Prices

September 16, 2018

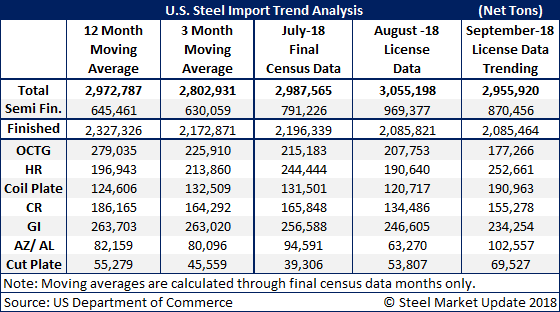

Finished Steel Imports Clearly Moving Lower

Written by John Packard

Earlier last week, the U.S. Department of Commerce released the latest foreign steel import license data for the months of August, and the new data for September. The August number suggests the month will come in around 3 million net tons, which is higher than July as well as the 3-month and 12-month moving averages. When digging down into the August number, we see that almost one-third of the total imports were semi-finished steels (mostly slabs). When comparing finished steels (removing semi’s), the August number is clearly lower than July as well as the 3MMA and 12MMA.

The September trend is still early with the numbers running somewhat in line with what we saw for August. SMU believes we should wait another week to see how the licenses come in and then compare those numbers against the last few to see if the trend is any different.