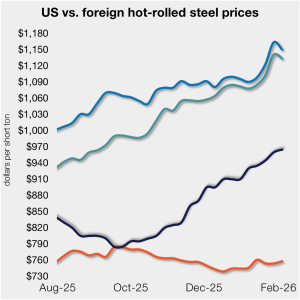

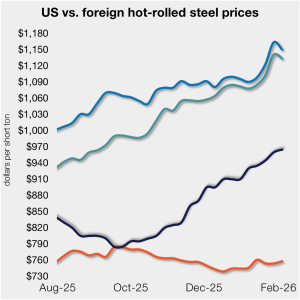

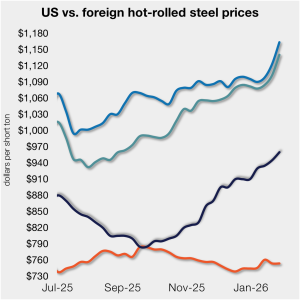

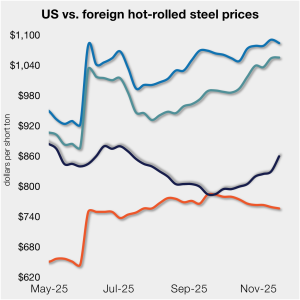

Spread between US HR prices and imports narrows

The price gap between US hot-rolled coil and landed offshore product narrowed this week, as price movements stateside and abroad diverged.

The price gap between US hot-rolled coil and landed offshore product narrowed this week, as price movements stateside and abroad diverged.

The price gap between US hot-rolled coil and landed offshore product inched higher, even as prices stateside and abroad mostly moved in tandem vs. last week.

Sheet prices mostly continued their uneven but steady march higher this week, according to SMU’s latest check of the market.

SMU’s sheet price indices climbed to new multi-month highs this week, while plate prices marginally declined.

Sheet prices are set to stay weak in China, hold steady in India, while they are set to rise in the EU and US due to protectionist limits on imports.

The galvanized steel market has kicked off the year with a firmer tone, marked by rising prices, lengthening lead times, and a noticeable shift in buyer sentiment. Service centers and distributors on HARDI’s latest sheet metal and coil handling council call described a market that is not overheating but steadily tightening.

The majority of SMU’s sheet and plate price indices rose this week, with multiple products climbing to new multi-month highs

Nucor’s consumer spot price (CSP) for hot-rolled coil remains unchanged at $950 per short ton (st) for the fourth consecutive week.

Sources in the domestic hot-rolled sheet market say they are standing by for an uptick in customer demand. These service center market participants, located in various regions of the US, expect to handle an influx of customer orders this month.

US Midwest sheet prices continued to rise alongside continued mill prices increases as lead times remained extended.

Sheet prices mostly ticked higher again this week. And the reasons shouldn’t come as a big surprise to anyone who has been reading SMU lately.

Participants in the domestic coil market hope producer price increases indicate strong market conditions entering the new year.

Less than half of the steel buyers who responded to our market survey this week reported that domestic mills are willing to talk price on new spot orders

ArcelorMittal Dofasco and Stelco are aiming to increase spot market base prices by a minimum of CA$100 per short ton (US$72/st), effective immediately.

The price gap between stateside hot band and landed offshore product shrank week over week (w/w).

Sheet prices are in the middle of one of their most sustained rallies since the first quarter, and this time in the absence of any tariff or trade policy shocks.

SMU’s price indices increased across the board this week, reaching new multi-month highs.

Most sheet prices inched up again this week following mill efforts to set a floor under tags and to increase them from there.

Atlas Tube, in a leading move, said it aims to increase prices for mechanical tubing, hollow structural sections (HSS), and piling products by at least $50 per short ton (st).

NLMK USA plans to increase prices for hot-rolled and cold-rolled coil by at least $50 per short ton (st). The move is effective immediately for all spot orders, the steelmaker said in a letter to customers on Friday.

SMU’s HR price stands at $800/st on average, up $5/st from last week. The modest gain came as the low end of our range firmed, and despite the high end of our range declining slightly.

Nucor has left its consumer spot price for hot-rolled coil at $875 per short ton for the eighth straight week.

SMU’s sheet and plate prices see-sawed this week as hot-rolled (HR) coil prices held their ground while prices for galvanized product slipped.

SMU’s latest survey results indicate that steel market participants think sheet prices are at or near a bottom. But most also think there is limited upside once they inflect higher.

Market participants predicted that prices should be at or near a bottom. But while most seemed to agree on that point, many also said they saw little upside given a quiet spot market and ongoing concerns about demand.

Half of the participants on this month's Air-Conditioning & Refrigeration Distributors International (HARDI) Sheet Metal/Air Handling Council call expect galvanized steel base prices to remain flat at ~$48 per hundredweight ($960/short ton) for the next 30 days.

Sheet prices were mixed this week as some mills continued to offer significant discounts to larger buyers while others have shifted toward being more disciplined, market participants said.

Nucor’s Dan Needham views the steelmaker’s flexibility and diversification as key to pivoting when economic conditions require.

Nucor is attempting to halt the decline in hot-rolled coil prices with the announcement of a $10-per-short-ton increase in its weekly consumer spot price on Monday.

Nucor has lowered its hot-rolled (HR) spot price by another $10 per short ton (st) this week.