Product

January 25, 2013

Hot Rolled Futures- Spot Down Futures Up

Written by John Packard

Written by: Andre Marshall, Crunchrisk

Financial Markets

The last of the obstacles to an improving economy, the debt ceiling and the spending cuts etc seem to be rolling over. The Republicans have cleverly put in a temporary debt ceiling increase covering us until May which will be after the budget talks in April and the Auto Spending Cuts in early May. This way there is no Quid Pro Quo discussion just a straight up discussion on each item. If the spending cuts go through in current form or another form, the temp debt increase will be all that’s likely needed.

As a result the markets have continued their climb. We have now broken that 1488 SP target we were looking for and now have resistance around 1546, which will be very tempting as we will only be 30 some points from all time highs. We are currently just under 1500 SP. Volatility is likely to pick up once we test that high and either go through it or don’t. From there we will likely test the June lows which was just above 1200. The highs test should transpire in the next 5 weeks.

Meanwhile Copper is stable at $3.66 and Crude is hovering either side of $96. Both fairly elevated levels in their range.

NYMEX HR

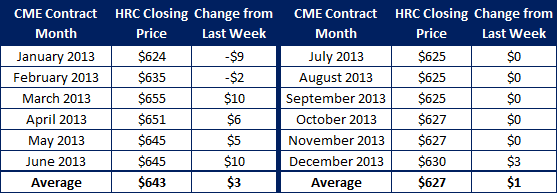

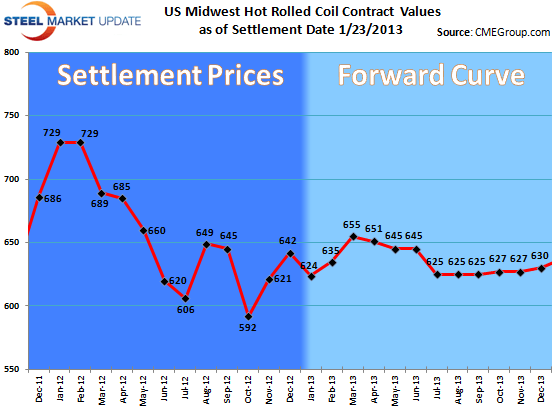

We have had another good week in futures as the front moths have been bid again. Feb has traded as high as $640’s, Mar as high as $656, and Q2 as high as low $640’s. We have had 1164 lots trade in the week or 23,280 ST. It might actually be close to a record. The back end of the forward curve has remained fairly steady either side of $630. The CRU spot index wooshed down to $605 capturing deals getting cut on the ground just as the mills came out with their price increase announcements. A similar pattern emerges to past cycles except that this time inventories are high and demand, ex auto, disappointing for Q1.

Iron Ore

The spot index came off from its highs the week prior from $158 area down to $145 area. We have since climbed a few dollars in the last few days as we get a bounce of that support for now. We are $148 zone right now. Forward curve remains backwardated with similar steepness to last week. We are either side of $139 on Mar and either side of $132 on Q2 working way into $115 zone beginning 2014.

Scrap

The Turkish market has gone quiet as their inventory replenishment appears to be over as discussed last week. This index which peaked at $409 when the high priced cargos were being lifted at $411-412 area CFR Turkey is now $401. The scrap supply from here has had some success switching to the Far East whose appetite and freight rates still worked. Net equivalent to the CFR Turkey market is a sideways to slightly dropping market. Chinese containerized still weak, Indian reappearing slowly.

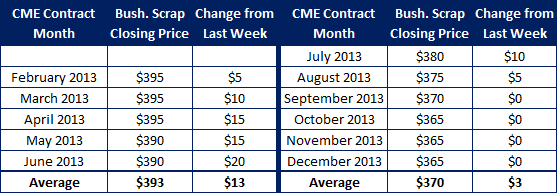

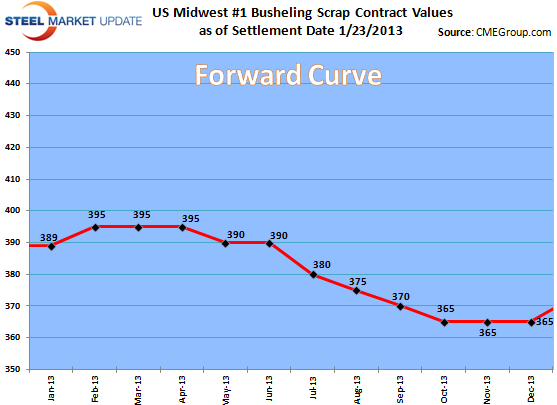

On the domestic front the BUS contract traded 30 lots this week all on screen. Last print of $395 to $390 for the first 4 months out have raised the settlement by $15 to $20. There have been some buying interest appearing on forwards in the Q2 and Q3 periods albeit below current settles. The price increase here on futures have gone contrary to positioning on the ground which looks like to be forming up to $20-30 down with some dealers already offered there and some mills positioning for down $30. Lead times at mills still inconsistent so hard to tell if demand will help from these deals cut on steel. Story on scrap flows hasn’t changed with higher than normal flows for both primes and secondaries in most zones.