Market Data

March 4, 2021

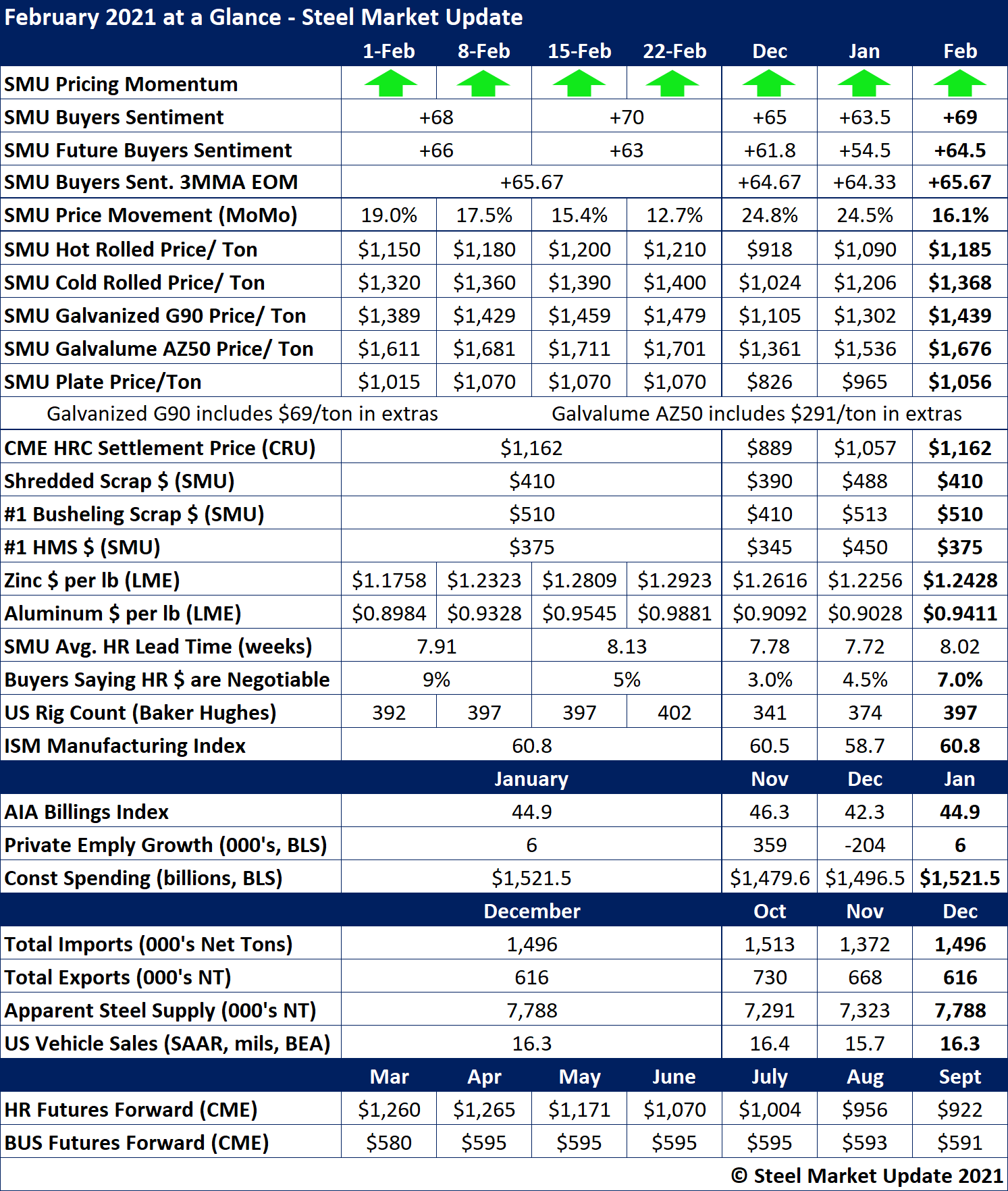

SMU's February At-a-Glance

Written by Brett Linton

Steel prices continued their upwards climb in the month of February, fueled by strong demand and tight supply. Hot rolled steel prices surpassed $1,200 per ton in the third week of the month, reaching levels never before seen. Steel Market Update’s hot rolled price index reached $1,210 per ton by the end of February, up $60 per ton from the beginning of the month and up $200 from the beginning of the year. The SMU Pricing Momentum Indicator has remained unchanged since the August 2020 adjustment to Higher, indicating prices are expected to rise further in the short term.

February busheling scrap prices were stable, while HMS and shredded scrap prices declined by $75 per ton compared to January. Both zinc and aluminum prices rose throughout the month, increasing 10% and 11%, respectively, from Feb. 1 to Feb. 28.

The SMU Buyers Sentiment Index remained optimistic, ending the month at +70, the highest reading since May 2018. The three-month moving average reached +65.67 as of Feb. 18, the highest reading since July 2018.

Hot rolled lead times extended further, reaching 8.13 weeks, while the percentage of buyers reporting that mills are willing to negotiate on HR prices ended the month at just 5%.

Key indicators of steel demand overall remained positive. The ISM Manufacturing Index indicated further expansion in the economy for the ninth consecutive month, and the AIA Billings Index continued to recover. Construction spending increased each month through January. Total U.S. steel imports and apparent steel supply both increased from November to December, while total exports declined.

See the chart below for other key metrics in the month of February:

By Brett Linton, Brett@SteelMarketUpdate.com