been able to invest in operations. That includes efforts to decarbonize. The bad news: That “new normal” could be tested. Because it’s not just domestic sheet prices that have been volatile. Geopolitics are too.

I’m writing these Final thoughts from the 2024 ISRI Convention and Exposition in Las Vegas. I wasn’t the only one with the good idea to attend. Approximately 6,625 others did – a new record for the event. So, a big congratulations to ISRI.

As the ISRI 2024 conference unfolds in Las Vegas, attendees are diving into crucial discussions shaping the future of the recycling industry. Here are the main topics being discussed: New steelmaking capacity coming online this year Export demand during this period Infrastructure spending Supply of pig iron and HBI Current logistics challenges May scrap prices […]

Last week was a newsy one for the US sheet market. Nucor’s announcement that it would publish a weekly HR spot price was the talk of the town – whether that was in chatter among colleagues, at the Boy Scouts of America Metals Industry dinner, or in SMU’s latest market survey. Some think that it could Nucor's spot HR price could bring stability to notoriously volatile US sheet prices, according to SMU's latest steel market survey. Others think it’s too early to gauge its impact. And still others said they were leery of any attempt by producers to control prices.

Total domestic aluminum mill products orders in March were up 0.2% compared to March 2023, according to the latest “Index of Net New Orders of Aluminum Mill Products” released by the US Aluminum Association (AA). This is much lower than the growth of 9.3% year over year (y/y) reported in February.

U.S. Steel Corp.’s impending sale to Japan’s Nippon Steel Corp. (NSC) has cleared one hurdle: USS stockholders voted overwhelmingly in favor of the nearly $15 billion merger.

While shipping and supply chains have always been subject to wars, pirates, privateers, geopolitical issues, and natural disasters, it seems that “it’s been busier lately when it comes to dealing with significant supply chain disruptions,” according to logistics expert Anton Posner.

To ease trade tensions with the United States, the economy ministry in Mexico is preparing measures to strengthen definitions on steel being shipped into the country. Mexico has faced accusations it is being used as a route for steel and aluminum produced in Asia to be sent on to the US, so-called triangulation.

US hot-rolled (HR) coil has become increasingly more expensive than offshore hot band as stateside prices have moved higher at a sharper pace vs. imports.

Next week, Las Vegas will host the largest recycled materials industry event. ISRI’s annual gathering at the Mandalay Bay Resort and Casino will unite more than 6,000 industry professionals to explore the latest trends in ferrous and nonferrous markets, provide networking opportunities, and support business growth. SMU and RMU eagerly anticipate participating, connecting with fellow attendees, and […]

Nucor made waves in the sheet market when it announced on Friday that it would begin publishing a weekly hot-rolled (HR) coil price. The Charlotte, N.C.-based steelmaker arguably made even bigger waves on Monday when it posted its first weekly HR number: $830 per short ton. That’s $70/st lower than the $900/st HR price Cliffs announced in late March. It’s also lower than prices in the mid-$800s that other mills were (less publicly) seeking.

They say all’s fair in love and war. But that doesn’t seem to be the case in steel. Being deemed “unfair” could get you slapped with shiny new Section 232 tariffs these days. Then again, “unfair” implies a judge. And people on opposing sides seldom agree with the judgment. Such seems to be the current case between the US and Mexico.

Personal Consumption Expenditures (PCE) inflation data was released on Friday, March 29, despite the stock market being closed for Good Friday. The year-over-year (y/y) PCE price index rose 2.5% in February, in line with market expectations but up from the 2.4% growth seen in January. The core PCE index, which excludes food and energy prices, rose 2.8% y/y in February, also in line with expectations and slightly down from 2.9% in January.

Directors of Swedish steelmaker SSAB have decided to replace blast furnace-based steelmaking at Lulea with a ‘green steel’ mini-mill process.

