Market Data

June 4, 2023

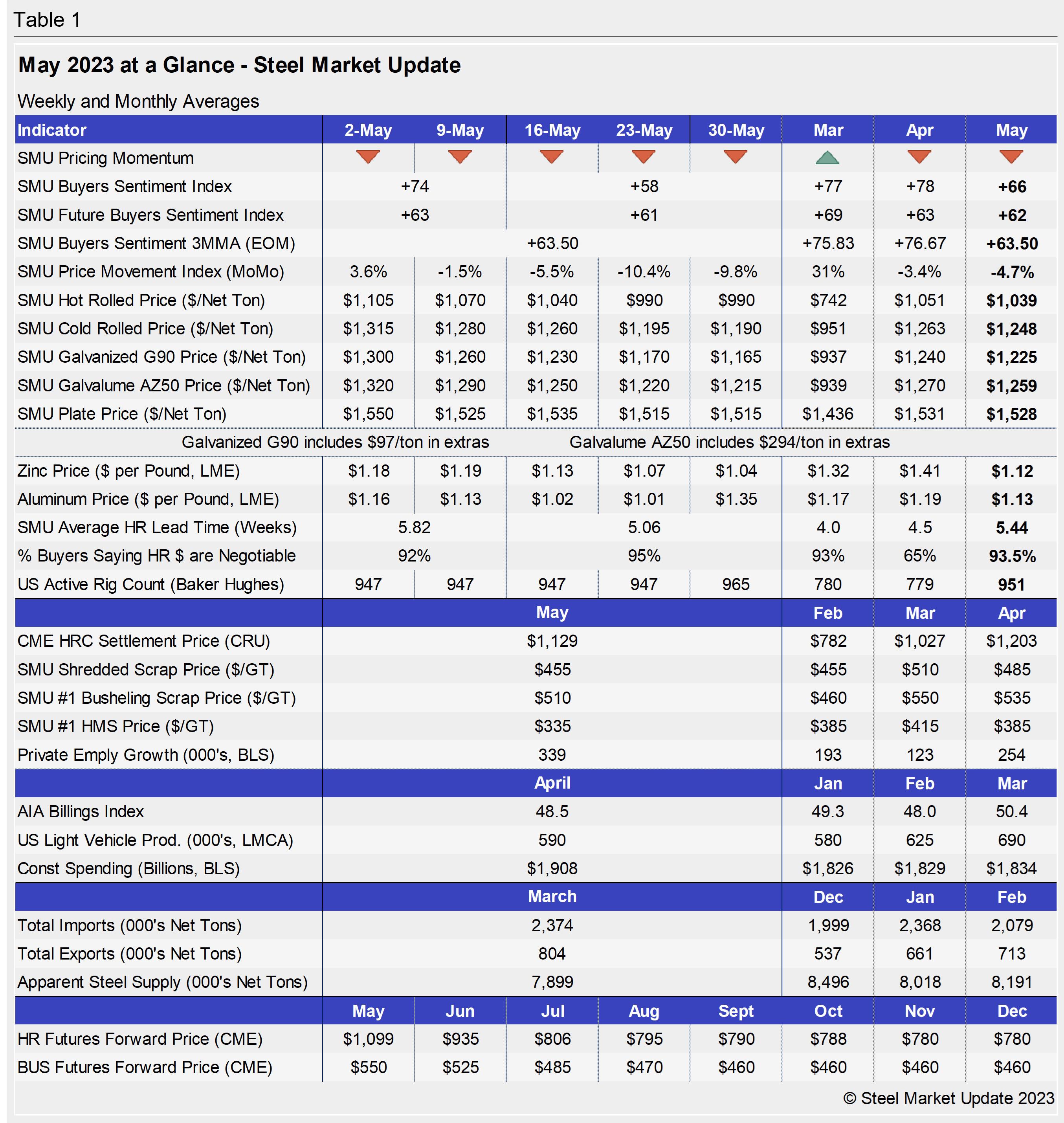

SMU's May at a Glance

Written by David Schollaert

Steel prices continued to erode in May, following a trend that began halfway through the previous month. Hot-rolled coil (HRC) prices ended May at $990 per ton ($49.50 per cwt) on average, falling by $130 per ton throughout the month.

The SMU Price Momentum Indicator for sheet products remained Lower during May after shifting to that position on April 25. The momentum change at the time was due to increased supply, weaker demand, and lower raw material costs—a trend that continued last month. Price Momentum on plate shifted to Neutral at the end of April, and it remained at that position throughout May as the market has yet to determine a clear direction.

Raw material prices continued to slide lower last month, a trend that began in April. Scrap prices fell another $30-50 per gross ton on average from April. Zinc and aluminum spot prices also ticked lower throughout May but remained within historic levels. You can view and chart multiple products in greater detail using our interactive pricing tool here.

The SMU Buyers Sentiment Index remained positive but started trending lower during the month. Current Buyers Sentiment fluctuated down from +74 and +58, respectively, while Future Sentiment was hovering at an average of +62. Our Buyers Sentiment 3MMA Index (measured as a three-month moving average), which had been trending up since late December 2022, shifted downward, falling from +76.67 in April to +63.50 in its latest reading in May.

Hot rolled lead times averaged 5.06 weeks in May, down from 6.07 weeks the month prior. SMU expects lead times to decline further as demand continues to ease. A history of HRC lead times can be found in our interactive pricing tool.

More than 95% of buyers are now reporting that mills are willing to negotiate on prices. Now 84% of the flat-rolled buyers we polled reported that mills were willing to talk price to secure an order, according to our latest survey, which is up from just about 65% in April.

Key indicators of steel demand remain positive overall, though not at the bullish levels some had predicted. And while the energy market and the construction sector continue to show signs of improvement, as does light-vehicle production, unemployment in those sectors ticked up in the jobs report from the US Department of Labor. Imports continued to increase through March, while export volumes and apparent steel supply remain healthy.

See the chart below for other key metrics in the month of May:

By David Schollaert, david@steelmarketupdate.com