Prices

May 6, 2018

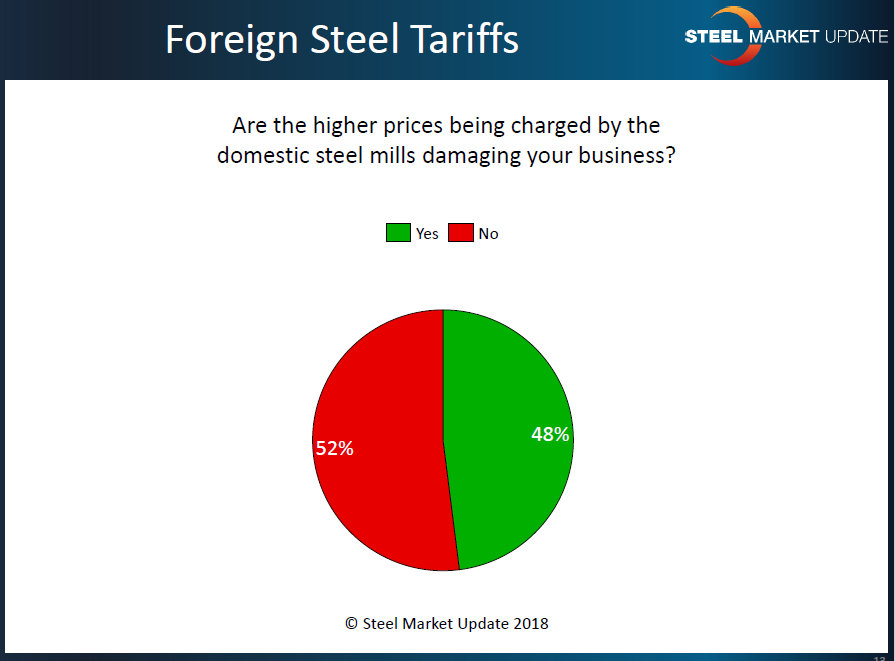

SMU Survey: Steel Prices Damaging to Your Business?

Written by John Packard

Last week Steel Market Update conducted our early May 2018 flat rolled and plate steel market trends survey. We sent invitations to 640 individuals representing approximately 620 companies mostly located in the United States and Canada. The purpose of our inquiries is to better follow various trends affecting the flat rolled and plate markets. We look for trends in pricing, sentiment, demand, supply, negotiations, spot prices out of service centers, foreign steel and many others. We also ask about issues of the day – those that may only exist for a short while before being replaced by another pressing issue. Last week we inquire as to what damage was being done to your business, if any, by the higher domestic steel mill spot prices.

What we found was a split market – 48 percent reported their company as being damaged while 52 percent said no damage was being done.

Here are some of the many comments left behind from our question: “Are higher prices being charged by the domestic steel mills damaging to your business?”

“Sure they are. Our customer base does not accept price increases and they have the clout to say no. We work off of tight margins so if we can’t pass at least some of the increases on then, of course, it is changing our business. We have to begin looking at how we make up for the downside which usually means jobs.” Manufacturing company

“The competition is undercutting market prices. For what reason, I have no idea.” Service center

“Not yet, but it will slow construction down. With the mills greed and the transportation chaos prices are going to keep going up.” Manufacturing company

“We have experienced delays in order receipt due in part by higher steel prices.” Manufacturing company

“OEM’s are struggling passing increases along.” Service center

“We need prices high to make imports competitive. My customers are passing on increases to their final customers so far.” Trading company

“Actually a godsend for our business.” Trading company

“Some projects went on hold waiting on the prices to come down.” Manufacturing company

“The higher prices aren’t damaging us yet, but if the mills allow for any price erosion, I fear what it could do to our inventory values.” Service center

“Two of my customers are in China currently negotiating steel parts shipments. So much for level playing field; whack-a-mole just moved downstream. The backbone of U.S. manufacturing; small to medium size businesses; do not have the money to lobby in our favor. That is why many businesses will not join the Steel Manufacturers Association. Backed the U.S. Steel mills; however, nil heard on steel parts moving overseas.” Manufacturing company

“Difficult to compete with Chinese or Taiwanese finished products.” Manufacturing company

“Some projects have been put on hold.” Toll processor

“It is driving production of some finished goods off shore which reduces the tons available to be sold by service centers in the US.” Service center