Prices

March 24, 2022

Hot Rolled Futures: Big Spike in Metallics Pushes Ferrous Prices Higher

Written by Jack Marshall

The following article on the hot rolled coil (HRC), scrap and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Hot Rolled

The Ukraine/Russia war continues to fester, leaving all markets with maximum uncertainty. HR physical prices have risen just over $300/ST in the last four weeks as measured by the indexes. We have seen an unprecedented week-to-week index increase this month with physical prices jumping over $180/ST. In HR’s previous move up from the mid $400/ST to the recent peak at almost $1,940/ST, the largest single monthly change in the index was just under $180/ST. The HR futures market has been caught off guard by the velocity of the price moves due to the conflict.

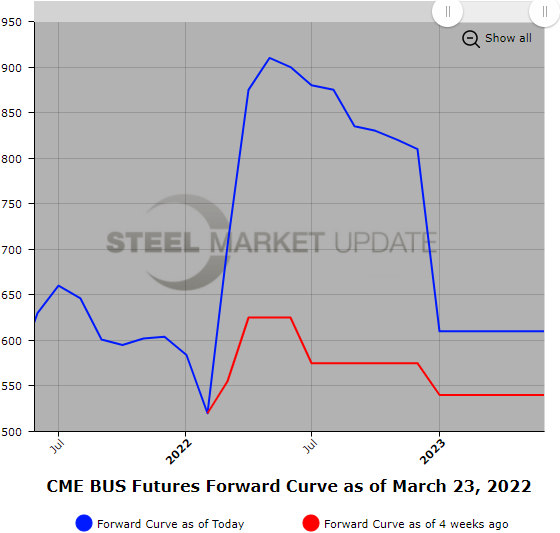

The Mar’22 HR future price reflects a potential $465/ST price increase over the last four weeks. The Q2’22 HR period settlements today reflect further upward price pressure as they are up over $585/ST from settlements four weeks ago. Market volatility has helped pushed initial margins for HR futures to record highs. Global supply disruptions of numerous commodities including food have yet to be divined. HR futures activity, which initially was busy, has receded somewhat as short market positions have been covered. The forward curve has a steeper backwardation beyond May/June than a month ago. Only $20/ST separated the Q2’22 versus the Q4’22 HR average price values versus today at $58/ST.

Below is a graph showing the history of the CME Group hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact us at info@SteelMarketUpdate.com.

Scrap

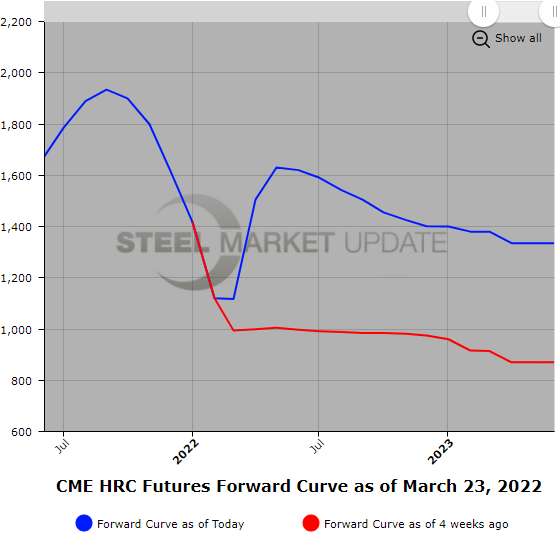

Metallics topped HR for volatility. BUS prices spiked higher as an expected supply pinch of Black Sea basic pig iron rippled through global steel markets, and prices of Brazilian pig iron spiked to $1,000/ton CFR U.S. port. In addition, 80/20 export prices also received a price boost from the metallics supply shortages. The Mar’22 BUS settlement price exploded higher, jumping $182/GT from Feb’22 BUS settlement. Q2’22 BUS futures average price settled at $625/GT four weeks back, and today it will settle at an average of $895/GT, a nice $270/GT jump. Market chatter has Apr’22 BUS rising another $100/GT, but that will likely change before we even get into April given these uncertain times.

Below is another graph showing the history of the CME Group busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here.