Prices

April 8, 2014

U.S. Steel Exports Show Mixed to Disappointing February Results

Written by Brett Linton

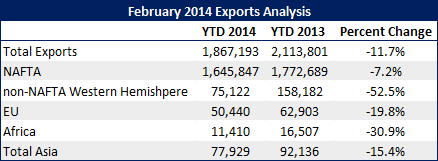

The American Institute for International Steel reported “February 2014 showed mixed to disappointing results for U.S. steel exports.” The following report is from an AIIS press release regarding exports of steel out of the domestic (US) mills during the month of February. Key to the data is NAFTA exports which, according to the AIIS, represent three-quarters of total steel exports out of the U.S. Here is the AIIS report:

A weaker result in February over January was particularly evident with respect to NAFTA exports, which represents about three-quarters of total U.S. steel exports. We saw a 9 percent drop in U.S. steel exports to Canada, and an almost identical 9.3 percent drop in U.S. steel exports to Mexico. One likely explanation is that by most accounts, during the mid-January through February time period, there was less steel moving in North America during one of the harshest winters the Midwest has seen in many years. In contrast, February over January U.S. steel exports to the EU did show a healthy gain of 13.3 percent, although February 2014 exports to the EU were down by nearly 25 percent compared to February 2013.

Mixed February over January 2014 export results were seen in Asia, with a modest 8.8 percent gain in U.S. steel exports to China, a nearly 50 percent decline to Korea, and a 14.4 percent increase to Singapore.

We are still hopeful that exports to our important NAFTA partners will improve significantly now that the weather will likely not be such an adverse factor in the Spring,” said Richard Chriss, AIIS Executive Director.

Total steel exports in February 2014 were 904 thousand tons compared to 963 thousand tons in January 2014, a 6.1 percent decrease, and an 12.8 % percent decrease compared to February 2013. According to year-to-date figures, exports decreased 11.7% compared to 2013 or from 2.114 million tons in 2013 to 1.867 million tons in 2014. (Source: American Institute for International Steel)