Market Data

May 16, 2024

Foreign HR import appeal shrinks as US prices ease

Written by Brett Linton

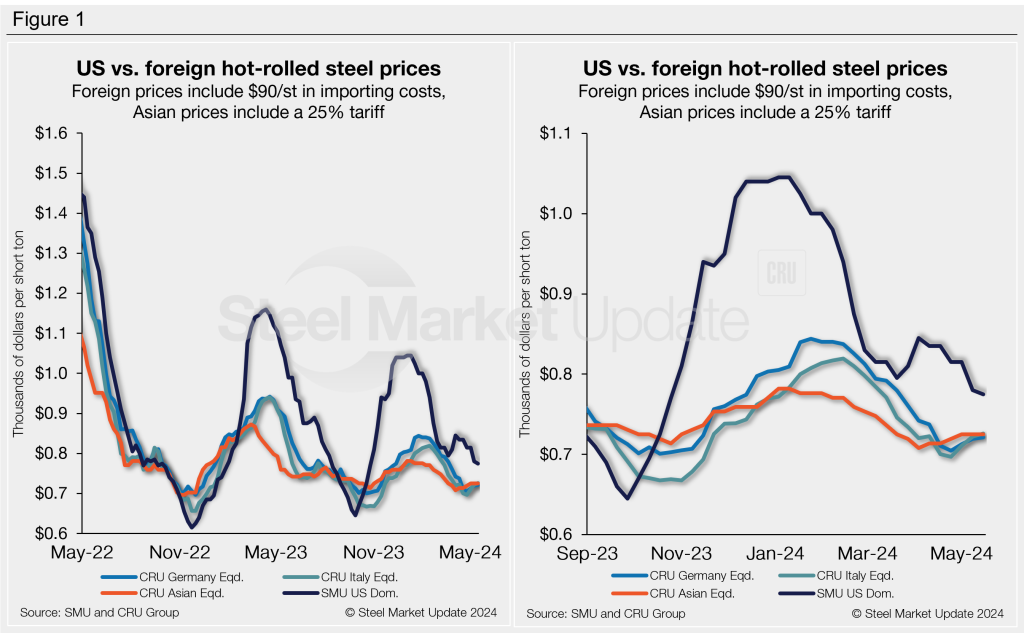

US hot-rolled (HR) coil prices saw further declines this week, while foreign prices were steady to slightly higher in the three regions we monitor. As a result, the competitiveness of foreign HR coil to US buyers continues to decrease.

On average, domestic HR prices are now just 6% more expensive than imported material. This theoretical foreign discount has been declining over the past five weeks, now over half of what it was one month ago but not quite as low as we saw back in March.

Recall that we saw significant foreign discounts towards the end of last year when imports from certain regions held a theoretical discount of nearly $300 per short ton (st). This discount rapidly diminished and nearly disappeared by March.

US HR coil is now $51/st more expensive on average than imported material. This rate is down $7/st week on week (w/w) and $76/st less than levels one month ago. Looking back to mid-March we saw average spreads of $40-49/st.

Figure 1 below compares HR price indices for various regions. The graph on the left shows a two-year snapshot, while the right graph zooms in on the last few months.

Methodology

In this theoretical analysis we compare SMU’s US HR coil weekly index to the CRU HR coil weekly indices for Germany, Italy, and East and Southeast Asian ports. We add $90/st to all foreign prices to account for freight costs, handling, and trader margin. This gives us an approximate CIF US ports price to compare against domestic prices. We do not include any antidumping (AD) or countervailing duties (CVD) in this analysis. Buyers should use our $90/st figure as a benchmark and adjust up or down based on their own costs. If you import steel and would like to share your experience with importing costs, please reach out to info@steelmarketupdate.com.

