Market Segment

September 22, 2020

HARDI Members Wonder: How High Can Galv Go?

Written by Tim Triplett

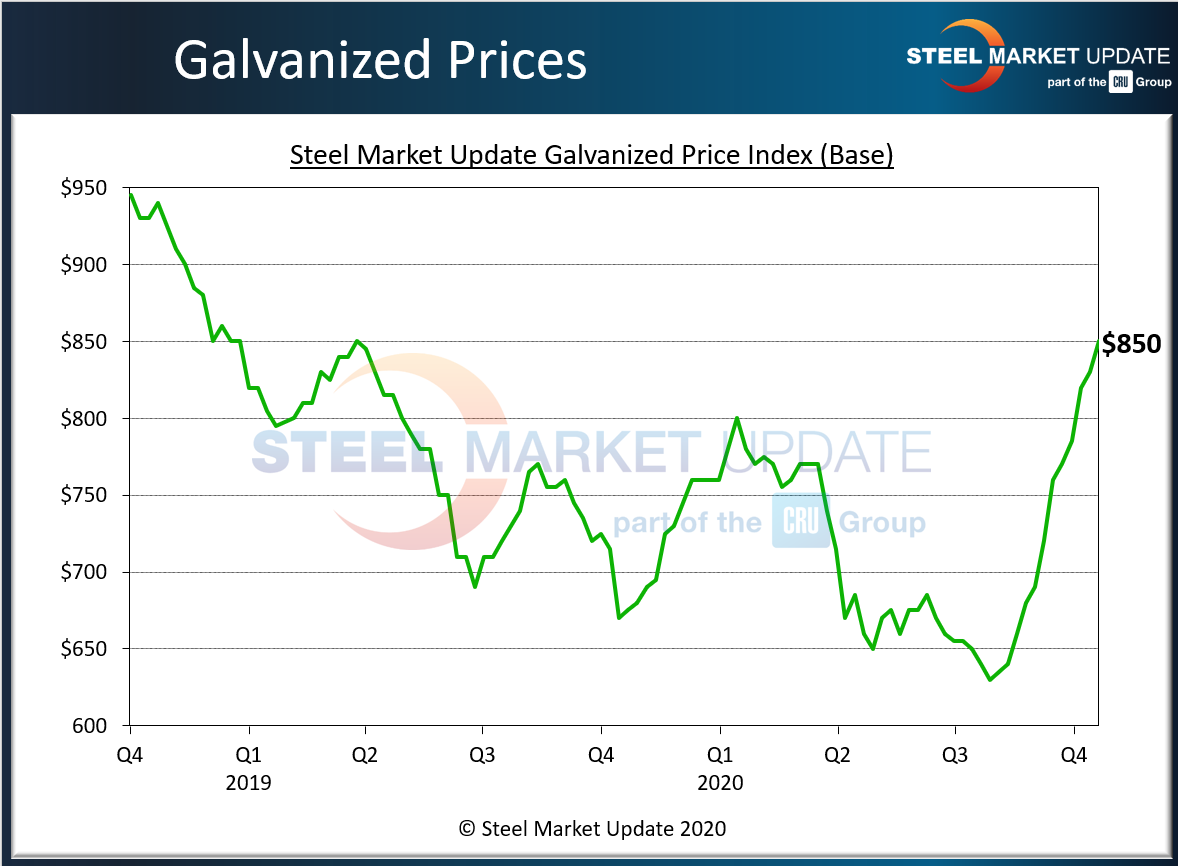

Galvanized steel prices have skyrocketed by more than $200 per ton since August, leaving wholesalers who serve the HVAC market to wonder how much higher the price can possibly go before it begins to cut into demand. On a conference call this morning, members of the Heating, Air Conditioning & Refrigeration Distributors International (HARDI) said they expect demand and pricing to remain strong into the first quarter next year, but they expressed concern about the long-term prospects for nonresidential construction.

