Prices

November 12, 2020

U.S. Steel Exports Recover Further in September

Written by Brett Linton

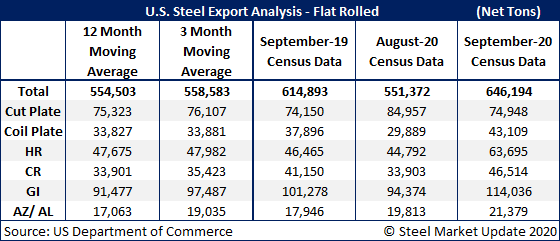

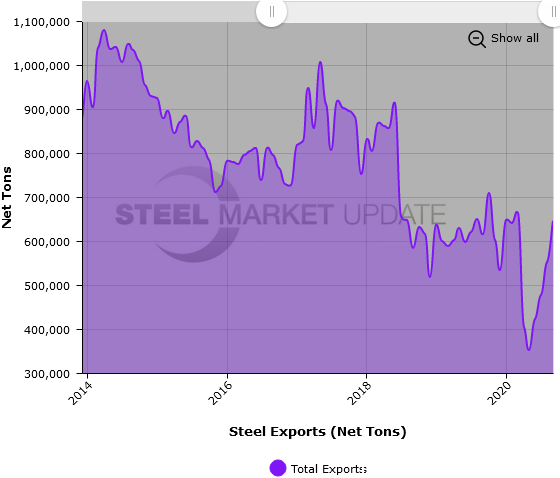

U.S. steel exports continued to recover in September, rising 17 percent from August to 646,194 net tons, according to recent U.S. Department of Commerce data. Total September exports are up 83 percent compared to four months prior, when May exports were at the lowest levels seen in SMU’s 24-year data history. Total September exports are up 5 percent from levels one year ago, the first year-over-year increase seen since March 2020.

The 2020 monthly average for exports has now increased to 534,000 tons, still well below the average for 2019 of 616,000 tons.

Total September exports were above both the three-month moving average (average of July through September 2020) and the 12-month moving average (average of October 2019 through September 2020). Here is a detailed breakdown by product:

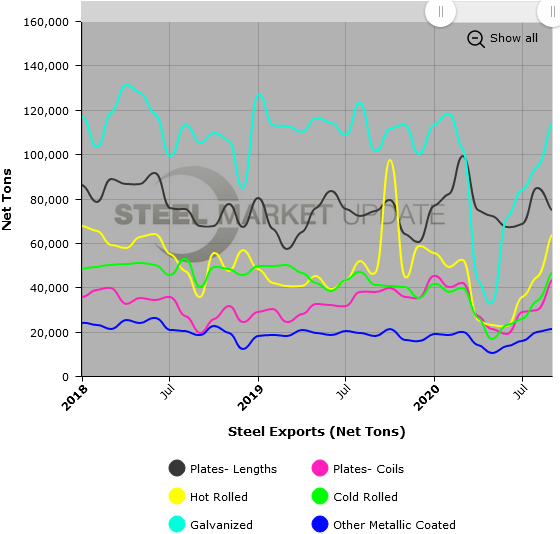

Cut plate exports were down 12 percent from August to 74,948 tons, up 1 percent compared to one year ago.

Exports of coiled plate were 43,109 tons in September, up 44 percent over last month, and up 14 percent year over year. Prior to September, the last time coiled plate exports were this high was January 2020.

Hot rolled steel exports rose 42 percent over August to 63,695 tons, up 37 percent from September 2019. The last time hot rolled exports were this high was October 2019.

Exports of cold rolled products were 46,514 tons in September, up 37 percent from August, and up 13 percent over the same month last year. Cold rolled exports are now at a 13-month high.

Galvanized exports increased 21 percent month over month to 114,036 tons. Compared to levels one year ago, September is up 13 percent. The last time galvanized exports were this high was February 2020.

Exports of all other metallic coated products were 21,379 tons, up 8 percent from August and up 19 percent compared to one year ago. Exports of other metallic coated products are now at a 23-month high.

Below are two graphs showing the history of U.S. steel exports through September data, in total and by product. To use their interactive features and see a longer history, view the graphs on our website by clicking here. If you need assistance logging into or navigating the website, contact us at info@SteelMarketUpdate.com.