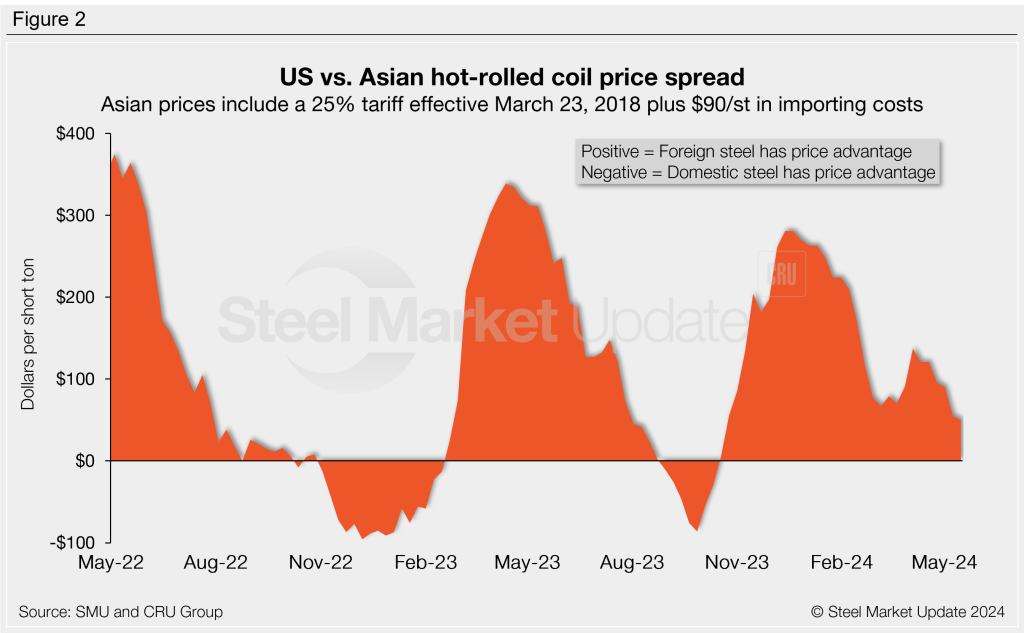

Asian HRC (East and Southeast Asian ports)

As of today, May 16, the CRU Asian HRC price held steady from last week at $508/st, one of the highest prices seen since late-March. Adding a 25% Section 232 tariff and $90/st in estimated import costs, the delivered price of Asian HRC to the US is approximately $725/st.

Based on SMU’s check of the market on Tuesday, domestic HR coil prices fell to $775/st on average this week, down $5 w/w.

Therefore, domestic HRC is theoretically $50/st or 6% more expensive than steel imported from Asia. This price gap is down $5/st w/w and now the narrowest spread seen in almost six months. Recall that Asian HR recently held potential discounts of $200/st or more in December and January.

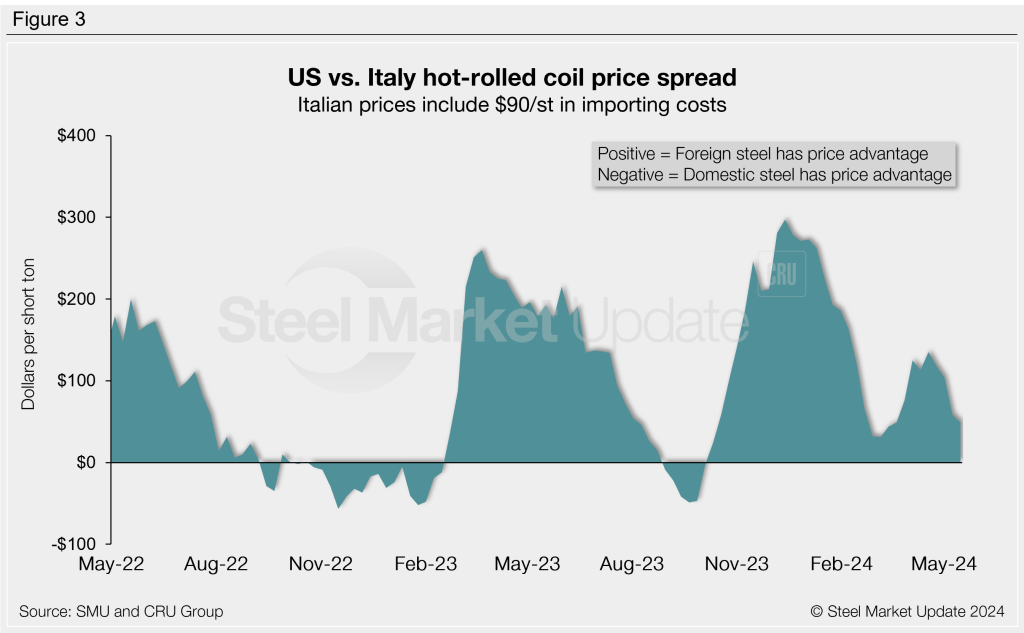

Italian HRC

Italian HR coil prices rose to a seven-week high of $636/st this week, up $4/st w/w. After adding import costs, the delivered price of Italian HR coil is in theory $726/st.

That means domestic HR coil is theoretically $49/st or 6% more expensive than steel imported from Italy, $9/st lower than last week. This spread has shrunk each of the past four weeks, following a 10-week high of $135 one month ago. Like the Asian spread, Italian prices had held a significant price advantage over US steel a few months ago, reaching a 22-month high of almost $300/st in mid-December.

German HRC

CRU’s German HR coil price rose $2/st from the week before to $631/st. After adding theoretical import costs, the delivered price of German HR coil is $721/st.

In theory, domestic HR coil is $54/st, or 7%, more expensive than HR coil imported from Germany. The spread is down to a seven-week low, having reached $124/st one month prior. Recall that just six months ago German HR coil held theoretical discounts of $265/st from domestic steel, a near two-year high.

Notes: Freight is important in deciding whether to import foreign steel or buy from a domestic mill. Domestic prices are referenced as FOB the producing mill, while foreign prices are CIF the port (Houston, NOLA, Savannah, Los Angeles, Camden, etc.). Inland freight, from either a domestic mill or from the port, can dramatically impact the competitiveness of both domestic and foreign steel. It’s also important to factor in lead times. In most markets, domestic steel will deliver more quickly than foreign steel.