Could we be looking at a weakness in June prices?

The chatter about the June ferrous scrap market has been noticeably muted as we come off the Memorial Day weekend.

The chatter about the June ferrous scrap market has been noticeably muted as we come off the Memorial Day weekend.

Sheet prices slipped again this week on a combination of moderate demand, increased imports, and higher import volumes.

Let's take a collective deep breath ::in:: and ::out::... And we're back. But where exactly are we? Are steel prices going up or down? Is demand really decelerating or is it an illusion? How is the market navigating the new mill pricing mechanisms?

Raw steel production in the US inched higher for a fourth consecutive week, the American Iron and Steel Institute (AISI) reported on Tuesday.

Prices for galvanized products have fallen from last month, and many market participants expect tags to continue their descent or at best remain flat in the month ahead.

Cleveland-Cliffs is potentially eyeing a buy of NLMK USA’s Midwest assets, according to a report in Bloomberg.

Nucor moved its published consumer spot price (CSP) up again this week.

The Biden administration recently announced tariffs on several products from China, including steel and aluminum. There has been much rejoicing over this move and there has been a great deal of support from the steel industry.

Nucor’s Consumer Spot Price (CSP), a legitimate mill offer price, is a potential disruptor to North American steel sheet commercial and procurement strategies. We will dive into the details of what we think the CSP is and why we believe it is a potential disruption to how the North American sheet market operates.

US drill rig activity eased further last week, receding to levels last seen at the start of 2022 according to the latest update from Baker Hughes

After achieving its 2030 greenhouse gas (GHG) emissions reduction targets well ahead of schedule, Cleveland-Cliffs Inc. has set new reduction goals.

Steelmaking raw material prices have moved in different directions over the past month, according to SMU’s latest analysis.

In conjunction with President Biden’s visit to Vietnam in September 2023, Vietnam’s government petitioned the US Department of Commerce (DOC) for “market economy” treatment. This would be a major trade concession, as DOC has recognized for years that Vietnam’s economy does not operate according to market principles. However, graduating Vietnam to market economy status would […]

Steel Market Update’s Steel Demand Index fell five points to a 12-month low and moving further into contraction territory, according to our latest survey data.

U.S. Steel has celebrated the launch and “operational readiness” of its direct reduced (DR)-grade pellet production facility in Minnesota.

Why have steel emissions policies forgotten about recycling? The short answer is that they haven’t. ResponsibleSteel was recently characterized in an article featured in the SMU Executive Newsletter as advocating for steel emissions policies which “discourage recycling.” In fact, ResponsibleSteel sees recycled scrap as playing a critical role in driving steel decarbonization. Recent revisions to […]

Here’s something I didn’t expect to see this week: SMU’s Current Buyers’ Sentiment Index dropped to its lowest point since August 2020.

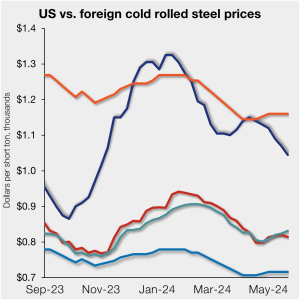

Offshore cold-rolled (CR) coil prices remain a cheaper option over domestic product, even as US CR coil prices tick lower, according to SMU’s latest check of the market.

Hot rolled buyers found mills less willing to negotiate spot pricing this week, while other products SMU tracks were mixed, according to our most recent survey data.

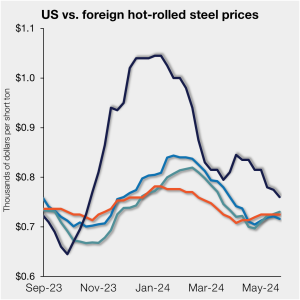

US hot-rolled (HR) coil prices declined again and now stand nearly even with offshore hot band on a landed basis.

Sideways and range-bound describes the US steel derivatives market over the past week, though the monthly picture shows a more notable decline in front-end flat prices. Week-over-week saw the June futures contract firm slightly, from $770 per short ton (st) to $780/st as of Thursday, May 23’s provisional close. However, the contract was down by […]

Venture Steel announced plans to expand its flat rolled processing facility in Ramos Arizpe, Coah., Mexico.

Steel Market Update will be taking time off in observance of Memorial Day.

Lead times on most steel products tracked by SMU held steady or contracted this week compared to two weeks earlier, according to our latest market survey.

SMU’s Steel Buyers’ Sentiment Indices both plummeted over 10 points this week, both hitting lows for 2024, according to our most recent survey data.

JSW Steel USA has rejoined the Steel Manufacturers Association (SMA).

Global steel output in April fell 3.1% from March’s 10-month high, according to World Steel Association’s (worldsteel) latest release.

From integrated to EAF, from hot-dipped galv to cold-rolled sheet, to the reputable vacuum tank degasser, the steel industry definitely has its own jargon. And we know our readers know that lingo backwards and forwards. Rather than test you on it, we thought we'd do something different.

Steel prices eased for both sheet and plate products this week, according to our latest canvass of the market

U.S. Steel’s board of directors has published a letter accusing Cleveland-Cliffs of a campaign of “misinformation” intended to “derail the transaction” of Japan’s Nippon Steel Corp. (NSC) to buy the Pittsburgh-based steelmaker. However, Cliffs has clapped back, with a release rebutting USS’ allegations.