Prices

October 25, 2022

SMU Price Ranges: Anyone See a Floor?

Written by Michael Cowden

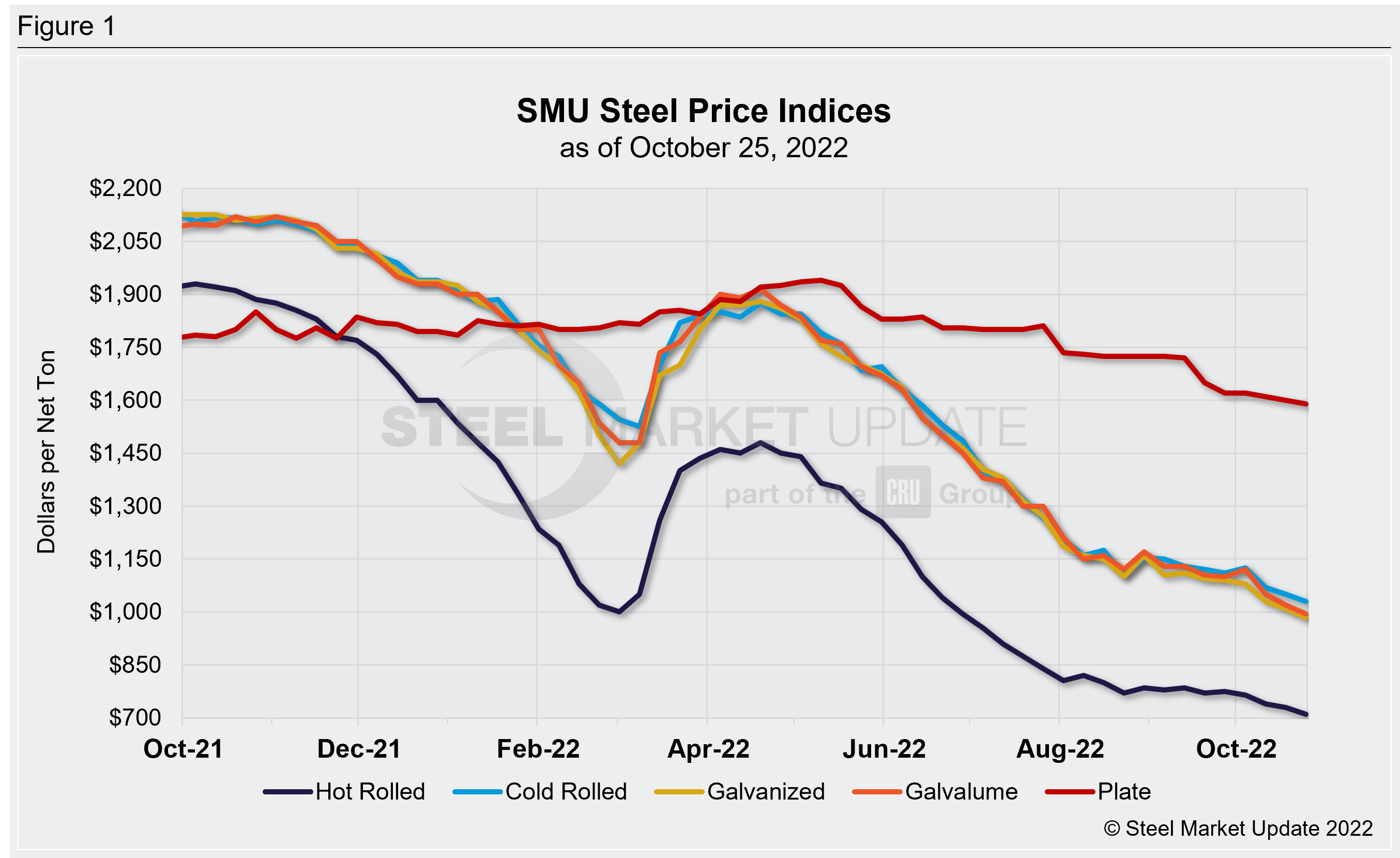

Domestic sheet prices slipped again this week across all sheet and plate products. It’s the continuation of a mostly downward trend on the sheet side that we’ve seen since mid/late April.

Hot-rolled, cold-rolled and coated products were all down $20–25 per ton ($1–1.25 per cwt). Plate prices slipped a more modest $10 per ton.

SMU’s average hot-rolled coil price now stands at $710 per ton, the lowest point since early November 2020 — nearly two years ago.

The difference between now and then? In November 2020, demand was rebounding from the depths of the pandemic amid low inventories. It was clear to anyone looking at the fundamentals that prices had nowhere to go but up — it was just a question of how high.

Now, opinion is more varied. Some market participants expect the slide to continue as integrated mills, electric arc furnace (EAF) producers and imports all grapple for market share by lowering prices. (Our understanding is that there are import offers in the low $600s per ton from both Asian and European mills.)

But others caution against complacency that prices will remain on a downward trajectory. They reason that the trend of lower prices could reverse as lead times get closer to the typically stronger first quarter — especially should a strike, lockout or unplanned outage catch the market by surprise. Some also suggested that infrastructure spending could surprise to the upside.

SMU is in the meantime keepings all its price momentum indicators pointed toward Lower. We don’t disagree that prices could inflect higher before year end. But we see few signs of that happening soon.

Hot-Rolled Coil: SMU price range is $660–760 per net ton ($33.00–38.00/cwt) with an average of $710 per ton ($35.50/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $40 per ton compared to one week ago, while the upper end remained unchanged. Our overall average is down $20 per ton from last week. Our price momentum indicator on hot-rolled steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Hot-Rolled Lead Times: 3–6 weeks* (preliminary ranges from our ongoing market survey, final lead times data will be released on Thursday)

Cold-Rolled Coil: SMU price range is $1,000–1,060 per net ton ($50.00–53.00/cwt) with an average of $1,030 per ton ($51.50/cwt) FOB mill, east of the Rockies. The lower end of our range remained unchanged compared to last week, while the upper end decreased $40 per ton. Our overall average is down $20 per ton from one week ago. Our price momentum indicator on cold-rolled steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Cold-Rolled Lead Times: 4–6 weeks*

Galvanized Coil: SMU price range is $940–1,030 per net ton ($47.00–51.50/cwt) with an average of $985 per ton ($49.25/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $10 per ton compared to one week ago, while the upper end decreased $40 per ton. Our overall average is down $25 per ton from last week. Our price momentum indicator on galvanized steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,037–1,127 per ton with an average of $1,082 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4–6 weeks*

Galvalume Coil: SMU price range is $940–1,050 per net ton ($47.00-52.50/cwt) with an average of $995 per ton ($49.75/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $50 per ton compared to last week, while the upper end remained unchanged. Our overall average is down $25 per ton from one week ago. Our price momentum indicator on Galvalume steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,234–1,344 per ton with an average of $1,289 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 4–7 weeks*

Plate: SMU price range is $1,560–1,620 per net ton ($78.00–81.00/cwt) with an average of $1,590 per ton ($79.50/cwt) FOB mill. The lower end of our range decreased $20 per ton compared to one week ago, while the upper end remained unchanged. Our overall average is down $10 per ton from last week. Our price momentum indicator on steel plate points to Lower, meaning we expect prices to decrease over the next 30 days.

Plate Lead Times: 2–5 weeks*

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.

By Michael Cowden, Michael@SteelMarketUpdate.com