Market Segment

February 18, 2016

US Service Center Flat Rolled Inventories Moving Closer to "Balanced"

Written by Brett Linton

The Metal Service Center Institute (MSCI) released shipment and inventory data for U.S. steel distributors this week. The headline for total steel products is shipments rose from December to January by 275,200 tons or 9.9 percent, but were still 470,400 tons or 13.3 percent below levels from one year ago.

U.S. steel service centers shipped a total of 3,053,200 tons during the 20 shipping days in January, up from 2,778,000 tons shipped in December with 2 additional shipping days. Compare this to January 2015 shipments of 3,523,600 tons with 21 shipping days.

Total inventories ended the month at 7,954,700 tons, and based on the daily shipment rate of 152,700 tons per day, the month ended with 2.6 months worth of inventories on the floors of the service centers. The 2.6 months supply figure is down from 3.0 months reported at the end of December and better than the 2.8 months in January 2015.

From SMU’s perspective the 2.6 months is probably pretty close to a balanced situation for this time of year (all products, USA only).

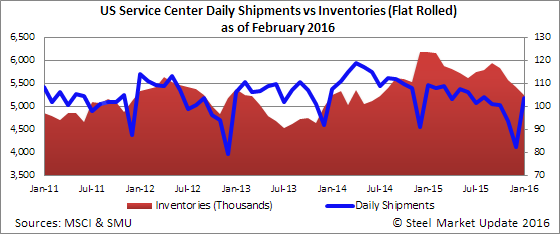

Flat Rolled

U.S. flat rolled distributors shipped 2,071,500 tons of sheet and coil products or an average of 103,600 tons per day. This us up 14.4 percent over last month but down 9.8 percent over levels one year ago. Flat rolled inventories stood at 5,241,100 tons as of the end of January, down 3.2 percent from December and down 15.1 percent from January 2015. Months of supply was reported to be 2.5 months, down from 3.0 months in December and down from 2.7 months in January 2015.

SMU Premium Forecast Results for January

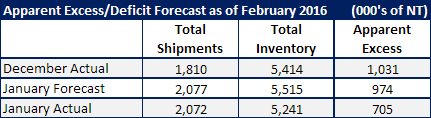

![]() Every month SMU produces a shipment forecast for our Premium level subscribers. Last month we forecast flat rolled shipments would be 2,077,000 tons. Our forecast called for daily shipments to be 5 percent lower than the previous year, or 103,835 tons per day. We hit the nail on the head for the second month in a row as January daily shipments were 103,600 tons per day.

Every month SMU produces a shipment forecast for our Premium level subscribers. Last month we forecast flat rolled shipments would be 2,077,000 tons. Our forecast called for daily shipments to be 5 percent lower than the previous year, or 103,835 tons per day. We hit the nail on the head for the second month in a row as January daily shipments were 103,600 tons per day.

When it came to inventories of flat rolled products, we originally forecast total inventories would rise in January to 5,515,000 tons. Inventories actually declined from December to January to 5,241,000 tons. This resulted in a much greater decline in our Apparent Excess figure, to 705,000 tons of excess steel. We will go into greater detail as to what this means and we will provide our updated forecast for February, March, April, May and June to our Premium members on Friday.

Carbon Plate

U.S. service centers shipped 267,100 tons of plate during the month of January, up 2.6 percent over December shipments but down 26.1 percent over levels one year ago. Plate inventories stood at 739,500 tons which is 12.7 percent lower than last month and 43.3 percent lower than one year ago levels. Based on the current shipping rate of 13,400 tons per day the distributors have 2.8 months of supply on hand, down from 3.3 months in December.

Pipe & Tube

Distributors shipped 190,600 tons of carbon pipe & tube during the month of December, down 1.2 percent from December and down 16.4 percent over January 2015 shipments. Inventories of pipe & tube stood at 575,300 tons, down 2.2 percent over last month and down 14.6 percent over one year ago. Pipe and tube months on hand remained the same at 3.0 months supply.