Market Data

September 2, 2020

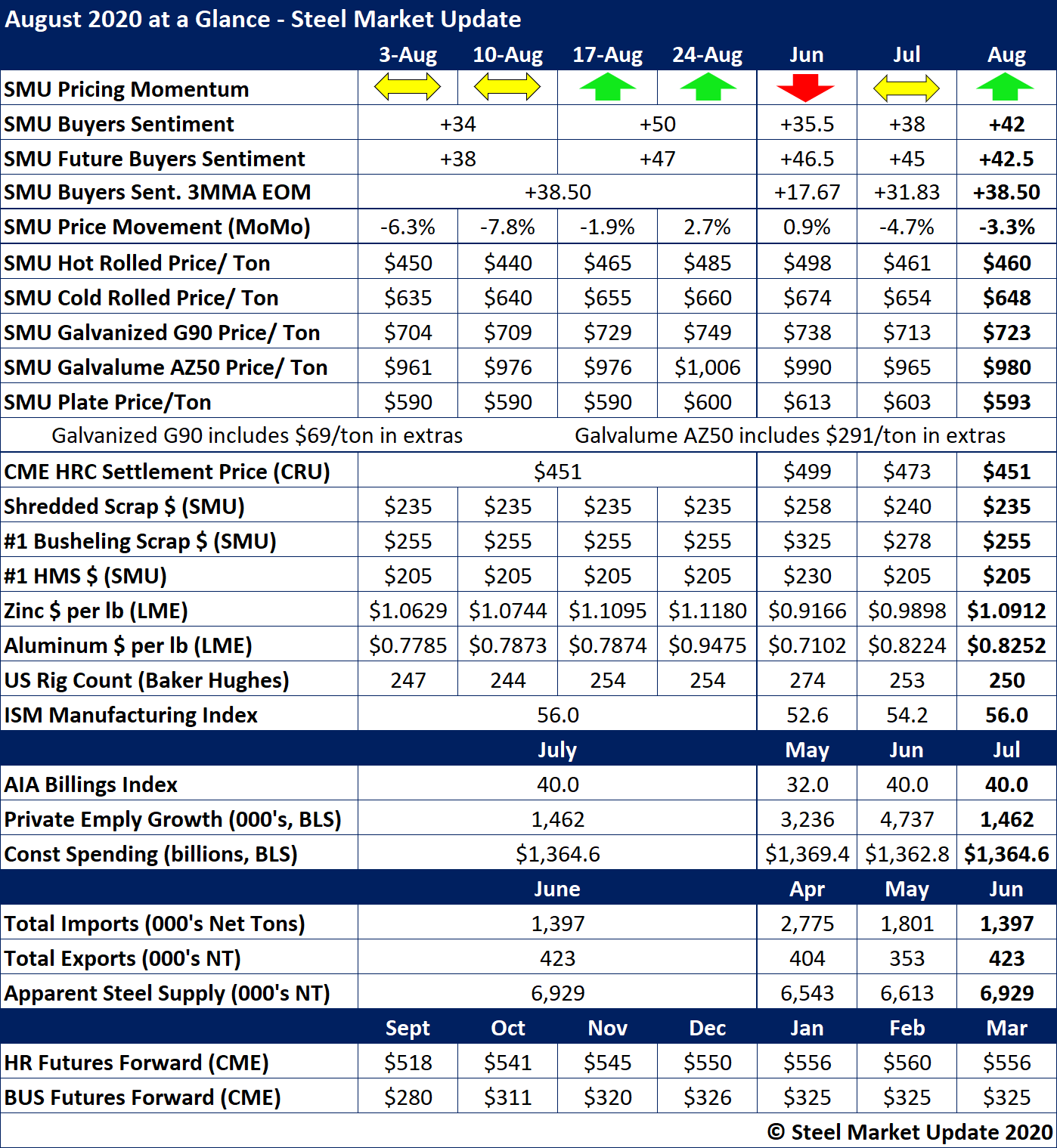

SMU's August At-a-Glance

Written by Brett Linton

Steel prices gained momentum in August as demand improved and the mills announced a new round of price increases. As of last week, Steel Market Update’s hot rolled price average had risen to $485 per ton, up $45 in just two weeks from the mid-month low, and has since topped the $500 mark. Scrap prices were flat to slightly down from July to August. SMU adjusted its Price Momentum Indicator from Neutral to Higher on Aug. 20.

SMU Buyers Sentiment Index readings further recovered, with Current Sentiment reaching +50 at the end of August. Future Sentiment ended the month at +47, while the three-month moving average reached +38.50 as of Aug. 21, the highest 3MMA seen in 20 weeks. Note that monthly sentiment readings in the chart below are averages for each month.

Key indicators of steel demand were mixed; the AIA Billings Index remained steady at 40.0, and private employment increased, albeit at a lesser rate compared to previous months. Construction spending increased in July but remained below May figures. The latest data on total steel imports showed a decline in June, while exports and apparent steel supply both increased.

See the chart below for other key metrics in the month of August: