CRU

March 27, 2024

CRU: Baltimore bridge collapse affects more than half of US thermal coal exports

Written by CRU

A container ship collided with the Francis Scott Key Bridge in Baltimore on March 26, causing it to collapse. This has blocked sea lanes into and out of Baltimore port, which is the largest source of US seaborne thermal coal exports.

The port usually exports 1–1.5 million metric tons (mt) of thermal coal per month. It is uncertain when sea shipping will be restored. But it could be several weeks or more. There are coal export terminals in Virginia, though diversion to these ports would raise costs.

Most Baltimore coal exports head to India

Most Baltimore exports head to India, with smaller amounts sent to Europe, China, and other destinations. The cement and brick industry accounts for most Indian purchases of US thermal coal. The industry could temporarily buy other high-grade thermal coal imports – such Australia, South Africa, Russia, Colombia, or other US ports – assuming the grade and impurities are suitable. Any increase of Russian thermal coal imports may be difficult because of US sanctions against SUEK, Russia’s largest thermal coal exporter, introduced in late February.

Substitute purchases from Australia and/or elsewhere to compensate for decreased exports from Baltimore might help support spot prices from these origins, such as FOB Newcastle 6,000 kcal/kg spot. Any price support would likely be temporary. Moreover, any price support may be limited because of mild winter temperatures in the northern hemisphere, which has led to good availability.

Thermal coal prices and inventories

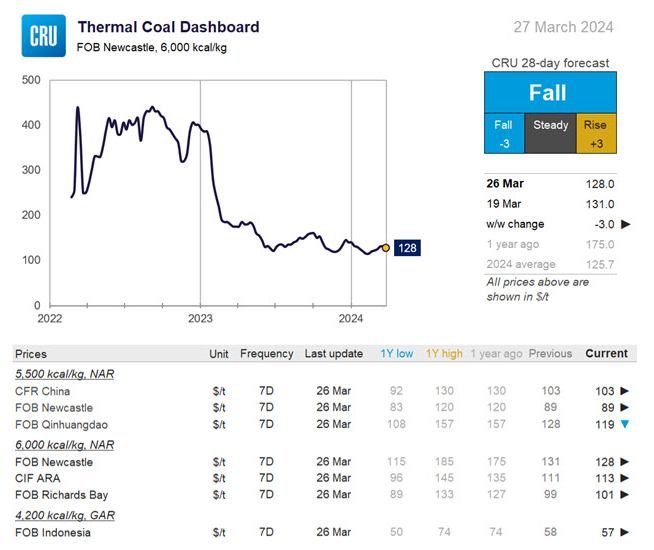

Some CRU-assessed thermal coal prices rose while others fell w/w. FOB Newcastle 6,000 kcal/kg spot declined $3 pet metric ton (mt) to $128/mt after rising the last several weeks. We expect Japan-Australia April contract negotiations will conclude in April at a price of $135–140/mt.

CIF ARA rose $2/mt to $113/mt, supported by European gas prices being slightly higher in the second half of March compared to the first half. Traders are reportedly discussing a very near-term ‘stable’ level for CIF ARA of $110–120/mt.

EU coal-fired generation this week is just below the level observed a year ago, after being significantly below 2023 levels earlier this year. European carbon prices have increased slightly, which may pressure European coal prices. However, we expect the carbon price will decline slightly over the next month, which would ease pressure on European coal prices.

FOB Richard’s Bay rose by $2/mt to $101/mt, supported by a rise in European prices.

FOB Qinhuangdao 5,500 declined by RMB60/mt (~$8.6/mt) over the past week, which is one of the biggest declines so far in 2024. Some restocking activities have been completed for the next several weeks. Thermal coal trading volumes have been thin, and inventories have started to rise. Chinese coal prices have likely reached, or are close to reaching, a price floor for now. Low prices are pressuring coal miners, and some private coal mines may reduce production, which would support prices.

Daqin railway, which connects the biggest coal-producing region in China to the coast and ports, will enter a one-month maintenance period during April. This will also reduce thermal coal supply and support prices over the next month.

Indian thermal coal stocks have been rising since December, as we have been reporting. Domestic production continues to be strong.

A hot summer coming

Many in the thermal coal market are expecting a hot summer in 2024. Some Asian countries are preparing to buy more thermal coal to satisfy expected cooling demand. For example, Vietnam has been importing more Australian thermal coal. India is preparing by asking gas-fired generators to secure contracts.

We forecast FOB Newcastle 6,000 kcal/kg spot will be lower in four weeks’ time. Assuming the Japan-Australia contract negotiations have ended, this will put pressure on spot prices. While the Baltimore bridge collapse will provide price support, it will be limited and temporary.

Natural gas market update

European gas prices have remained near EUR27/MWh over the last two weeks, which is slightly higher than during the first half of March. Overall, these prices are still very low compared to the last two years. Mild temperatures, particularly in Europe and the US, as well as subdued industrial demand and high global inventories maintain downward pressure on prices.

European inventories at the beginning of April 2024 will be very high at ~58%, which will reduce summer gas buying needs. We expect gas inventories will remain high throughout 2024. The Baltimore bridge collapse should not affect US LNG exports, with the sole US LNG export terminal in the East Coast reporting no impacts.

This article was first published by CRU. Learn more about CRU’s services at www.crugroup.com/analysis.