Prices

February 11, 2014

December Steel Exports Decline

Written by Brett Linton

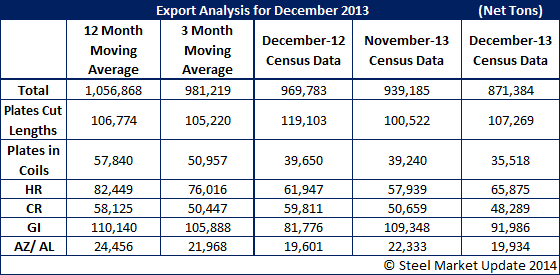

December 2013 U.S. exports for all steel products fell 7.2 percent over November to 871,384 net tons (NT). Compared to December of the previous year when total exports were 969,783 NT, December 2014 exports were down over 10.1 percent. December tonnage was below both the 3 and 12 month moving average (MMA). The primary countries that received steel exports for all products were Canada and Mexico.

Exports of plates cut lengths were 107,269 NT in December, up 6.7 percent from the previous month but down 9.9 percent from the same month one year ago. December tonnage exported was above both the 3MMA and 12MMA.

Plates in coils exports dropped 9.5 percent month-over-month (MOM) in December to 35,518 NT, and were also down 10.4 percent compared to December 2013 exports. Reported December tonnage was below both the 3MMA and 12MMA.

Exports of hot rolled sheet products were 65,875 NT in December, up 13.7 percent MOM and up 6.3 percent compared to December 2012 figures. However, hot rolled exports in December were below both the 3MMA and 12MMA.

Cold rolled exports dropped 4.7 percent MOM in December to 48,289 NT, and were down 19.3 percent over figures from the same month one year ago. Like hot rolled, cold rolled exports in December were below the 3MMA and 12MMA.

Galvanized exports came in at 91,986 NT in December, down 15.9 percent from November but up 12.5 percent from December 2012. Total December tonnage for galvanized exports was below both the 3MMA and 12MMA.

Exports of other metallic coated products, primarily Galvalume, were down 10.7 percent in December to 19,934 NT. This is an increase of 1.7 percent compared to the same month one year ago. December exports of other metallic coated steel in December were below both the 3MMA and 12MMA.