You might have noticed that SMU has been publishing more articles about scrap in recent months. That was no accident. In fact, we’ve found enough of an audience that CRU, our parent company, has decided to launch a new publication – Recycled Metals Update, or RMU. It cover both ferrous and nonferrous scrap. RMU’s website is here. You can go there now and request a 30-day free trial. It’s that simple.

Steel companies in Mexico have lined up capex plans totaling $5.7 billion in the next three years. The focus is on replacing imports with domestic production, said David Gutierrez, outgoing president of sector association Canacero. “The investments are aimed at reducing imports, strengthening national production, and ensuring that the benefits stay in the country,” he was quoted as saying at Canacero’s annual congress by regional news service Business News Americas.

The Biden administration this week announced landmark industrial funding to support potentially transformational industrial decarbonization projects. In total, thirty-three projects across eight industrial sectors will receive up to $6 billion in federal funds from the US Department of Energy’s (DOE) Office of Clean Energy Demonstrations (OCED).

US hot-rolled coil and offshore hot band moved further away from parity this week as stateside prices have begun to move higher in response to mill increases.

A container ship collided with the Francis Scott Key Bridge in Baltimore on March 26, causing it to collapse. This has blocked sea lanes into and out of Baltimore port, which is the largest source of US seaborne thermal coal exports. The port usually exports 1–1.5 million metric tons (mt) of thermal coal per month. It is uncertain when sea shipping will be restored. But it could be several weeks or more. There are coal export terminals in Virginia, though diversion to these ports would raise costs.

Cleveland-Cliffs Inc. has plans to replace the blast furnace at its Middletown Works in Ohio with a direct-reduced iron (DRI) plant and two electric melting furnaces (EMFs).

The LME 3-month aluminum price resumed moving lower on the morning of March 22 and was last seen trading at $2,290 per metric ton. The price was unable to break through an important resistance level at $2,300/mt on March 21. EGA to acquire European recycler Emirates Global Aluminium of the UAE has signed a binding […]

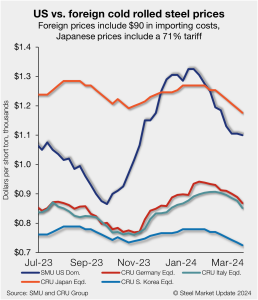

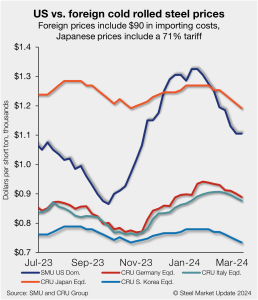

Foreign cold-rolled (CR) coil remains notably less expensive than domestic product even with repeated tag declines across all regions, according to SMU’s latest check of the market.

APAC steel prices are likely to bottom out in the near term as seasonally higher demand coupled with production cuts may support prices. In the EU, prices are likely to remain under pressure, while fresh price increases are expected in the US. APAC steel prices are likely to bottom out in the near term In […]

2024 started with a $200 per short ton (st), one-week demon drop in the CME Midwest hot-rolled (HR) coil futures. Then, HR futures consolidated in the low $800s/st with the April future trading to as low as $770/st as the curve shifted into contango or upward sloping. A big move was expected, and a big […]

US hot-rolled coil (HRC) remains more expensive than offshore hot band but continues to move closer to parity as prices decline further. The premium domestic product had over imports for roughly five months now remains near parity as tags abroad and stateside inch down.

Are we still looking for a bottom on sheet prices? In what direction are steel and scrap prices headed? How’s demand holding up at the moment?

Foreign cold-rolled coil (CR) remains significantly less expensive than domestic product even as US tags continue to decline in a hurry, according to SMU’s latest check of the market.

The CRUspi fell by 8.3% month over month (m/m) in March to 206.6 as weaker-than-expected demand weighed on markets around the world. Price falls were notable across all regions, with elevated inventory levels pushing prices in the US and Europe, and disappointing stimulus measures from the Chinese government weighing on those in Asia.