September steel exports drop to lowest level of year

After rising to a one-year high in August, the volume of steel that exited the country in September fell 10% month on month (m/m) to 760,000 short tons (st).

After rising to a one-year high in August, the volume of steel that exited the country in September fell 10% month on month (m/m) to 760,000 short tons (st).

As we await the formation of November’s domestic ferrous scrap market, all the recent action is in the export market. However, it is debatable whether events in this arena are influencing our US market other than psychologically. This opinion has been expressed by several sources that I have approached.

The volume of finished steel entering the US market declined in August from July, according to SMU’s analysis of data from the US Department of Commerce and the American Iron and Steel Institute (AISI). Referred to as ‘apparent steel supply,’ we calculate this monthly rate by combining domestic steel mill shipments and finished US steel imports and deducting total US steel exports.

The amount of steel exiting the country in August reached the highest monthly rate recorded since August 2023.

Following May’s five-month low, US steel exports ticked higher in July, according to the latest US Department of Commerce data. The amount of steel exiting the country rose 6% month on month (m/m) to 818,000 short tons (st). This is back in line with trade levels seen in recent months.

After nearing a two-year high in May, the volume of finished steel entering the US market (referred to as ‘apparent steel supply’) receded in June, according to SMU’s latest analysis of data from the Department of Commerce and the American Iron and Steel Institute (AISI).

Total US steel exports declined again in June, down 2% month-on-month (m/m) to 773,000 short tons (st) according to the latest US Department of Commerce data.

GrafTech cited a “challenging” part of the business cycle as its net loss widened in the second quarter.

They say a picture is worth a thousand words. Well, when you add in some commentary from respected peers in the steel industry to those pictures, that may shoot you up to five thousand words, at least. In that spirit, we’ve added some snapshots from our market survey this week, along with some comments from market participants.

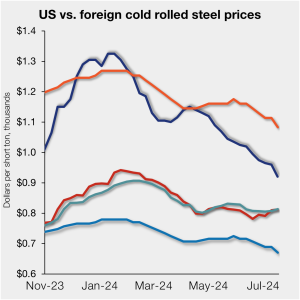

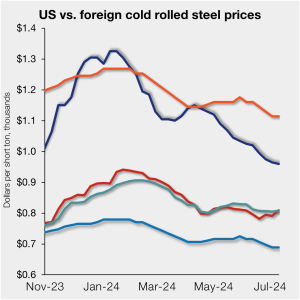

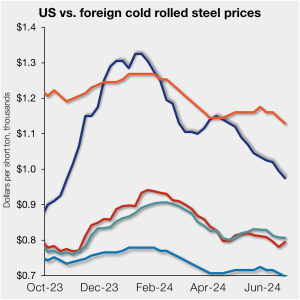

The price gap between US cold-rolled (CR) coil and imported CR has fallen to a 10-month low as domestic tags continue to drift lower. Domestic CR coil prices averaged $920 per short ton (st) in our check of the market on Tuesday, July 16, down $40/st from the week before. CR tags are now down […]

The United Kingdom and other countries are using the “green” label to subsidize bailouts of obsolete, inefficient, and excess capacity that should exit the market. US steelmakers have invested billions of dollars in technologies that curb greenhouse gas output. These investments have been market-based and led by EAF producers such as Nucor, Steel Dynamics, and CMC.

North American auto assemblies ticked down by nearly 6% in June after reaching a nine-month high in May, according to LMC Automotive data. Assemblies were also down 1.4% year on year (y/y).

A roundup of aluminum news from CRU.

Steel is, mostly for historical reasons, a bellwether of international policy. No longer an industry of primary importance, its advocates still proclaim that it is. And steel still continues to punch above its weight in Washington, DC. Below are a few recent examples.

Offshore cold-rolled (CR) coil remains cheaper than domestic product. The gap continues to tighten, however, as US CR coil prices slip to a nine-month low. Domestic CR coil tags averaged $960 per short ton (st) in our check of the market on Tuesday, July 9, down $5/st from the week before. CR tags are now […]

The volume of finished steel entering the US market, dubbed ‘apparent steel supply,’ ticked up 3% from April to May according to SMU analysis of Department of Commerce and the American Iron and Steel Institute (AISI) data.

The ferrous scrap export market on the Atlantic and Gulf Coasts of North America has maintained its pricing for several months despite continuing declines in domestic markets.

Following April’s eight-month high, May represents the second-lowest export rate of the year, only greater than January’s 771,000 st level.

Radius Recycling continued to bleed red in its most recent quarterly report as it negotiated persistently challenging conditions in the recycled metals market.

It’s been a slow start to the week as far as news goes, something you’d expect ahead of a shortened Independence Day week. That said, it’s not as if transactions have completely ground to a halt. (Prices continue to drift lower.) And while news might be slow, rumors of low-priced deals, price hikes, and trade cases seem to have filled that void.

Low global sheet demand continued to weigh on prices around the world this week. In the US, mills were forced to remain aggressive to secure orders during this period of demand weakness. And compounded by recent new capacity ramp-ups, has forced US hot rolled (HR) coil prices down closer to levels seen in offshore markets. […]

Offshore cold-rolled (CR) coil remains cheaper than domestic product pricing even as US CR coil prices slip to an eight-month low. Domestic CR coil tags stood at $975 per short ton (st) on average in our check of the market on Tuesday, June 25, down $20/st from the week before. Domestic CR prices are, on […]

The Canadian Steel Producers Association (CSPA) has lauded Canada’s decision to launch an investigation into China’s unfair trade practices in electric vehicles (EVs). However, the association hopes the government will go even further and extend the investigation into other sectors.

We have heard ominous warnings about a flood of Mexican steel threatening the US market. It's the kind of rhetoric that gets thrown around often with little regard for the facts. The reality is that the Mexican steel surge is simply not happening, and the US steel industry has consistently maintained a significant trade surplus in finished products with Mexico. In 2023 alone, this surplus exceeded $3 billion.

The chairman of a large American steel company called for Mexico to be dropped from USMCA at a steel industry conference last week. This follows earlier calls from members of Congress to reinstate Section 232 duties on Mexico. How did we get to this point?

Demand has remained persistently weak across the globe for sheet steel, weighing on prices. US HR coil prices fell the furthest this week as high-volume, low-priced deals were transacted as mills looked to fill order books and competed with one another amid relative demand weakness. Meanwhile, European prices were also down due to low demand […]

Please enjoy this roundup of recent news from the aluminum industry from our colleagues at CRU. EU to hit Chinese electric cars with tariffs up to 48% The European Commission notified carmakers on June 12 that it would provisionally apply additional duties of 17-38% on imported Chinese EVs from next month. The duties will be […]

North American auto assemblies ticked higher in May, moving up for the second straight month and reaching a nine-month high, according to LMC Automotive data. While assemblies were up month on month (m/m), they are still 1.7% lower year on year (y/y).

As the scrap market for June settles at lowered levels, let’s look at the situation for exports of ferrous scrap from the US East and Gulf coasts. Despite declines in the North American ferrous markets over the last two months, export prices have remained range-bound within a tight trading window. After a brief decline last […]

Pig iron prices have been trending higher in all key markets besides Europe. Limited exports from Brazil and Ukraine are contributing to higher prices in the USA, though soft demand cushioned a sharp price upswing. In the US, pig iron prices increased by $15 per metric ton (mt) m/m to $485/mt CFR NOLA. Buying activity […]