Prices

March 1, 2015

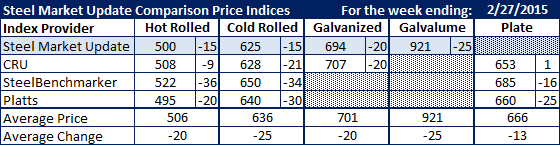

SMU Comparison Price Indices: Double Digit Drop

Written by John Packard

Virtually all flat rolled steel products indexed by the steel indices followed by Steel Market Update saw steel pricing decline by double digits and, in most cases, the erosion in pricing on hot rolled, cold rolled, galvanized and coated was at least $20 per ton ($1.00/cwt).

First an observation, as we watch the weekly price adjustments, we have become aware of the differences we see in pricing and price movement for those indexes that produce prices weekly versus SteelBenchmarker which only produces prices twice per month. It seems as though SteelBenchmarker has been unable to keep pace with the almost daily changes in pricing. We are unsure as to the reason other than they only look at U.S. prices two times and do not watch pricing during the rest of the month.

This past week is a good example. All of the indexes see hot rolled prices as being very close to $500 per ton. The only exception is SteelBenchmarker at $522 per ton.

We see similar inconsistencies in the other products identified in the table below.

Separate from the SteelBenchmarker issue, the bottom line for those of you buying or selling steel: flat rolled pricing continues to weaken and the benchmark hot rolled coil average breaking through $500 seems to be a foregone conclusion.

We are hearing of resistance at $460-$470 per ton on hot rolled as domestic mill numbers at that level are equal to or in some cases better than new orders for foreign steel import. SMU believes it is important for the domestic mills to keep the price spread between domestic and foreign imports as low as possible over an extended period of time in order to break the flood of imports we have seen over the past 6 to 9 months.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.