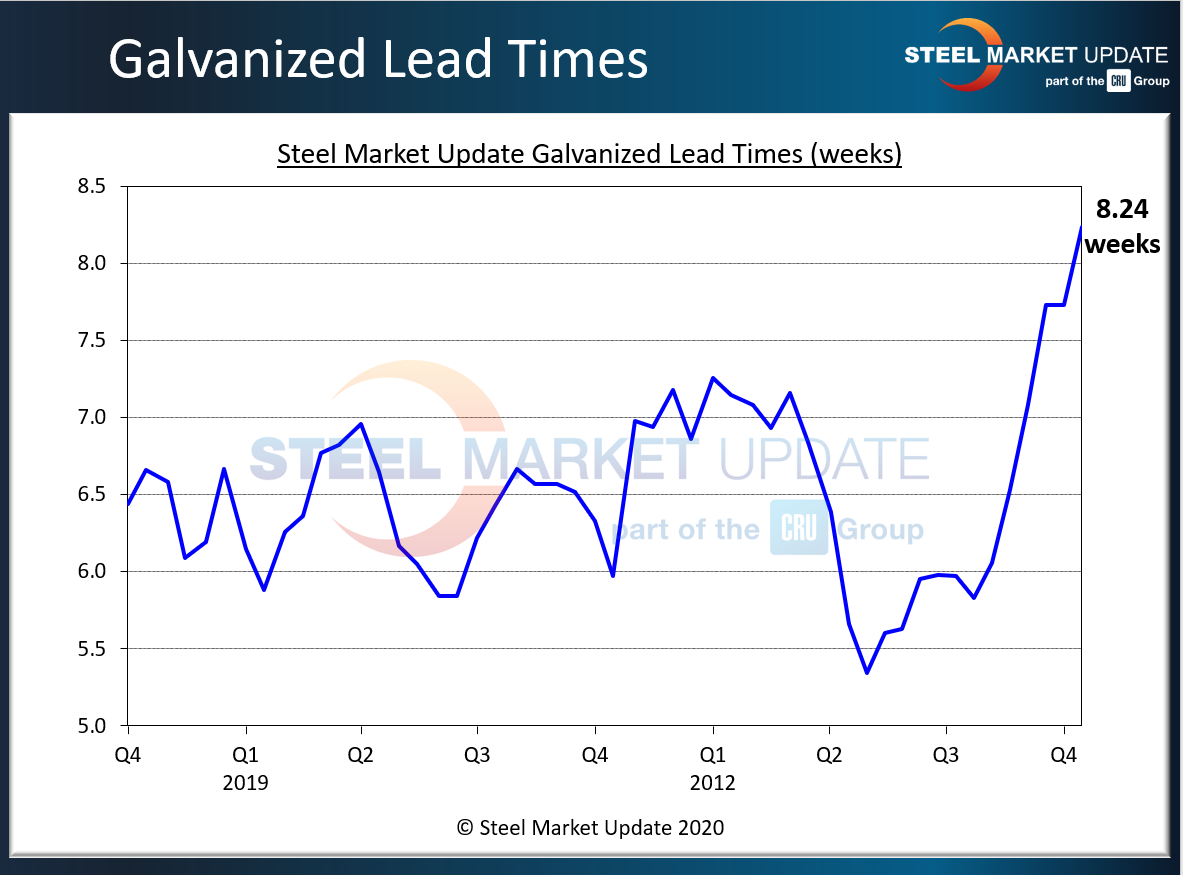

Steel supplies remain tight as the mills are slow to bring back idled capacity, lead times extend, scrap prices are up, and inventories and imports are near historic lows—all factors that promote higher steel prices. “A price of $42.50/cwt is a legitimate number now for galv. The question is how long it will last,” said one executive on the call.

John Packard, president and publisher of Steel Market Update, noted that lead times for spot orders of galvanized steel have extended to more than eight weeks and the galvanized price has hit a lofty $850 per ton and climbing.

The tight steel supplies are due to loosen, though, starting with increased production from Big River Steel, which is expected to begin delivering flat roll from its newly expanded Arkansas mill in November or December. U.S. Steel may try to close the deal to buy the remainder of BRS soon, possibly even this year, Packard said.

Pointing to SMU’s Steel Buyers Sentiment Index, now at a bullish +68, Packard added: “Buyers and sellers in the steel industry are very optimistic about their businesses right now. The market is strong enough now that the mills don’t even have to announce a price increase in order to get one.”

Comments from most of the HARDI members reflect a fairly positive outlook:

“From a pricing standpoint, the pace and degree of the increase is greater than we anticipated. I thought $40/cwt might be a resistance level, but we have busted through that mark.” Nevertheless, soft demand in August has been offset by strength in September and October, “and we expect a solid finish to the year.”

“On the supply side, the tone from the mills regarding 2021 contract negotiations has been a lot firmer. They are definitely pushing prices higher, reducing discounts, increasing minimums. But steady demand in the spot market should keep activity going into Q1.”

“Customers see prices going up and are adding inventory on the buy side. Demand is strong on the sell side, though commercial construction is on an EKG right now—down one week, up the next. Residential construction is seeing continued momentum, though, and we are going to ride that wave.”

“We did increase inventories in August and September, but with prices as high as they are now, we have taken our foot off the gas. That, along with increased sales, has gotten inventories back to normal.”

The outlook for nonresidential construction, a big HVAC market, is worrisome for some members of the trade group:

“I am concerned about Q1. Our business is heavy in commercial construction and the ABI (Architecture Billings Index) has me worried.” The American Institute of Architect’s ABI is an economic indicator of nonresidential construction activity with a lead time of 9-12 months. The ABI for September was improved, but still registered 47.0, below a reading of 50 or more that indicates growth.

“Prices have gone up rapidly. I am hearing $44-45/cwt ($880-900 per ton) from the mills and they are getting it. I expect prices to creep up through the first quarter. A lot depends on the election and COVID. Freight issues in 2021 will have an influence on the total price.”

“Q1 will be questionable. We see our business, which is more commercial than residential, flat through Q1 and starting to pick up in the second quarter next year. Not bad, but our steel prices costs up.”

“It’s hard to look past the preponderance of forecasters who see pain ahead for nonresidential construction. I am still optimistic, but I think it will be more of a slog than we are used to, with less room for error.”

Based on a poll of the HARDI members on the call, most see galvanized steel prices increasing further in the next 30 days, but declining in the next six months. All the respondents expect the market to add $1-2/cwt or another $20-40 per ton by this time next month, taking the price to $870-890. Six months from now, the majority on the call predict a correction of $2-4/cwt or $40-80 per ton, with prices beginning to fall as early as the first quarter.

Steel Market Update participates in a monthly steel conference call hosted by HARDI. The call is dedicated to a better understanding of the galvanized steel market. The participants are HARDI member companies are wholesalers who supply products to the construction markets, also on the call are service centers and manufacturing companies that either buy or sell galvanized sheet and coil products used in the HVAC industry and are suppliers into the HARDI member companies.